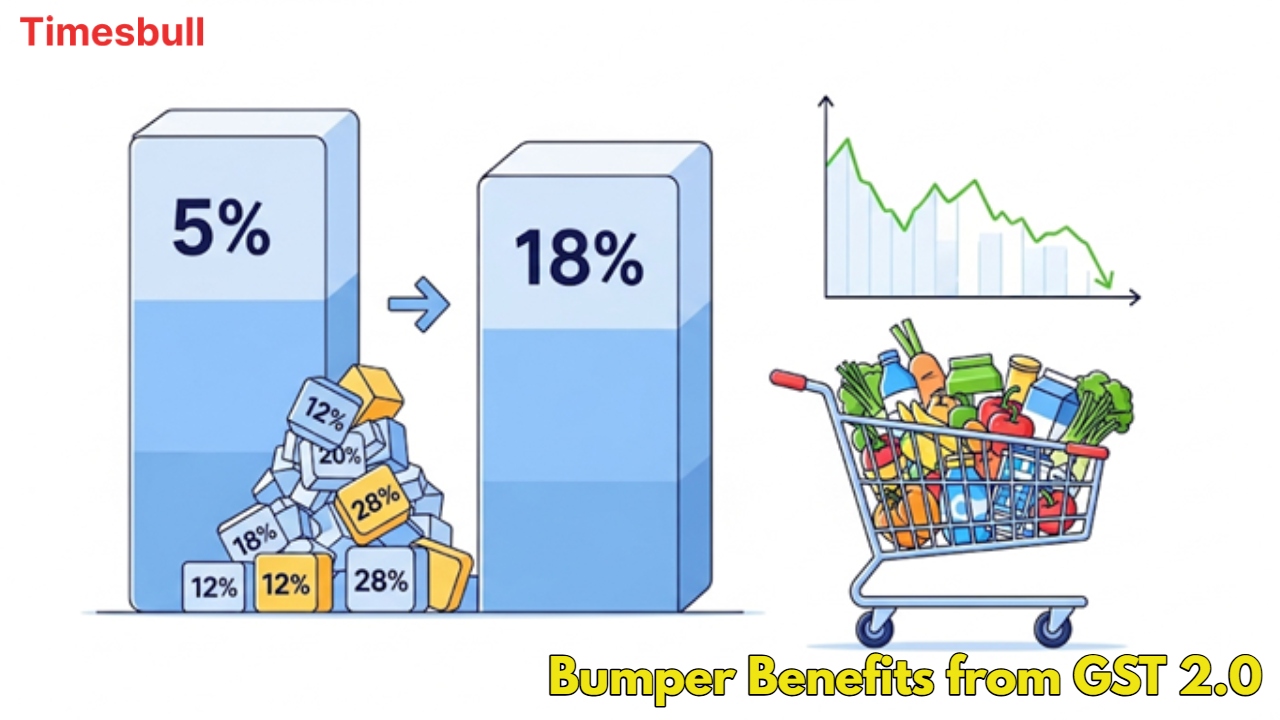

The GST Council has simplified the tax slabs in its meeting held on 3-4 September. Now there will be only two slabs of 5% and 18%, which will come into effect from September 22. This change will directly benefit the general public of the country, as many everyday things will become cheaper.

If you are confused about how much you will save with GST 2.0, then the government has also given a solution to this. Now you can calculate your savings through a special website. Let’s know about this new system and website.

Calculate savings like this

The government’s My Gov platform has launched a website called ‘savingwithgst.in’. On this website, you can find out your savings by comparing the prices before and after September 22. It has different categories of food items, electronics goods, kitchen items, and lifestyle-related items.

To know how much savings will be on which item, you just have to add the item of your choice to the cart. After this, you will see the original price of that item in the cart, the price at the time of VAT, and the new price after GST 2.0. For example, if you add milk to the cart, the price of milk at ₹ 60 per liter will be shown as ₹ 63.6 with VAT, whereas under GST 2.0, it will remain ₹ 60.

What will become cheaper with the new tax slab

In the GST Council meeting, the tax slabs of 12% and 28% have been abolished. Now only the slabs of 5% and 18% will remain. Apart from this, a 40% tax has been imposed on luxury items. This change will directly make many everyday essential items and packaged food items cheaper.

Now, zero (0%) GST will be levied on ultra-high temperature (UHT) milk, packaged and labeled paneer or chenna, and all Indian breads. At the same time, 5% GST will be levied on household items like soap, shampoo, toothbrush, toothpaste, tableware, and bicycles. This step is in line with Prime Minister Narendra Modi’s promise to implement ‘Next Generation GST Reforms’, which will bring economic reforms in the country and provide relief to the common people.