Millions of people in the country prefer to invest their savings in safe investments. For such individuals, the Indian Postal Department’s Monthly Income Scheme (MIS) is an excellent option. This scheme is especially beneficial for those who want a fixed monthly income. By investing in this scheme, investors receive a fixed monthly interest rate.

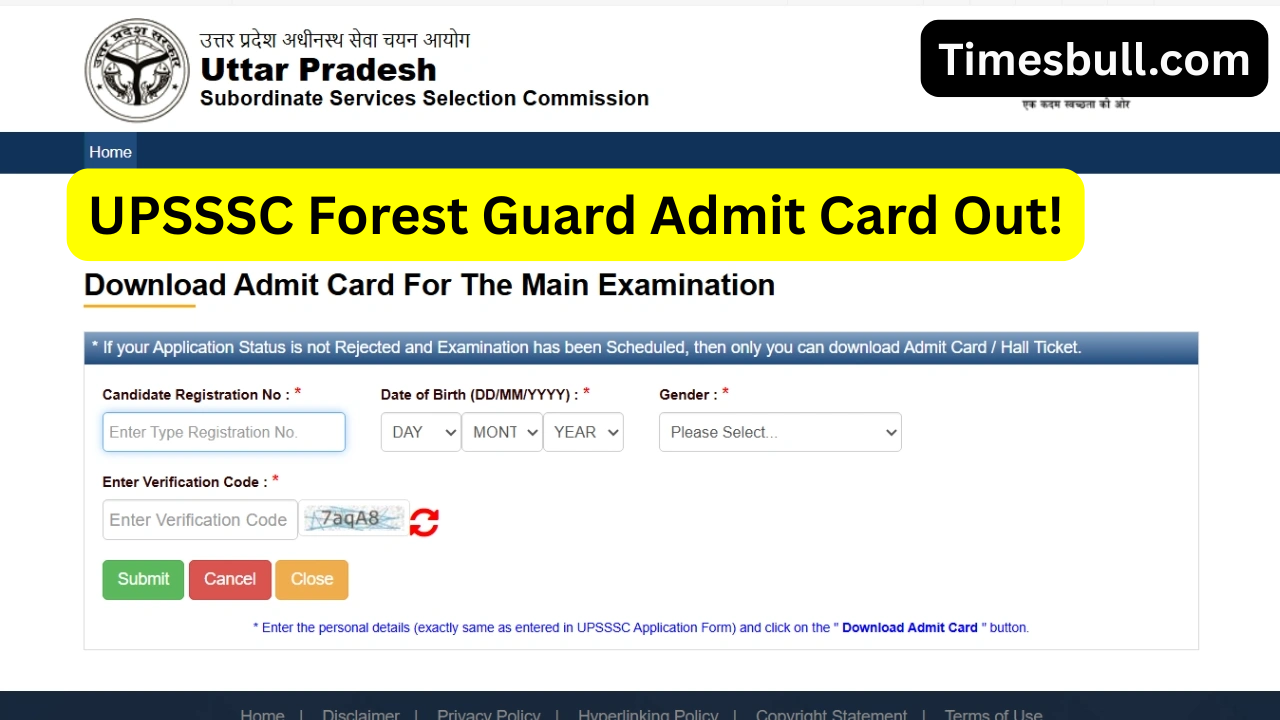

Read Money- UPSSSC Forest Guard Admit Card 2025 Released! Download at upsssc.gov.in – Exam on November 9

The MIS scheme offers 7.4 percent annual interest

Currently, the Post Office MIS scheme offers an annual interest rate of 7.4 percent. This means that if you invest in it, you receive a regular interest income at the same rate every month. Investments in this scheme can begin with a minimum of ₹1,000. A maximum of ₹9 lakh can be invested in a single account and ₹15 lakh in a joint account. A maximum of three people are allowed to join a joint account.

A one-time investment and a five-year security period

The most important feature of the Monthly Income Scheme is that it requires only a single investment. After that, interest is transferred directly to the investor’s bank account every month. The scheme matures in five years. After five years, the investor receives their entire deposit back.

₹2,467 interest per month on ₹4 lakh

If an individual or couple invests ₹4 lakh in an MIS scheme, they will receive approximately ₹2,467 in interest each month. This amount will be credited regularly to their account for five years. This scheme is a reliable option for those seeking a fixed and secure income, such as senior citizens or homemakers.

Read More- LIC’s New Scheme 2025: Invest Rs 8 Lakhs Once and Save Rs 125 Monthly – Best Plan for Women

A Post Office Savings Account is Required to Open an Account

To avail the benefits of the MIS scheme, investors must have a Post Office savings account. If you don’t have one, you’ll need to open one first. Only then can you invest in the Monthly Income Scheme. This scheme is completely safe because it is administered by the Government of India. Therefore, investors have no fear of losing money.