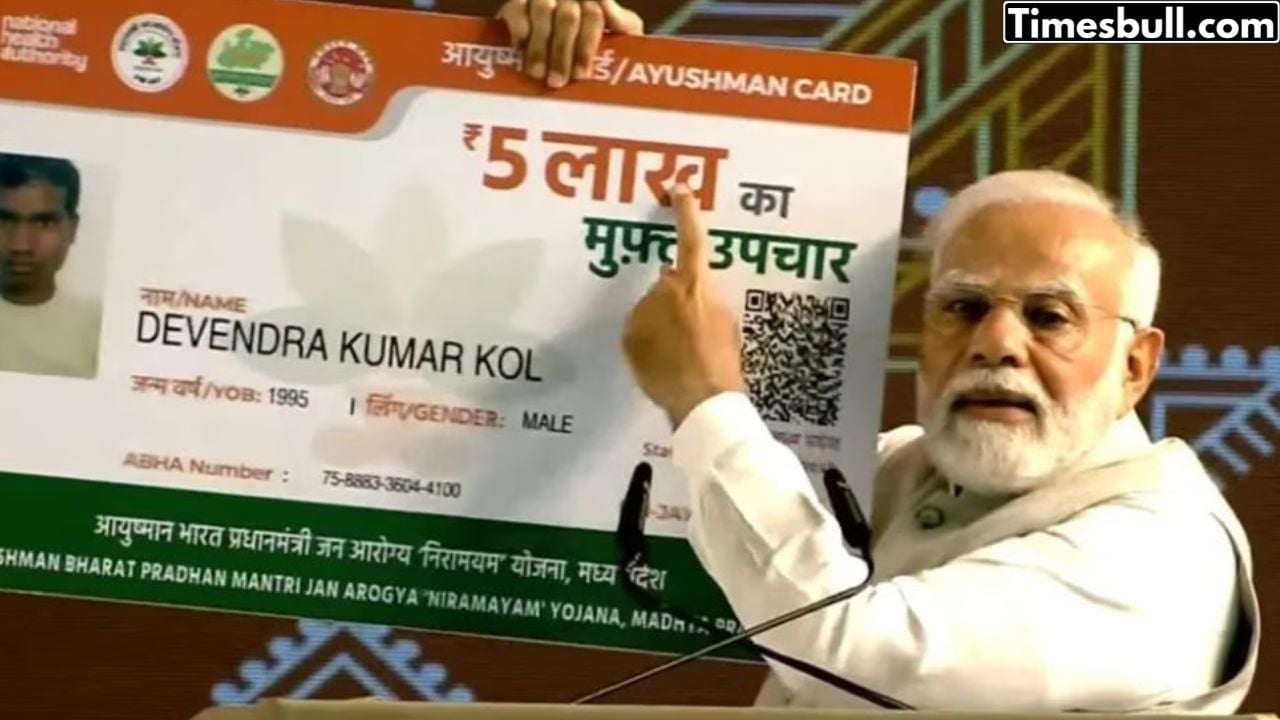

The Indian government has taken several major steps to make healthcare accessible to the common man, most notably the Ayushman Bharat scheme. It is considered one of the largest health insurance schemes in the world. Incomplete information often leads to last-minute difficulties in hospitalization. Therefore, if you are a beneficiary of this scheme, it is extremely important for you to thoroughly understand its rules and treatment limits.

What does the ₹5 lakh limit mean

The primary objective of the Pradhan Mantri Jan Arogya Yojana (PM-JAY), launched by the government, is to provide a health security cover to economically weaker sections. The answer regarding the frequency of treatment is a bit complicated and important to understand. Technically, there is no set limit on the number of hospitalizations per year. You can be admitted an unlimited number of times, but this benefit only applies up to an annual limit of ₹5 lakh.

This scheme operates on a ‘Family Floater’ basis. This means that this ₹5 lakh cover is not per person, but for the entire family. For example, if your family has six members, this ₹5 lakh amount can be used for the treatment of one ailing member or, if necessary, divided among all members. Once your card’s wallet balance (₹5 lakh limit) is exhausted, you will have to bear the remaining expenses yourself. Therefore, it is wise to be mindful of the balance when seeking treatment.

Also Read-Massive PAN Rule Change: Aadhaar Linking Mandatory Before December 31, 2025

The card will be useful only for serious illnesses

People often go to the hospital with the Ayushman card even for minor ailments and are disappointed. It is important to clarify that this plan is primarily for serious conditions requiring hospitalization. Its benefits are not available for general physician consultations, X-rays, blood tests, or minor medications.

However, if the case is serious, such as heart valve replacement, prostate cancer, kidney transplant, coronary angioplasty, or neurosurgery, this card is a boon. In such situations, patients don’t have to pay hefty hospital bills out of their own pockets, and the entire procedure is cashless. This scheme is designed to save patients from the burden of debt.

Get your card easily from the comfort of your home

Earlier, availing the benefits of government schemes required multiple visits to offices, but now the government has made this process completely transparent and digital. You don’t need to pay any middlemen or agents to get your card. You can do this yourself by downloading the government’s ‘Ayushman App’ on your smartphone.

Your mobile number and Aadhaar are used to log in to the app. Here, you can check your family’s eligibility by selecting your state and district. If a member’s name is listed but the card hasn’t been generated, an ‘Authenticate’ option will appear next to their name. Here, e-KYC can be completed using Aadhaar OTP and photo verification. You can download the card from the same app within a week of verification.

Also Read-Sukanya Samriddhi Yojana-Deposit Only ₹250 to Begin Your Daughter’s ₹71 Lakh SSY Millionaire Journey