Everyone worries about life after retirement. We think that when we are not of the age to work, when our body will not support us, then how will we live? By the way, most people keep saving something or the other while worrying about the future. But they do not think much about pension plans.

If you are also looking for such a pension plan, in which you become entitled to a lifetime pension by paying a low premium, then Atal Pension Yojana is a great option. Under this pension plan, when you turn 60, you get a pension of ₹ 1000 to ₹ 5000 every month. So, why not secure your future by joining this great scheme today?

Great initiative of the government for the unorganized sector employees

Atal Pension Yojana (APY) is a pension scheme of the Government of India. This scheme is for those Indian citizens aged 18 to 40 years who have a bank account. The main objective of this scheme is to provide a fixed source of income to the employees of the unorganized sector in old age. This scheme can prove to be a boon for millions of people who do private jobs or who do not have a fixed pension plan.

Know the eligibility conditions

Any person between 18 and 40 years can open an Atal Pension Yojana account. To join the scheme, it is necessary to have a savings bank account, an Aadhaar card, and an active mobile number. You will also have to submit a photocopy of your mobile number and Aadhaar card. After the application is approved, you will get a confirmation message. This scheme is open to every Indian citizen who wants to secure their future financially.

Your monthly installment will be decided according to your age

To get a pension of ₹ 1000 to ₹ 5000 every month in Atal Pension Yojana, the applicant has to invest from ₹ 42 to ₹ 210 per month. Getting a lifetime pension with such a low installment is a great deal. This investment has to be made when the plan is taken at the age of 18. If the applicant is 40 years or older, he has to make a monthly contribution of ₹291 to ₹1454 per month. The maximum contribution is for a pension of ₹5000. That is, the sooner you join this scheme, the lower your monthly installment.

Invest for 20 years and get a lifetime pension

If a person invests under Atal Pension Yojana, he has to invest for at least 20 years. Investment can be made every month, every 3 months, or in 6 months. The money will be auto-debited. The amount to be deducted will depend on how much pension you want after retirement. This is a long-term investment that makes you financially self-reliant after the age of 60.

Take advantage of a deduction of up to ₹1.5 lakh

In Atal Pension Yojana, you will be able to claim tax benefits of up to ₹1.5 lakh under Section 80C of the Income Tax Act. This scheme not only provides you with pension security, but also helps you save your tax. So, it is a double benefit.

An easy way to apply online

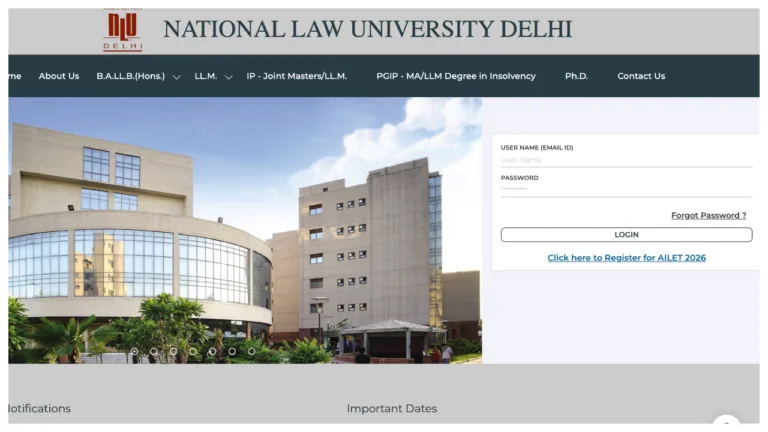

You can apply online for Atal Pension Yojana through SBI. If you have a bank account in SBI, then you can avail of this scheme through net banking. For this, first go to the SBI portal. Click on the e-services link. In the new window that opens, there will be a link named Social Security Scheme. Click on it. 3 options will appear.

You have to click on APY from PMJJBY/PMSBY/APY. The form will open; fill it out correctly. Which pension option are you choosing, for example, ₹ 5000 per month? Your monthly installment will be decided based on your age. On pressing the submit button, the form will be submitted. You will get a receipt number, by which you can check the status of your form. This online process makes it very easy for you to apply.