8th Pay Commission: Millions of folks in the country have money that hasn’t been claimed. There’s a new initiative to get it back to the people who rightfully own it. The central government kicked off the “Your Money, Your Right” campaign. PM Narendra Modi mentioned on LinkedIn that so far, under this campaign, Rs 2,000 crore has been returned to its rightful owners. This initiative started in October 2025.

PM Modi pointed out that this is a chance to get back our forgotten wealth. He encouraged everyone to get involved in the “Your Money, Your Right” movement. The goal of the campaign is to help return unclaimed financial assets like bank deposits, insurance, dividends, shares, mutual funds, and pensions to the people who are entitled to them.

1 lakh crore rupees are just sitting there unclaimed

At a recent event, PM Modi said, “Indian banks have unclaimed Rs 78,000 crore belonging to our citizens. Insurance companies have Rs 14,000 crore unclaimed. Mutual fund companies have Rs 3,000 crore unclaimed, and Rs 9,000 crore in dividends are also unclaimed.” In his post, PM Modi noted that these figures have surprised many. Over Rs 1 lakh crore of such money is just lying around unclaimed in the country.

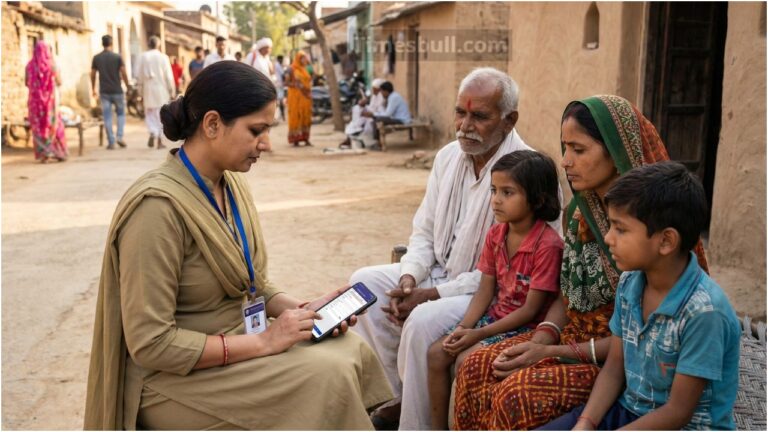

To make this movement a success, PM Modi announced that Suvidha camps have been set up in 477 districts. These camps are organized all over the country, in both rural and urban areas. They’ve been specifically placed in remote locations to ensure that every citizen can access them.

What is the fitment factor?

Is this fitment factor the same across all pay levels (Levels 1 to 18)? Krishnamurthy explains that in the 7th CPC, it was the same for all employees. The Index of Rationalization (IoR) is different for different levels, but it is not directly related to the fitment factor. Who makes the final decision on the fitment factor? Experts say that the Pay Commission gives its recommendation, but the final authority rests with the Union Cabinet. In the 6th CPC too, the government had approved a higher fitment factor, going against the Commission’s recommendation. In such a situation, the government can also make changes in the multiplier of the 8th Pay Commission as per the need.

How much can the salary increase?

Rising DA rates and annual increments also affect the fitment factor. Krishnamurthy says that the argument for a higher fitment factor becomes stronger due to DA and delays, but the government’s financial capacity will determine its limits. Vaidya says that after adding DA to the basic salary, the actual increase does not appear to be very large. For example, applying a factor of 1.8 to a basic salary of Rs 18,000 will result in a new basic salary of Rs 32,400, but adding 58% DA, the actual increase is only about 13%.

What’s calculation?

The fitment factor will have a big effect on salaries and pensions. For instance, an employee earning a basic salary of Rs 18,000 might see their pay jump to Rs 32,940 with a factor of 1.83, and to Rs 44,280 with a factor of 2.46. Likewise, someone with a basic salary of Rs 50,000 could find themselves in the new pay band of Rs 91,500 to Rs 1.23 lakh. Pensions will also take a hit.

If a fitment factor of 2.0 is put in place, an employee retiring with a basic salary of Rs 25,000 would see their new basic salary rise to Rs 50,000, but their pension would drop by Rs 25,000. In general, experts think that the fitment factor from the 8th Pay Commission could be between 2.0 and 2.2, but the final call will hinge on the government’s financial situation and the Commission’s advice.