New Delhi: The year 2026 is going to be very important for PF employees. The central government may make some major announcements. In fact, the central government now transfers interest on deposits to the EPFO every financial year. The interest amount is approved at a meeting of the EPFO’s Central Board of Trustees.

The Ministry of Labour and Employment is once again considering paying interest. This time, it may provide an increased interest rate of 0.50 per cent for the financial year 2025-2026. Overall, the government may announce an interest rate of 8.7 per cent for PF employees. Last financial year, 8 per cent interest was transferred.

Read More: Will You Start a Paperware Business from Home? Apply This Way Under the Modi Government’s New Scheme

How much money will be deposited into the PF employees’ accounts?

If the central government approves an interest rate of 8.75 per cent for the financial years 2025 and 2026, it will be good news. This year, interest rates may increase by up to 0.50 per cent. In such a situation, employees may be wondering how much money will be credited to their accounts.

In fact, if a PF employee has ₹7 lakh in their account, then an amount of up to ₹58,000 can be transferred at an interest rate of 8.75%. If an employee has ₹6 lakh in their account, then they can receive approximately ₹50,000 in interest.

Approximately 8 crore employees are expected to benefit from the interest. The government is expected to approve the interest amount in February. After approval, the government will transfer the money to the EPFO, which will then be credited to the employees’ accounts. You can also easily check your account balance. There are now several online processes.

Check balance via SMS service.

You can send a message to 7738299899 from your registered mobile number.

You will need to enter your UAN number (instead of “EPFOHO UAN”) in the message.

You will then receive your balance information via SMS immediately.

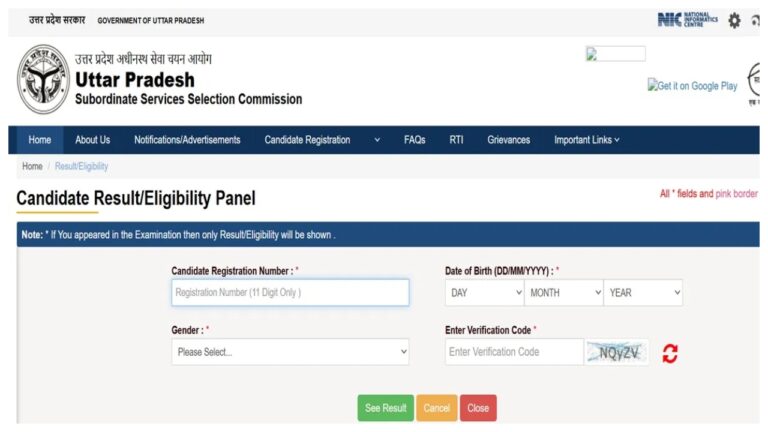

Check your balance through the EPFO portal.

To check your balance on the EPFO portal, first go to the passbook portal.

You will then need to log in by entering your UAN, password, and captcha.

After this, under “View,” click on “View Passbook” or “View Passbook (Lite).”