In today’s digital age, most of us use online payments, but in some places, only cash works. In such a situation, what will you do if you do not have a debit card or it is lost? Now there is no need to worry! You can learn how to withdraw money from your Aadhaar card. This method of withdrawing money from the bank through AEPS, i.e., Aadhaar, is very easy and safe.

New way to withdraw money

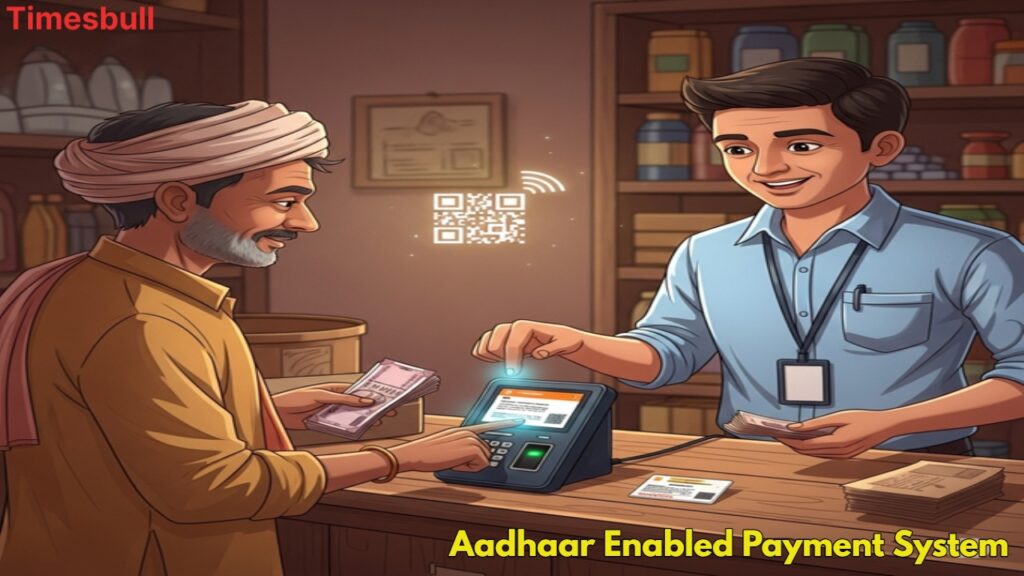

You can withdraw the money deposited in your bank account with the help of an Aadhaar card. This facility is called Aadhaar Enabled Payment System (AEPS), which has been started by the National Payment Corporation of India (NPCI). With this system, you can withdraw money from the bank, deposit, check your balance, or even get a mini statement using only your Aadhaar number and fingerprint. In this revolutionary method, you neither need an ATM card nor any PIN or OTP. The only condition is that your Aadhaar card should be linked to your bank account.

Complete process of withdrawing money from Aadhaar

If you want to withdraw money from Aadhaar, then this process is very easy:

Go to the nearest micro ATM or banking correspondent (BC). These people sit in shops or small branches of banks that have a small portable machine.

Enter your 12-digit Aadhaar number in the BC agent’s machine.

Now place your finger in the machine. It will verify your identity by matching your fingerprints with the Aadhaar database.

Choose the cash withdrawal option on the screen.

Put the amount of money you want to withdraw in the machine.

As soon as your identification is successful, you will get cash. Also, an SMS with transaction information will also come to your registered mobile number.

While using this facility, remember these things

There are some important terms and conditions for withdrawing money from AEPS, which will be beneficial for you to know.

Your bank account should be linked to your Aadhaar card.

Only the account that is linked to Aadhaar as the primary account will work.

Only a fingerprint is required for the transaction, no OTP or PIN.

RBI has not set any specific limit, but most banks allow withdrawal up to ₹50,000 for security reasons.

Apart from withdrawing money, you can also check your balance, deposit, and take out a mini statement.

In this way, AEPS has made the method of withdrawing money from the bank very simple for those who often had to face the inconvenience of a debit card or ATM.