PPF Investment Scheme: PPF is considered a safe and long-term savings scheme. According to its rules, an individual can open only one PPF account in their own name. This scheme does not provide the facility of joint accounts. However, if both husband and wife earn, they can open separate PPF accounts in their respective names. This is the most important basis for building a fund of more than 3 crore rupees, as it fully leverages their individual investment capabilities.

To build a fund of approximately 3.09 crore rupees, both husband and wife would need to invest a maximum of 1.5 lakh rupees in PPF every year. This uses the 15+15 formula, which has long been a popular strategy among PPF investors.

This formula will generate a substantial amount of money

In this formula, the first 15 years are the original maturity period of the PPF account. After this, the account is extended, known as an extension. This extension can be done in three different stages of 5 years each. This brings the total investment period to 30 years, allowing investors to benefit from compounding over a longer period.

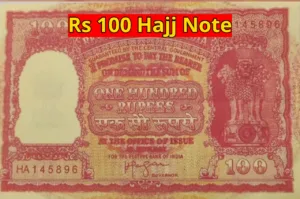

Read Here: This 100 Rupee Note has Created a Stir, Find Out Why it’s Selling for 5.6 Million Rupees

How to Build a Fund of Rs. 3.09 Crore

If both husband and wife deposit Rs. 1.5 lakh annually in their respective PPF accounts for 30 years, the total investment in one account would be Rs. 45 lakh. Currently, PPF earns an annual interest rate of 7.1%. Calculating at this rate, the interest on one account would be approximately Rs. 1.09 crore. Combining investments and interest, a single account yields approximately Rs. 1.54 crore. When the amounts from both accounts are combined, the total amount exceeds Rs. 3.09 crore.

How to Extend a PPF Account

To extend a PPF account, an investor must apply to the same bank or post office where the account was opened. This application must be submitted within one year of the maturity date. A prescribed form must be filled out and submitted. If the extension form is not submitted on time, further investment is not permitted.

Read Here: Opposition tables no-confidence motion to remove Speaker amid heavy uproar in Lok Sabha

Read Here: Buy Top 5 camera phones for under 20,000 with amazing offer

Major Tax Savings Advantage

The PPF scheme is classified under the EEE category, meaning it offers three levels of tax exemption. The amount deposited in the account is tax-free, the interest earned is completely tax-free, and the maturity amount is tax-free. This is why PPF is considered a safe and tax-friendly investment option.