After the continuous reduction in interest rates by the Reserve Bank of India (RBI), on one hand, home loan borrowers have got relief, on the other hand, the interest on bank fixed deposits (FD) has come down. Almost all banks, including the State Bank of India (SBI) and HDFC Bank, have reduced the interest rates of FDs. But, don’t panic! You can still get great returns by investing money in many small savings schemes. In these schemes, you are getting attractive interest ranging from 7.5 percent to 8.2 percent, which is much more than FD. This is a great opportunity to earn more while keeping your money safe.

Sukanya Samriddhi Yojana

If you want to make your daughter’s future safe and golden, then Sukanya Samriddhi Yojana (SSY) is the best option for you. In this scheme, investors are currently getting a great interest of 8.2 percent. You can open this account in the name of your daughter below 10 years of age. In this, ₹ 250 to ₹ 1.50 lakh can be deposited annually. This scheme can be opened by parents or legal guardians. By investing in this scheme, you can not only create a large fund for your daughter, but also avail of tax exemption.

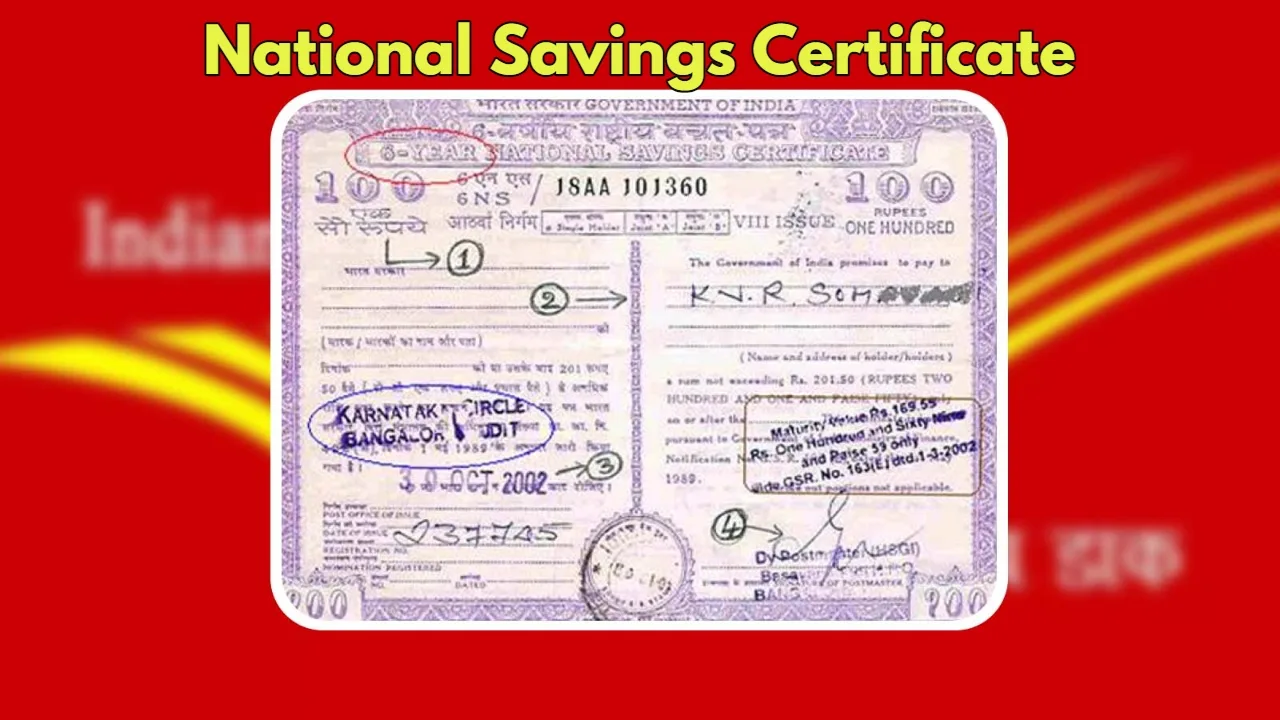

National Savings Certificate

The money invested in National Savings Certificate (NSC) is currently giving a return of 7.7 percent. It is a safe and reliable option for those who want assured returns on their investment. The lock-in period of this scheme is five years. You can avail of tax exemption under Section 80C of the Income Tax Act by investing up to ₹ 1.5 lakh in NSC in a financial year. However, it is important to know that you will have to pay income tax on the interest income received from NSC (on maturity).

Post Office Monthly Income Scheme

For investors who want a fixed income every month, the Post Office Monthly Income Scheme (POMIS) is a great option. It is giving a return of 7.4 percent on the money invested. The maturity period of this scheme is five years. A minimum of ₹1,000 can be deposited in POMIS, and after this, one can invest in multiples of ₹1000. The maximum deposit limit for a single account is ₹9 lakh. The maximum deposit limit for a joint account is ₹15 lakh. This scheme is great for retired people or housewives who want a regular monthly income on their investment.

Kisan Vikas Patra

Kisan Vikas Patra (KVP) is a lump sum deposit scheme. Currently, this scheme is giving 7.5 percent interest. It is very popular among investors who are risk-averse and want to see their money double safely. In KVP, you can invest a minimum of ₹1,000 and in multiples of ₹100 thereafter. There is no maximum investment limit, so even big investors can take advantage of it. In KVP, your money doubles in a fixed period, which makes it a very attractive option.

Senior Citizen Savings Scheme

If you want to invest your retirement fund in a place where you get bumper interest, then there is nothing better than the Senior Citizen Saving Scheme (SCSS). Only persons above 60 years of age can invest in this scheme (in some cases, even 55 years). Currently, this scheme is offering the highest interest of 8.2 percent, which makes it the most attractive option for senior citizens. Up to ₹30 lakh can be invested in SCSS. This scheme provides senior citizens with regular and assured income in their old age, enabling them to remain financially independent.