In the recently concluded winter session of Parliament, the government made its position clear on the demand to increase pensions from ₹1,000 to ₹7,500. In this era of inflation, surviving on a mere ₹1,000 pension is a challenge, and this is why pensioners across the country have been continuously appealing to the government.

The government’s response to this issue will impact the future of millions of families. In today’s special article, we will delve deeper into why the government is unable to resolve the challenges standing in the way of increasing pensions and what the current status of your application for a higher pension is with the EPFO.

What are pensioners’ expectations

In mid-December 2025, MP Rajesh Ranjan asked a very direct and serious question to the Ministry of Labor and Employment in the Lok Sabha. He asked why there is such a delay in increasing the minimum pension under EPS-95 to ₹7,500 when millions of elderly people in the country are facing financial hardship. This demand of pensioners is not limited to money alone but also includes many other important aspects.

They want the government to provide them with a respectable amount, along with dearness allowance, so that rising prices do not affect them. Furthermore, free medical care for the elderly and strengthening the security of family pensions are also among their key demands. The government has accepted these demands but has also highlighted the financial implications of implementing them.

Also Read-Atal Pension Yojana Update: No Increase in ₹5,000 Pension, Government Clarifies

Learn How Your Pension System Works

The government informed Parliament that the EPS-95 scheme is currently based on a ‘defined contribution-defined benefit’ social security model. Simply put, the pension received depends entirely on the amount contributed by the employee and employer to the fund. This fund has two major sources: the employer, which invests 8.33% of the employee’s salary.

The second is the central government, which contributes 1.16% as budgetary support. It’s important to note that this calculation is limited to a maximum salary limit of ₹15,000. The government argues that all pension benefits are paid from this deposit, and a sudden, significant increase could disrupt the fund’s balance.

Clear Refusal on Actuarial Deficit and DA

The government has cited the actuarial deficit as the primary reason for not increasing pensions. According to the government, when the fund was evaluated annually, it was revealed that the current fund balance was significantly lower than the future pension payments. Simply put, the fund does not have enough capital to directly pay ₹7,500 to each pensioner.

Furthermore, regarding the demand for linking pensions to dearness allowance, the government cited the report of the High-Powered Monitoring Committee. The committee’s investigation found that linking pensions to the cost-of-living index or dearness allowance is not currently feasible given the current financial situation. Therefore, the government has maintained the minimum threshold of ₹1,000 that has been in place since 2014, which it ensures through additional budgetary support.

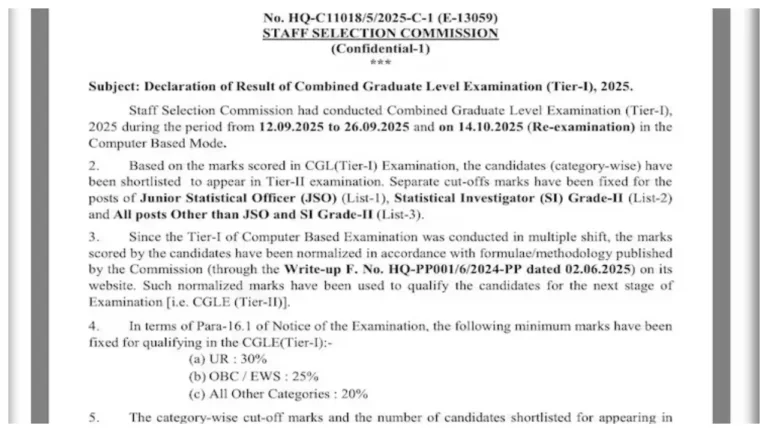

Supreme Court Order and EPFO’s Current Action

Parliament was also briefed on the landmark Supreme Court ruling in November 2022 regarding higher pensions for higher salaries. The government stated that the EPFO has taken several important steps to implement this order promptly. An online portal was also launched for this purpose, through which millions of applications have been received so far.

Data up to November 2025 shows that approximately 99 percent of all applications received by the EPFO have been processed. This process is now in its final stages, and pension calculations for those whose Joint Option Forms have been submitted by employers are being processed under the new rules. However, this arrangement applies only to those who have opted for higher pay, and those receiving the standard minimum pension are still waiting.

Also Read-India Launches e-Passport: Chip-Based Passport to End Long Airport Queues