RBI Bonds: Are you thinking of making a fixed deposit (FD) for more than 5 years, but are disappointed with the low interest rate on bank FDs, Then there is a great option for you. Reserve Bank of India (RBI) Floating Rate Savings Bond 2020. This is an excellent government bond that is currently paying much more interest than bank FDs. If you want safe and stable returns, then this RBI bond can prove to be a game-changer for you. Let’s know about this great investment option in detail.

What is RBI Floating Rate Savings Bond 2020

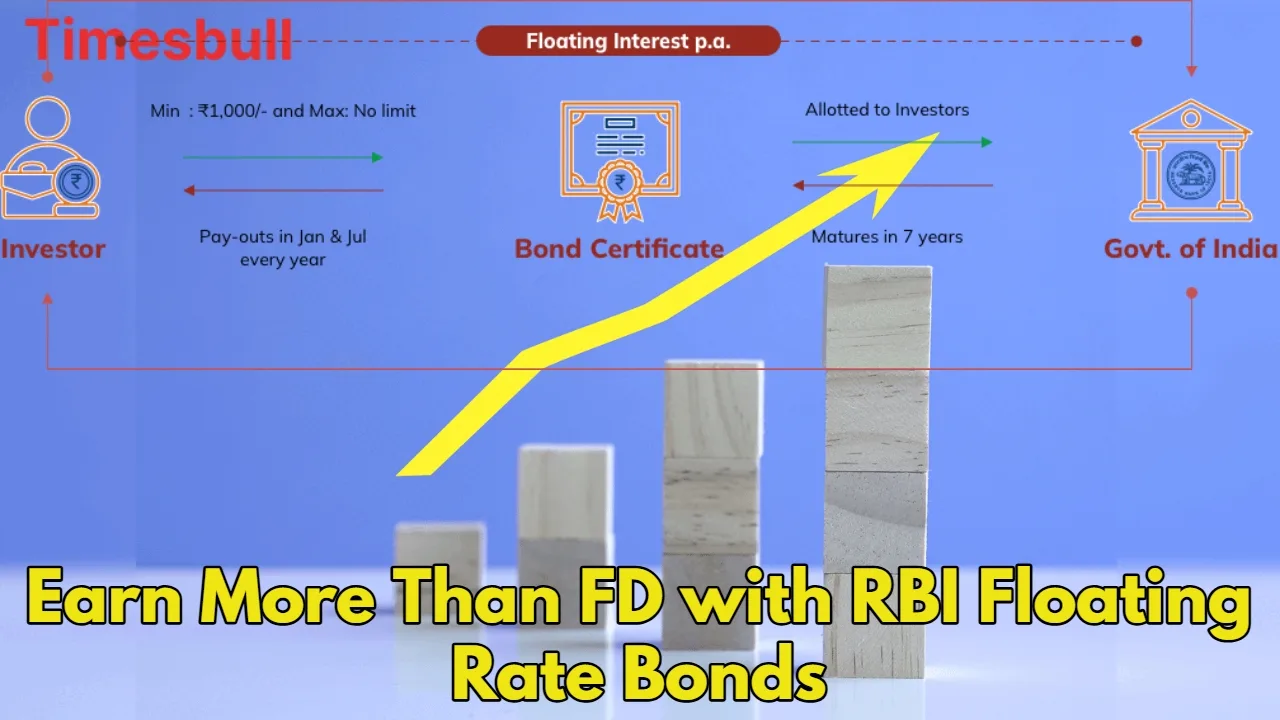

RBI Floating Rate Savings Bond is a government security issued by the Reserve Bank of India on behalf of the Government of India. You can invest money in it for seven years. The most special thing about it is that its name is ‘Floating Rate’, that is, the interest rate on it is not fixed, but keeps changing according to the market conditions.

Currently, this bond is offering a whopping 8.05% per annum. You can invest a minimum of ₹1,000, and there is no maximum investment limit. This means you can invest any amount at your convenience. However, it is important to note that the interest income from these bonds will be taxable as per your income tax slab.

Bank FDs and RBI bonds

When it comes to safe investments, both bank FDs and RBI bonds are popular choices. But when it comes to interest rates, RBI Floating Rate Savings Bonds are way ahead. Let’s compare the FD rates of some major banks:

State Bank of India

Maximum 6.70% interest for two years to less than three years on deposits less than ₹3 crore. Senior citizens get 7.20% interest for the same period.

ICICI Bank

Maximum 6.85% interest for a period of 18 months to 2 years on deposits less than ₹3 crore. Senior citizens get 7.35% interest.

Axis Bank

Maximum 7.05% interest for a period of 18 months to 2 years on deposits less than ₹3 crore. Senior citizens get 7.55% interest.

You can see that the 8.05% interest on RBI Floating Rate Savings Bond is much higher than the FD rates of these major banks, especially for general investors. This makes it an attractive option for those who are looking for better returns than FDs.

For which investors is the RBI bond best

RBI Floating Rate Savings Bond is a great option for conservative investors who want fixed returns and do not want to take risks on their investments. Being ‘sovereign bonds’, i.e. backed by the Government of India, these have the lowest risk. Your money is completely safe.

You can invest in it through the bank both online and offline. However, some banks do not allow joint account or minor account in online application. For this you may have to visit the bank branch. This bond is also good for those who want to invest for a long period and want to benefit from interest rate fluctuations.