Every parent thinks that their children should not face the problems in life that they have faced. For this, they make every possible effort. Everyone makes arrangements for the child’s education and marriage, but do you know that you can also secure your child’s retirement life with a small investment? For this, you have to open a child’s account under NPS Vatsalya Yojana. If you start investing even with just ₹ 1000, then at the age of 60, your child will have a fund of ₹ 2.3 crore and will get a pension of ₹ 1 lakh every month. This is a great opportunity to make your child’s future golden.

Who can open this ‘special’ account

NPS Vatsalya is a government scheme, through which a lump sum retirement fund and pension can be arranged for the child. Parents can start investing by opening this account in the name of the child up to the age of 18 years. The minimum investment limit in this is ₹1000. There is no maximum investment limit. The account can be opened in the name of the present child, however, the child parents or legal guardians of the child call also take care of the account till the child age of 18 years. After attaining the age of 18, the child can handle this account himself.

Understand how your child will become a ‘crorepati

If you open an NPS Vatsalya account at the time of your child’s birth and invest ₹1000 in it till the age of 18, and your child invests ₹1000 every month in this amazing scheme from the 19th year of child till the age of 60, then the total investment amount till the age of the 60 will be ₹7,20,000. Suppose he gets a return of 10% on it, then he will get only ₹3,77,61,849 as interest and his total corpus will be ₹3,84,81,849. This is an incredible example of the power of compounding.

This way you will get a fund of ₹2.3 crores and a pension of ₹1 lakh

In NPS scheme, you need to have to invest at least 40% of your total share in the annuity. In such a situation, if your child invests 40 percent in an annuity, then he will have to invest ₹1,53,92,740 in the annuity. In such a situation, he will get ₹2,30,89,109 as a retirement fund. If the annuity gives a return of 8%, then he will get ₹1,02,618 as pension every month. This is a sure way to make your child’s old age financially secure.

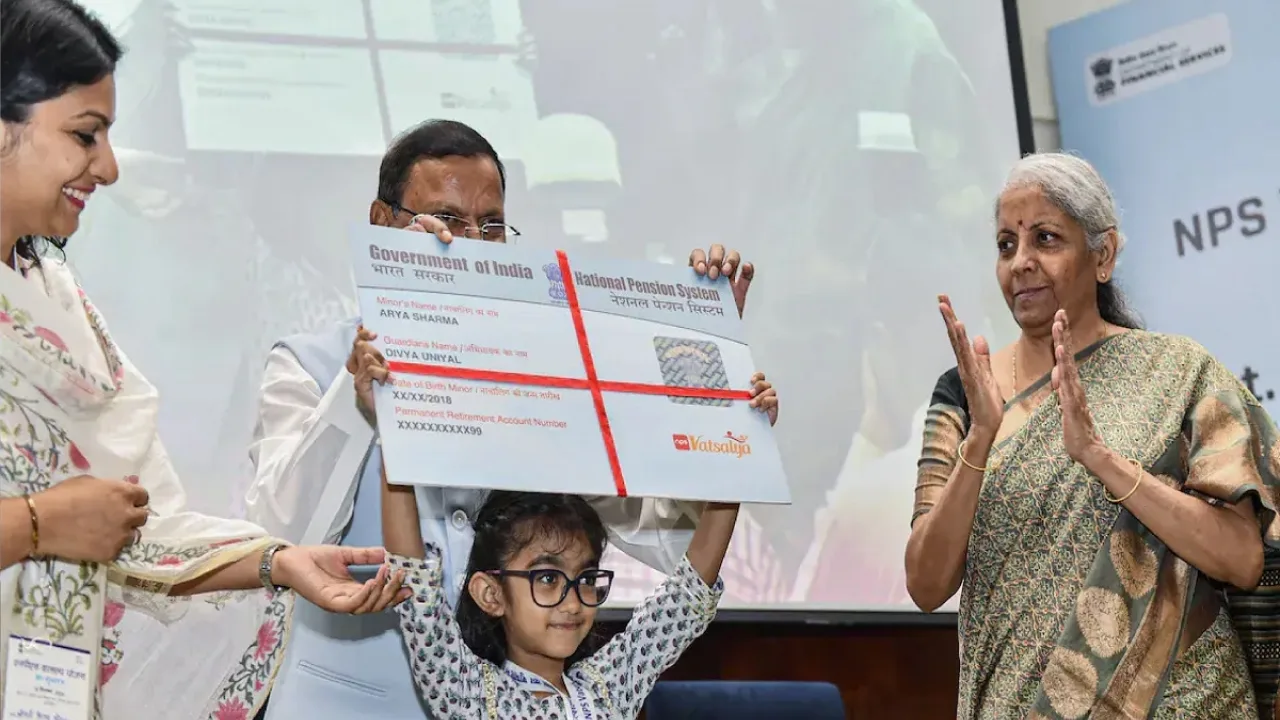

Where will this ‘safe’ account be opened

NPS Vatsalya account can be also opened in any big banks, or the Indian Postal Department. However, this account will be regulated directly by the Pension Fund Regulatory and Development Authority (PFRDA). Those who want to open this account online can open the account by visiting the eNPS platform of NPS Trust. This process is easy and transparent.

‘Golden’ opportunity of the partial withdrawal

This amazing government scheme gives the opportunity of partial withdrawal 3 times till the child turns 18 of age. However, for this the NPS account should be at least 3 years old. Parents can partially withdraw a maximum of 25% of the contribution in case of education, treatment of a particular disease and disability. This facility provides you financial assistance in times of need.

‘Exit’ option at the age of 18

When the child turns into 18 years age, the NPS Vatsalya account is totally converted into a regular NPS account. In such a situation, the child has to complete KYC afresh within three months. At the age of 18, the subscriber can exit NPS if he wants, but the condition is that at least 80% of the amount has to be reinvested in an annuity, while 20% can be withdrawn as a lump sum. If the total amount is less than ₹ 2.5 lakh, the entire amount can be withdrawn at once. This is a great way to provide your child with financial independence for the future.