Nowadays, a large number of people work in the private sector. During their jobs, they save money, but many struggle to secure a pension for old age. That’s why it is important to invest in the right plan early so that you don’t have to worry about a regular income after retirement.

Today, we will tell you about a special pension plan where you only need to pay one premium to secure your pension. The best part? You can start receiving your pension from the age of 40 if you choose. Check out all the important details about this pension plan below.

Know About LIC Saral Pension Plan

We are talking about the LIC Saral Pension Plan, an immediate annuity plan where you start receiving a pension as soon as you purchase the policy. The best part is that you don’t have to wait until 60 to get your pension—you can start receiving benefits from the age of 40.

Pay Premium Only Once & Get Lifetime Pension

A unique feature of this plan is that you only need to pay the premium once when buying the policy. Once the payment is made, the policyholder starts receiving a pension, which remains fixed for a lifetime.

Single Life & Joint Life Plans

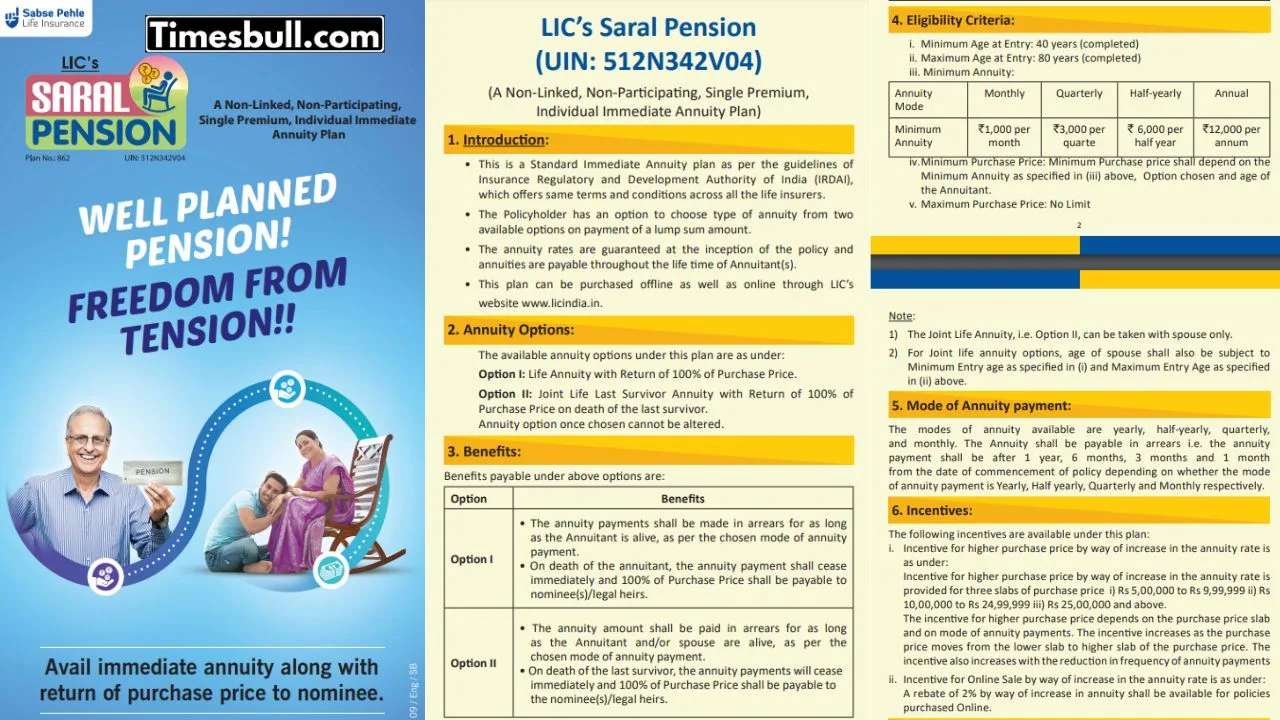

The Saral Pension Plan comes with two options:

- Single Life Plan – The policyholder receives a pension for life. After their death, the investment amount is given to the nominee.

- Joint Life Plan – This covers both husband and wife. The primary policyholder receives a pension first, and after their death, the spouse continues to receive the pension. Once both pass away, the nominee gets the deposited amount.

How Much Pension Can You Get?

- You can receive a minimum monthly pension of ₹1,000, and there is no maximum limit.

- The pension amount depends on how much you invest. You can choose to receive it monthly, quarterly, half-yearly, or annually.

According to LIC’s website:

- If you invest ₹10 lakh at 60 years of age, you will receive ₹64,350 annually.

- If you and your spouse (60 & 55 years old) buy a joint life plan, you will receive ₹63,650 annually.

Retirement isn’t the end of earning—it’s the beginning of financial freedom! With LIC of India’s Smart Pension, enjoy a lifetime of steady income and stress-free golden years.https://t.co/YU86iMOu9M#LIC #SmartPension #PensionPlan pic.twitter.com/4bXUXbz90g

— LIC India Forever (@LICIndiaForever) February 19, 2025

Who Can Invest?

- Anyone between 40 to 80 years of age can invest in this scheme.

- If you invest at 40 years of age, you can start receiving a pension immediately and continue for life.

Loan & Surrender Facility

- A loan facility is available after 6 months of purchasing the plan.

- In case of financial emergencies, you can surrender the policy after six months.