If you think that a PAN card is just an identity card, then this news is for you! The government has launched PAN 2.0, making PAN an advanced digital tool. This new system has modern features like a paperless process, all services on a single portal, and a dynamic QR code. Here we are telling you in detail about the new PAN card system.

What is PAN 2.0 and why is it so special

PAN 2.0 was launched by the Ministry of Finance in November 2024. Its main objective is to provide better, faster, and more reliable services to taxpayers. Under this new initiative, all the services related to PAN will be available on a single integrated portal. The entire process will be digital and paperless. This step is a big change towards further strengthening India’s digital infrastructure.

5 big benefits of PAN 2.0

The biggest feature of PAN 2.0 is that it will make every work related to PAN very easy for you. Some of its major benefits are given below:

1. Instant online issuance of PAN card.

2. The entire process is digital and paperless, which has reduced the need to upload documents.

3. Better data security and verification system.

4. Facility to save the card in a digital wallet or mobile.

5. Easy process to update address, photo, or signature online.

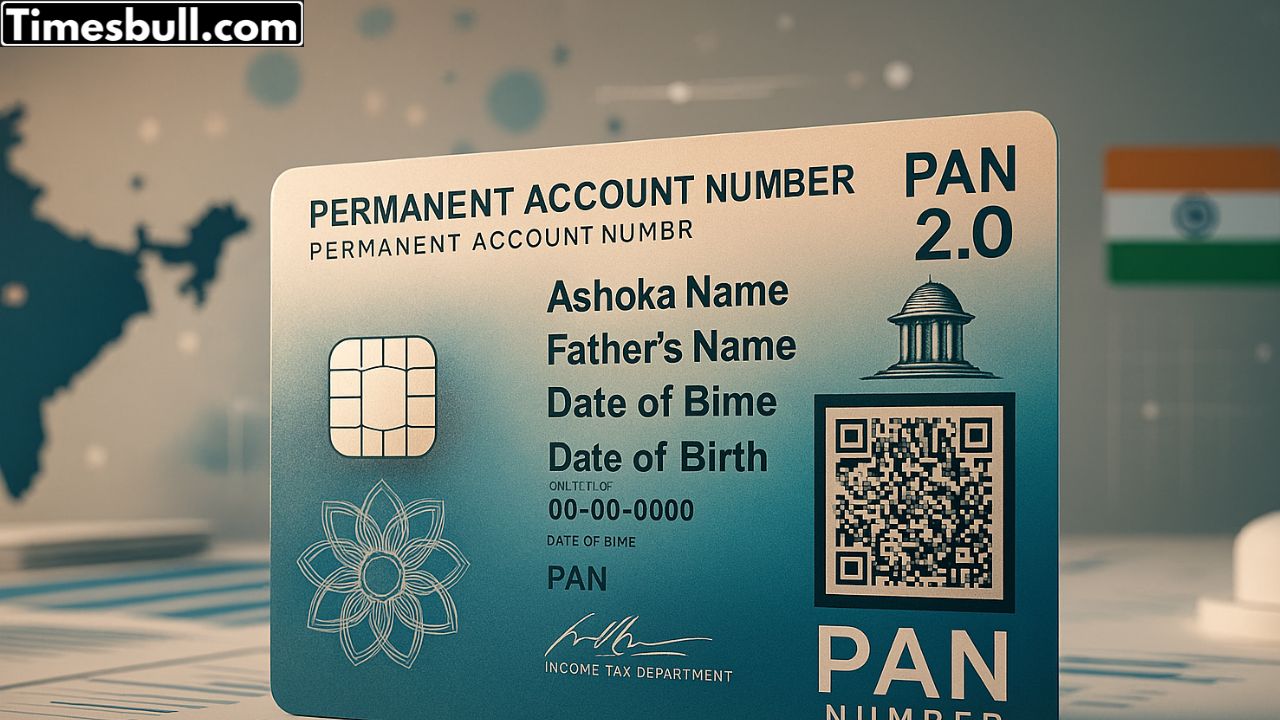

How different is the new PAN 2.0 from the old PAN card

The QR code has been given in the PAN card since 2017, but in PAN 2.0, this QR code has now become dynamic. This means that when you scan this QR code, it will show updated information in real-time. This will make it very easy to check the authenticity of the card, verify identity, and prevent fraud.

What will old PAN card holders have to do?

The government has made it clear that old PAN cards will also remain fully valid under PAN 2.0. Those who have cards before 2017, which do not have a QR code, can get a new card if they want, but it is not mandatory. Unless you get any update or correction done, there is no need to panic or make a new request.

Heavy penalty for negligence related to PAN

According to section 272B of the Income Tax Act, if a person holds more than one PAN card or gives wrong information, then they can be fined up to ₹ 10,000. In such cases, the person will have to go to their respective income tax office and deactivate the extra PAN card. The government is going to be strict on this issue as well, so it is very important to be careful.