Punjab National Bank (PNB) is the third-largest government bank in the country in terms of market capitalization. PNB also ranks among the largest government banks in India in terms of customers, with crores of customers and a strong network of thousands of branches. If you are a PNB customer, this news is for you.

Punjab National Bank offers various types of savings accounts to its customers. In addition to the basic savings account, you can also open a PNB Unnati Saving Fund account. Moreover, PNB allows you to open a Prudent Sweep account.

Penalty for Not Maintaining Minimum Balance in PNB Accounts

Like other banks, Punjab National Bank (PNB) provides many services to its customers and charges service fees for these. In addition, PNB imposes penalties in certain cases. If you do not maintain the minimum balance in your savings account, PNB can deduct money directly from your account. Here’s what you need to know about the penalties for not maintaining the minimum balance.

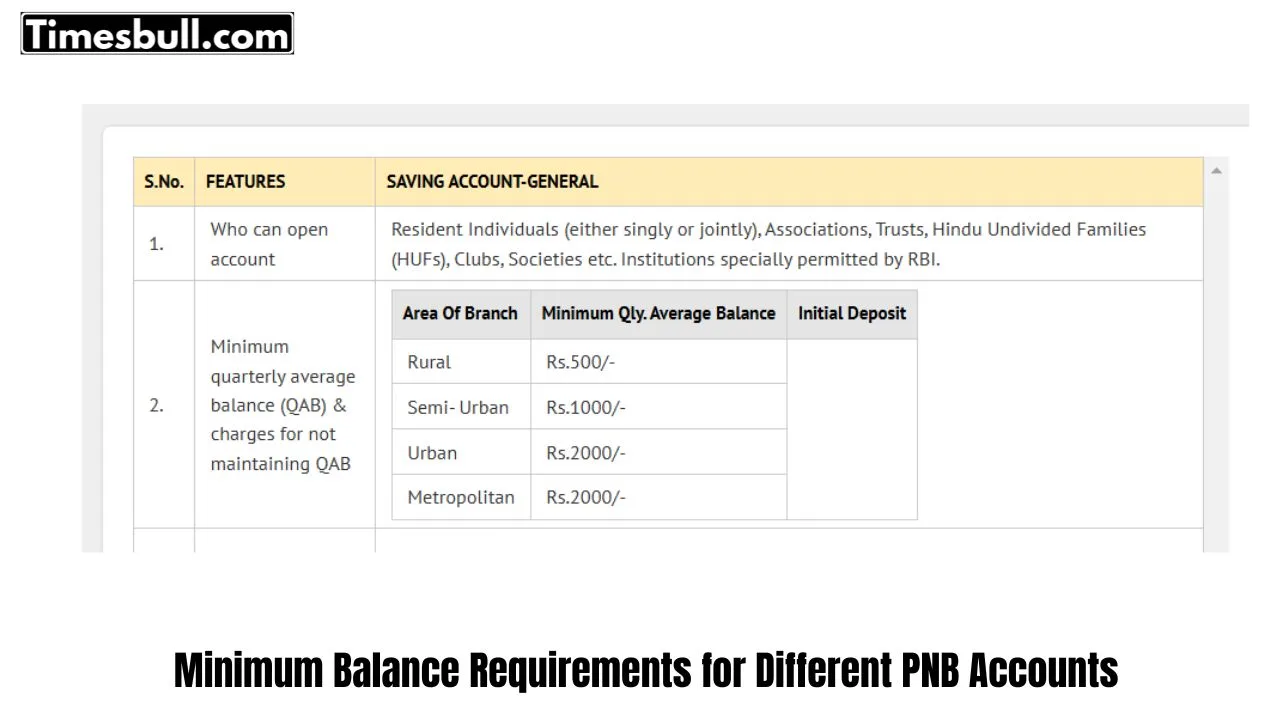

Minimum Balance Requirements for Different Accounts

1. Basic Savings Account

For PNB’s basic savings accounts, there is no requirement to maintain a minimum balance.

2. PNB Prudent Sweep Account

For the PNB Prudent Sweep Account, you must maintain a minimum balance of Rs 25,000. Failing to do so will result in a penalty.

3. PNB Unnati Saving Fund Account

The minimum balance requirement varies depending on the location of the branch:

- Rural Areas: Rs 500

- Semi-Urban Areas: Rs 1,000

- Urban and Metro Areas: Rs 2,000

Take control of your privacy & prevent unauthorized access to your data with a strong Lock Screen security!#MobileSecurity #CyberSecurity #CyberSmartYou #CyberAwareness #SafeBanking #PNB pic.twitter.com/7CqWcPEFRw

— Punjab National Bank (@pnbindia) January 30, 2025

Penalty for Not Maintaining Minimum Balance

If you fail to maintain the required minimum balance in any of these accounts, PNB will directly deduct the penalty amount from your account.