There is very big good news for crores of EPFO members. The Employees Provident Fund Organization (EPFO) is going to launch the EPFO 3.0 platform this month for the convenience of all its members. This will be a revolutionary step because, under EPFO 3.0, members will start getting many new facilities, the most important of which is to directly withdraw money deposited in their PF account from ATM.

This facility will make the process of PF withdrawal unprecedentedly simple and fast. Let us know what other new features will be there in EPFO 3.0 and how all EPFO members will benefit from them.

What is EPFO 3.0 and when will it be launched

EPFO 3.0 is actually an upgraded version of the digital platform of the Employees Provident Fund Organization, which will be based on modern IT systems. Through this, more than 9 crore EPF subscribers across the country are expected to get easy and fast service.

This platform will not only streamline the services but will also improve transparency and efficiency. Although the official launch date of EPFO 3.0 has not been revealed yet, according to reports, it is likely to be launched by the end of June.

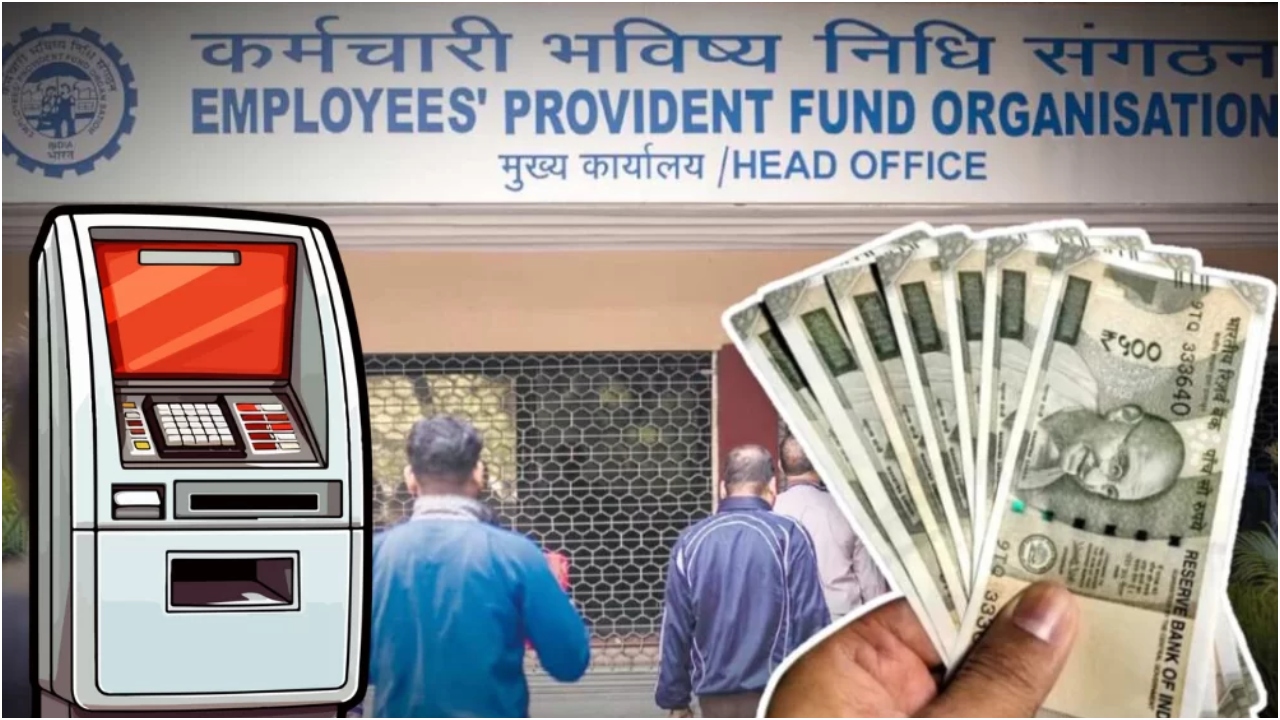

How to withdraw PF money from an ATM

Till now, to withdraw PF money, one had to fill out the online claim form, upload documents, and then wait for approval. However, after the arrival of EPFO 3.0, people will be able to withdraw the money deposited in their PF account directly from the ATM, just like they withdraw from the bank account. This facility will be completely digital and money will be available quickly and easily.

To withdraw PF from ATM, some important conditions must be fulfilled:

- Your Universal Account Number (UAN) must be activated.

- Your bank account and Aadhaar must be linked to your PF account.

- The last date for linking all these has been fixed as June 30.

According to reports, the withdrawal limit from ATMs can be up to ₹ 1 Lakh or 50% of the total balance. This is a big relief for those who need cash immediately.

Auto-claim settlement will be easy in PF

Auto-claim settlement facility will be provided in EPFO 3.0 so that the money can be transferred directly to your account without any manual intervention. This means that you will not have to wait long to receive the money after claiming.

Also, the process will be very easy. Actually, in the new system, as soon as you submit an online claim request, the system will process it itself and the money will reach your bank account within the stipulated time. This will make the process transparent and fast.

The hassle of filling out the form is over

Now if the name, date of birth, or any other information has been entered incorrectly in your PF account, then there will be no need to go to the office to fill the form to correct it. Under EPFO 3.0, you will be able to do all these tasks online yourself, which will make the whole process even easier. This digital correction is a great convenience for the members and will save time.

Preparations to make PF digital and user-friendly

The main goal of EPFO 3.0 is to make PF services completely digital and user-friendly. Where earlier people had to visit offices for small things, now all the work can be done online on a single portal. Whether it is withdrawing money, correcting a mistake, or making a claim.