Gratuity Rules 2025 – In India, gratuity has always been considered a reward for an employee’s loyalty and long service. It is a financial benefit given by the employer when an employee resigns, retires, or completes their service period. But with the new 2025 rules, the most significant relief has come for fixed-term and contract employees—because gratuity can now be claimed after just one year of service.

What Exactly Is Gratuity and Why Does It Matter?

Gratuity is a monetary appreciation given to an employee for their dedication, long service, and hard work. When someone invests their time, effort, and loyalty in a company, the employer ensures the employee does not leave empty-handed. This amount often serves as a key source of support during job transitions or retirement, helping secure the employee’s financial future.

Previously, employees needed at least 5 years of continuous service to be eligible. But the 2025 reforms under the new labour codes have changed the landscape entirely.

What Has Changed Under the New Gratuity Rules 2025?

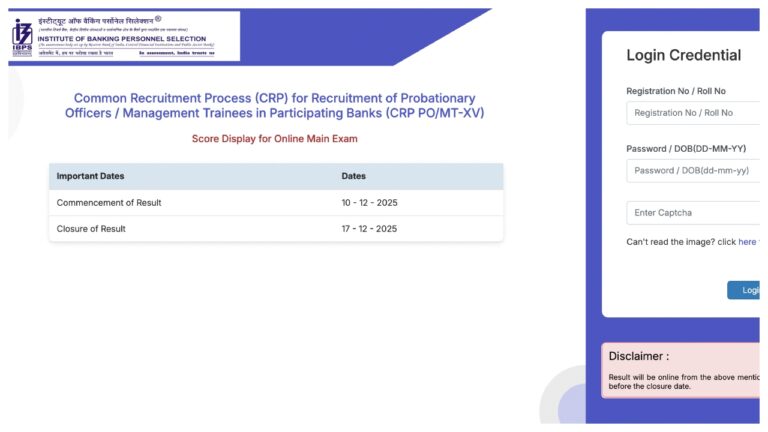

The Indian government replaced 29 old labour laws with four new labour codes, simplifying the entire calculation and eligibility system. The highlight of this change is the inclusion of fixed-term employees, who were often excluded despite working long hours and short tenures.

Under the revised rules that took effect on 21 November 2025, even if an employee has worked for one year, they are legally entitled to receive gratuity, provided there is no involvement in fraud or unlawful activity.

Another primary rule states that at least 50% of the CTC must be basic salary, thereby increasing employees’ gratuity.

How Gratuity Is Calculated Under the New Rule?

Gratuity is calculated using a simple, standard formula:

Gratuity = (Last Basic Salary + DA) × 15 × Number of Years of Service ÷ 26

Here,

* 15 = number of days considered for gratuity

* 26 = working days in a month as per the government rule

Example: Suppose someone worked 1 year in a company with a monthly salary of ₹50,000. Out of this, let’s assume the Basic + DA is ₹30,000.

Then the gratuity would be:

(30,000 × 15 × 1) ÷ 26 = ₹17,308

This amount becomes the employee’s legal right.

What If a Company Refuses to Pay Gratuity?

Many employees face delays or refusals while claiming gratuity. But under the law, gratuity is a mandatory benefit. If an employer denies payment without a valid reason, the employee can file a complaint with the District Labour Commissioner, and strict action may follow.

Why These New Rules Are a Major Relief for Employees?

The new gratuity rules bring multiple benefits:

- Fixed-term and contract workers now get full gratuity rights after 1 year

- Gratuity calculation is more transparent and employee-friendly

- A higher basic salary means a higher gratuity amount

- Up to ₹20 lakh gratuity is completely tax-free, giving a significant financial advantage

- These changes ensure that every employee, regardless of tenure or contract type, receives the reward they genuinely deserve.