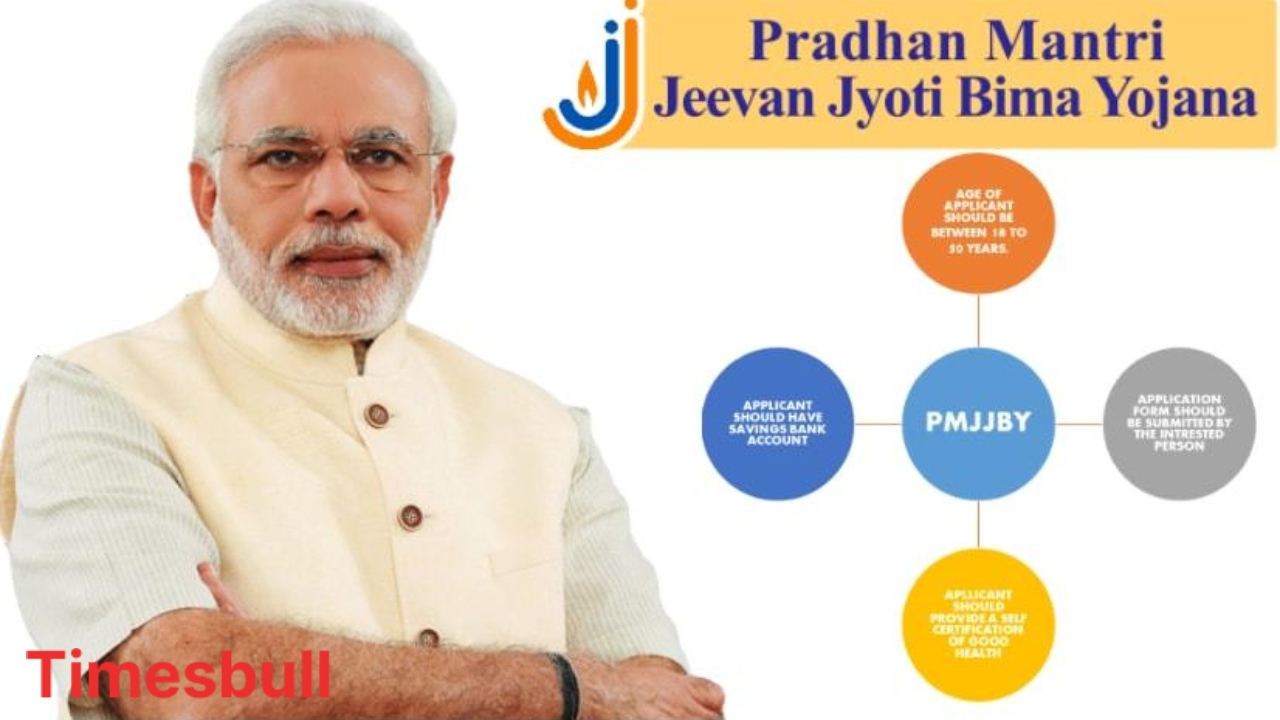

Millions of people across the country are ensuring financial security for themselves and their families by joining the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY). For a long time, people were desperately seeking a plan that offered greater protection at a lower premium. The Pradhan Mantri Jeevan Jyoti Bima Yojana has successfully addressed this crucial need. Now, even low-income families can avail themselves of life insurance and provide financial support to their families in times of emergency.

Premiums and Renewal

This plan offers annual life insurance cover, which must be renewed annually. By paying a premium of just ₹436, you receive an annual insurance cover of ₹2 lakh. This is a highly cost-effective way to protect your family against any contingency.

Also Read-PMMVY 2025-Government to Provide ₹5,000 Support to Pregnant and Lactating Mothers

Eligibility and Investment

The low investment requirement of this plan makes it unique. Applicants for the Pradhan Mantri Jeevan Jyoti Bima Yojana must be between 18 and 50 years of age. Additionally, applicants must have a bank account, as premium payments are automatically debited from the same account. This feature makes the scheme simple and digital-friendly, allowing everyone to use it without any hassle.

Immediate Payment of ₹2 Lakh

The most important aspect of PMJJBY is that in the event of the policyholder’s death due to any reason, the nominee receives an immediate payment of ₹2 lakh. This amount provides financial support to the family in times of emergency. This ₹2 lakh sum assured is extremely helpful in meeting the family’s funeral expenses and immediate living needs.

Easy Registration Process and Required Documents

Registration for this scheme is very easy. You can apply by visiting your nearest bank. You will need to provide certain documents at the time of application, including your Aadhaar card, identity card, bank account passbook, mobile number, and a passport-sized photo. The bank staff will help you complete your application process smoothly. This scheme is providing security and confidence to millions of Indian families, enabling them to move towards a secure future without worrying about contingencies.

Also Read-SBI Discontinues mCASH: Bank Issues Urgent Advisory for All Account Holders