Government Small Saving Schemes: If you are troubled by the fluctuations of the stock market or hesitate to take risks, then there are some government investment options available for you that are not only completely safe but also give good returns. These schemes are not affected by the fall in the market and the capital remains completely safe.

Public Provident Fund

PPF is a long-term investment scheme which is guaranteed by the Central Government. It currently offers 7.1% annual interest which is decided by the government every quarter. Its lock-in period is 15 years. The interest and maturity amount received on it are completely tax-free. Under section 80C, tax exemption of up to Rs 1.5 lakh is available on investment in the old tax regime.

Sukanya Samriddhi Yojana

If your daughter is less than 10 years old, then this scheme is best for you. It offers interest up to 8.2% which is more than PPF. The amount on maturity is completely tax-free. This scheme also offers tax exemption under section 80C. Its lock-in period is till the girl turns 21 or till her marriage.

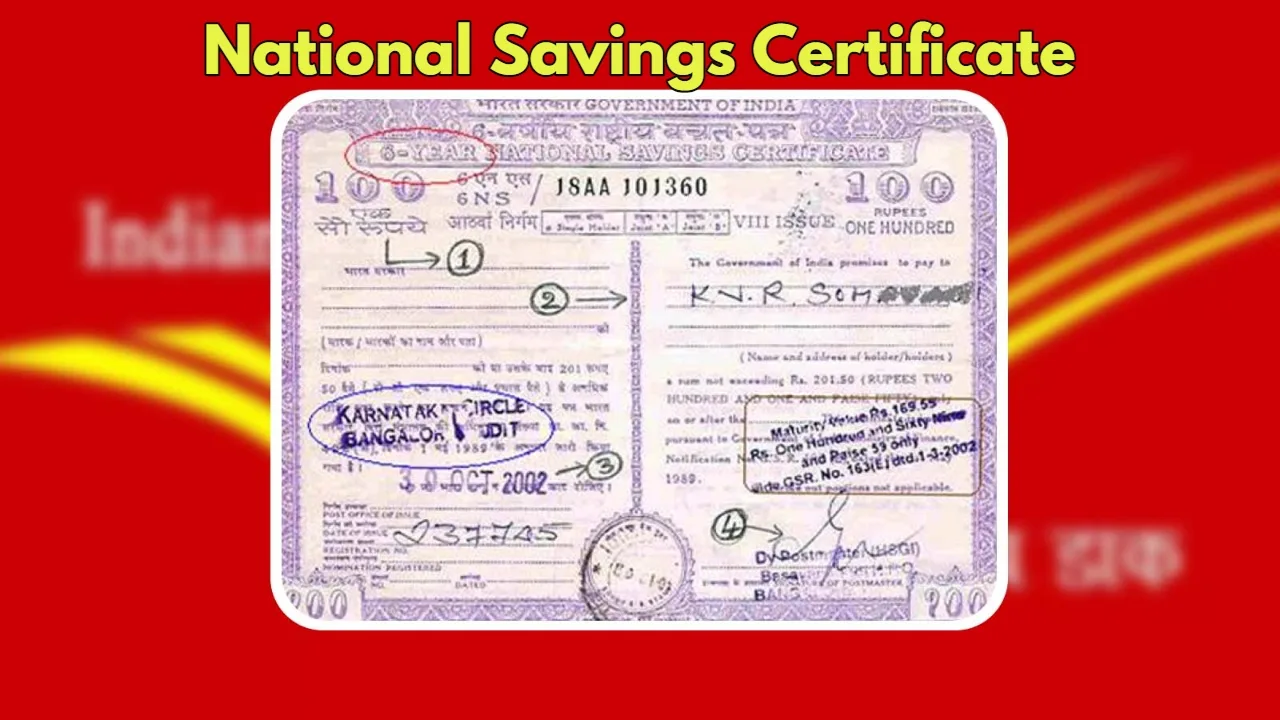

National Savings Certificate

You can invest in NSC from any post office. This scheme is completely safe and currently offers 7.7% annual interest. Its duration is 5 years and this interest is linked to the compounding rate. Interest is taxable but the investment amount is exempted under 80C.

Kisan Vikas Patra

This scheme is especially popular for rural investors. It currently offers 7.5% annual interest and the investment amount doubles in 115 months (9 years 7 months). This is also available in post offices and is completely safe. Neither the market fluctuations affect these government investment schemes nor is there a risk of capital sinking. These schemes are a great option for investors who want safe, stable, and tax-saving returns. In the era of market instability, such safe options are necessary for financial stability.

Why choose these government schemes

These government investment schemes are not affected by market fluctuations, nor is there any risk of capital sinking. These schemes are an excellent option for investors who want safe, stable, and tax-saving returns. In times of market instability, such safe options are very important for financial stability.