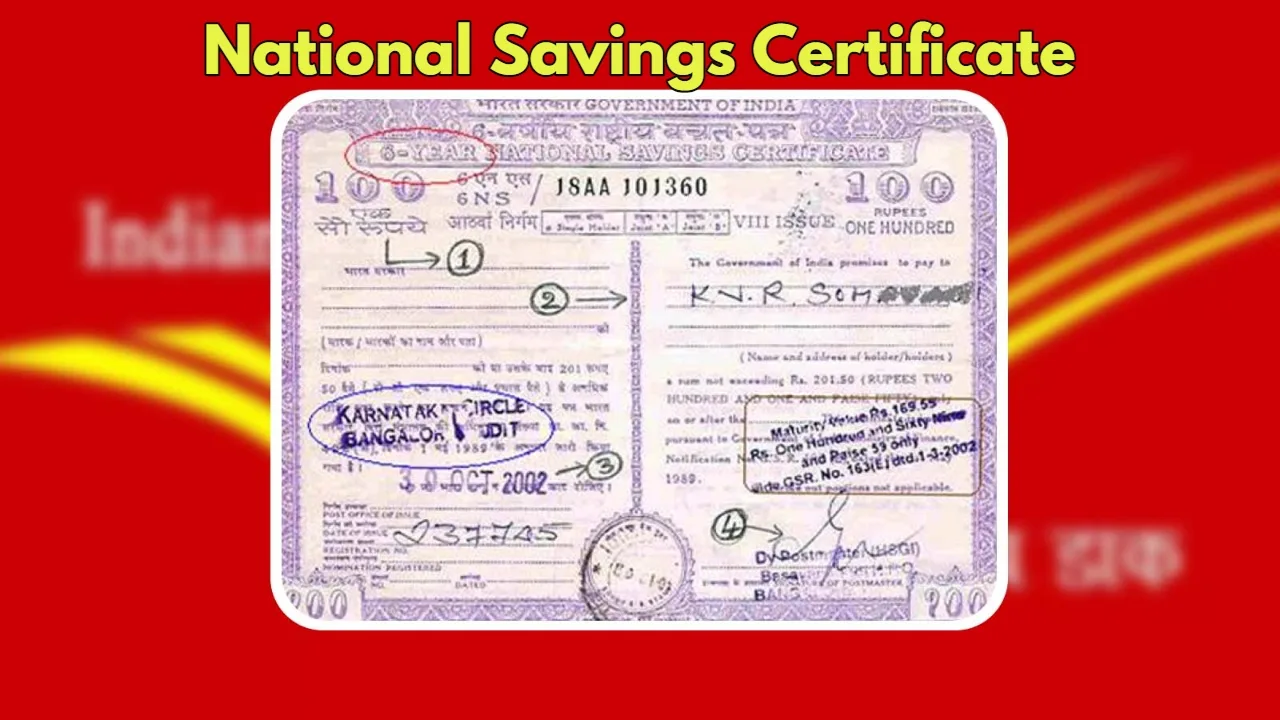

It is very important to make better financial planning for the better future of children. Of course, there are many options available in the market for this, but as an option with guaranteed returns, the National Savings Certificate (NSC) of the Post Office is also a great option. Along with better returns, there is also a provision of Income Tax Exemption. If you want, you can easily open an NSC account in your nearest post office and start investing every year. When the child needs higher education or the time of marriage comes, then this investment of yours will be very useful for them.

Who can open an NSC account

Keeping in mind the future of children, any adult can open a Post Office National Savings Certificate account in their name. Three adults can also open a joint account together. Apart from this, an account can be opened for a minor by a guardian. A guardian can open an account on behalf of a minor child. Any minor aged 10 years or above can open an account in his/her name. Most importantly, you can open as many NSC accounts as you want; there is no limit.

Minimum Investment Amount and Tax Exemption

Investment in a National Savings Certificate account can be started with a minimum of ₹1000, and after that, any amount can be deposited in multiples of ₹100. There is no maximum investment limit, i.e., you can invest any amount as per your wish. Investment made in this scheme is eligible for tax deduction under Section 80C of the Income Tax Act. It also helps you save tax.

When will the scheme mature

Your deposit in the National Savings Certificate will mature after completion of a period of 5 years from the date of deposit. Accumulation of interest will happen at the end of every year, and the interest of the first four years will be considered automatically reinvested and will be added to the principal amount of the certificate. At the end of every year, a certificate of accumulated interest can be obtained from the post office on request, or it can also be downloaded through the Internet Banking of the Postal Department.

Guaranteed return with better interest

This savings scheme of the post office is currently giving 7.7 percent annual interest. The return on investment can be understood with an example. According to the official website of the post office, if you invest ₹ 10,000, then on maturity, you will get a return of ₹ 4,490 as interest. This return is also guaranteed, because this scheme has no direct relation with the market. This investment is completely safe as it is a savings scheme of the Government of India. There is no risk of your money sinking in it.