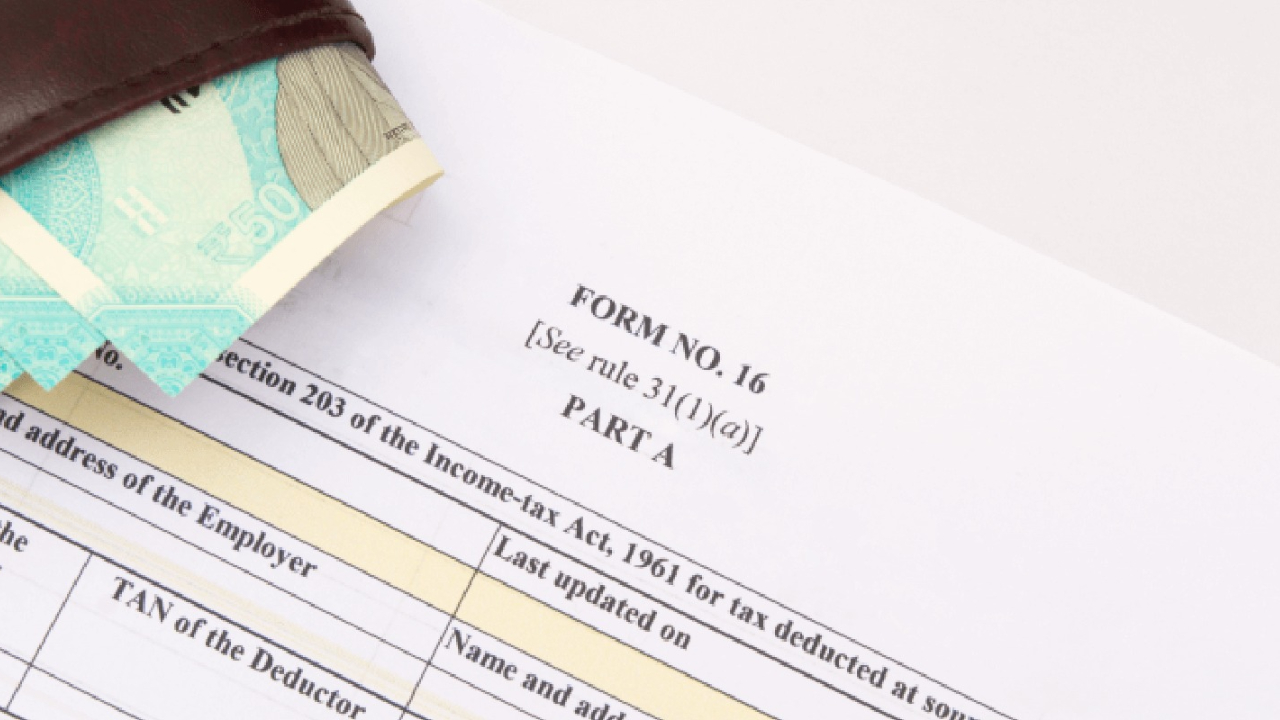

ITR Filling: For those who earn a salary, Form-16 is an important document for filing an Income Tax Return (ITR). If you are employed, you must have received your Form 16 by now, because companies have to give it to their employees by June 15 every year.

However, it is not right to fill ITR just by looking at Form 16. Another important document is Form 26AS. The information given in both should match each other, otherwise, you will not get a tax credit and you may get a notice from the Income Tax Department.

What is the difference between Form 16 and Form 26AS

The biggest difference between these two forms is that Form 16 is issued by the employer, while Form 26AS is issued by the Income Tax Department. Form-16 contains the information on TDS deducted from your salary, while 26AS contains the information on TDS deducted from all your income, tax deposited, and refund. Form-16 is used at the time of filing ITR, while 26AS is used to match the information of Form-16. There should be no mismatch between the two.

What things to keep in mind

The PAN number must be written correctly in both forms. The salary and TDS deducted information shown in Form 16 should match with Form 26AS. If you have changed jobs, then fill out ITR by combining Form 16 of both employers, otherwise the tax calculation will be wrong and then a notice will reach you.

What to do if there is a difference in both the forms

If the data does not match in Form 16 and 26AS, then first contact the person who has deducted tax on your income i.e. your employer. Inform the company’s HR about this. They may make some corrections in their data, which will fix the mismatch. If you do not get help from there, then seek help directly from a tax expert or CA, otherwise you are sure to get a notice.

What mistake can the employer make

Your PAN may have been written incorrectly, due to which the TDS transaction could not be recorded on it. It is also possible that TDS has been deducted, but has not been deposited to the government. Not only this, it is possible that wrong information about the salary has been sent in the form, due to which the mismatch is showing. In any of these situations, the deductor will have to update his TDS return.

Why is form matching necessary

Tax credit will be available only when the information in both documents is the same. If this does not happen, your refund may get stuck. It is possible that you have to pay more tax. Due to this mismatch, your return can be declared defective by the Income Tax Department and a notice can be sent to you.