NPS Vatsalya: All parents want to do something for their children so that they do not have to face problems later in life. Securing the future of their children is not only their responsibility but also their first priority. Planning in advance for children’s education, their marriage and major expenses in their life is very important.

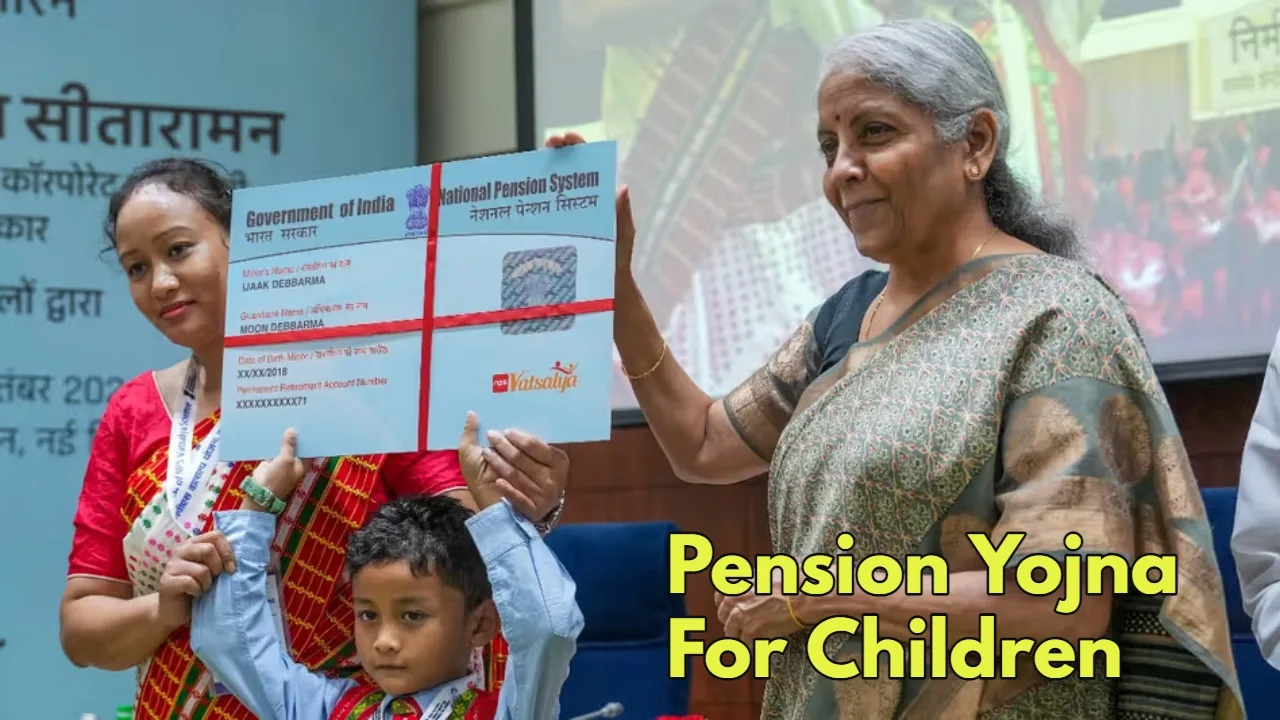

In such a situation, inflation is increasing. In such a situation, this planning becomes even more important. If you invest in the right scheme, then you can create a good fund for your children till they grow up. Which can be useful for them in the future. The government has started NPS Vatsalya Yojana for this. Which is a very beneficial scheme for the future of children.

You can start investing from Rs 1000

NPS Vatsalya Yojana is a format of National Pension Scheme. Which was started in September last year. It is specially designed for minor children. In this scheme, parents or guardians of children can open NPS account for their minor children. And can deposit a fixed amount every month or year till the age of 18 years. Let us tell you that in this scheme, investment can be started from one thousand rupees and there is no maximum investment limit in it. Let us tell you that this account gets converted into NPS account after the age of 18 years.

You also get a good return on the amount deposited in NPS Vatsalya Yojana. If we talk about long term in this scheme, then a return of about 9.15% to 10% is expected. Not only this, if needed, you can also withdraw some part of the amount invested in this scheme. Like you can withdraw up to 25% of the money for studies or for any emergency situation. You are also given tax exemption in the scheme.

If we assume an average annual return of 10% in NPS Vatsalya Yojana, then according to this, if you deposit 15 thousand rupees every month for 15 years for a 3-year-old child, then by the time he turns 18, approximately Rs 60,24,318 will be deposited in his account at the rate of 10% average return. Which will be a decent amount.