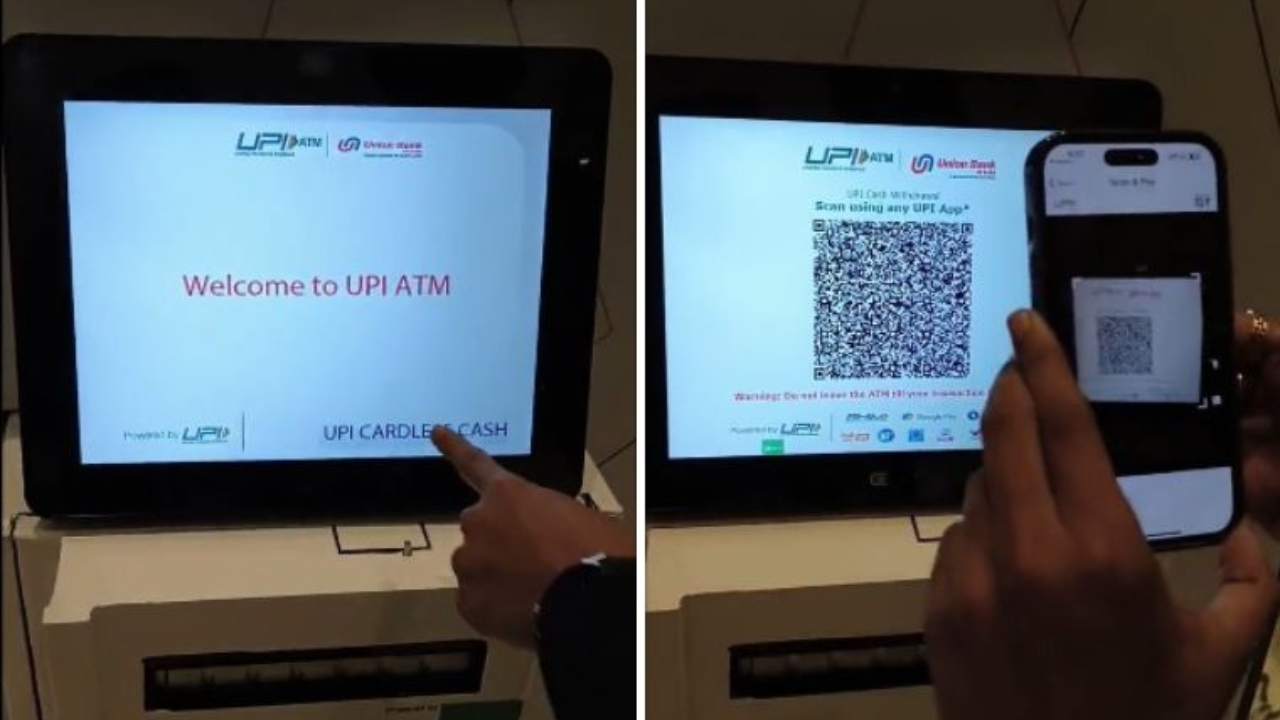

UPI-ATM: Withdrawing cash in India is going to be even easier. Now you will not need to go to the ATM. With the help of UPI app, you will get the facility of withdrawal by scanning QR code from the smartphone itself. This new facility will especially benefit people living in rural and small towns, where there are less ATMs and bank branches. Let’s understand about this new system.

New way to withdraw cash from QR code

UPI is used extensively for online payments, but now you will be able to withdraw cash by scanning QR code from any UPI app, which will also help in offline payments. These QR codes will be installed at the outlets of Business Correspondents, which are present in lakhs of places across the country.

Business Correspondents are actually like small branches of banks that provide banking services even in remote areas. When you scan the QR code, your money will be deducted directly from your bank account and deposited in the account of the Business Correspondent, then you can withdraw cash from there.

What’s new from the old system?

Earlier also there was a facility of cardless withdrawal through UPI, but it was limited to only a few select ATMs and some special merchants. Also, the withdrawal limit was Rs 1000 in urban areas and Rs 2000 in rural areas. But now this facility will reach the business correspondent outlets, which will be able to reach more people easily. Apart from this, now withdrawals can be made even without biometric (fingerprint) or ATM card. This will be of great help to those who have difficulty using ATM card or fingerprint.

Waiting for RBI approval

Currently, approval from the Reserve Bank of India is awaited for this new facility. NPCI (National Payment Corporation of India) wants to implement this system so that more and more people can easily withdraw cash digitally. After the implementation of this facility, people living in rural and small-town areas will be able to easily take advantage of digital payments. This facility will prove to be very helpful especially for those people for whom it is difficult to go to the bank or find an ATM.