The PAN 2.0 project has been announced by the central government, with the intention to improve taxpayer services. However, the old PAN cards will continue to remain valid even with the new PAN 2.0 project in place. If there are no corrections or updates being made on the Individual’s existing PAN Card, then no need for an application for a New PAN Card was instructed by the Department of Income Tax. However, you as a taxpayer must ensure that your PAN Card is active at present.

There are occasions when the Department of Income Tax will deactivate a PAN Card for reasons of concern, such as if an individual possesses more than 1 PAN Card or if the Department of Income Tax has a suspicion of fraudulent activity against the Individual, the PAN card is subject to cancellation by the Department of Income Tax. As a taxpayer, to determine if your PAN Card is active or deactivated, follow a few simple steps. To verify your PAN Card is still active, please visit the following link:

How to check if your PAN card is active?

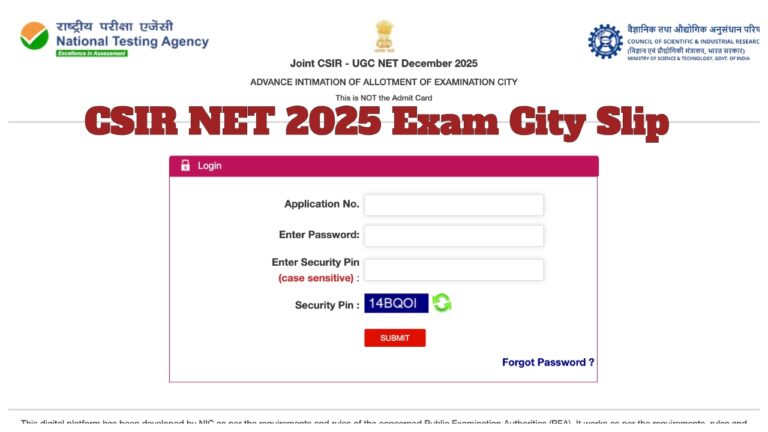

You can check the status of your PAN card by visiting the Income Tax Department’s e-filing portal. Go to the website and click on the ‘Verify Your Pan Status’ option. Then enter your mobile number, PAN number, date of birth and full name. Click on the ‘Continue’ option. An OTP will come on your registered mobile number. After providing the OTP, click on the ‘Validate’ option. If your PAN is active, you will receive the message ‘Your PAN is Active’.

Also Read-Watch – Arshdeep Singh and Virat Kohli viral funny chat video after IND vs SA 3rd ODI

What Will Happen to My Stale vs My Inoperative PAN?

If your PAN is not linked to your Aadhaar, and your Aadhaar has not been linked to your PAN before 30 June 2023, your PAN will be made inoperative after that date, if your PAN has been inactive. As such, inoperative is not the same as inactive. According to the Official announcement by the Government of India, if the taxpayer’s PAN is inoperative, the taxpayer will not be able to continue to file his tax return with the inoperative PAN. The taxpayer can verify that he is inoperative on the official website of the Income Tax Department based upon the linking status of the Aadhaar number.

Also Read –PVC PAN Card Online- Simple Process to Get a New Card Delivered to Your Address

How to make your inactive PAN active again?

The process to reactivate an inoperative PAN is to link the PAN to the Aadhaar. The holder will incur a penalty of Rs 1,000. The process to link the Aadhaar is available in the Quick links section of the Income Tax Department website and by clicking the Link Aadhaar button. The penalty for linking is not recoverable. Your PAN is considered active once linked to the Aadhaar number. If a PAN is inactive/taxpayers with an inoperative PAN cannot file their returns.