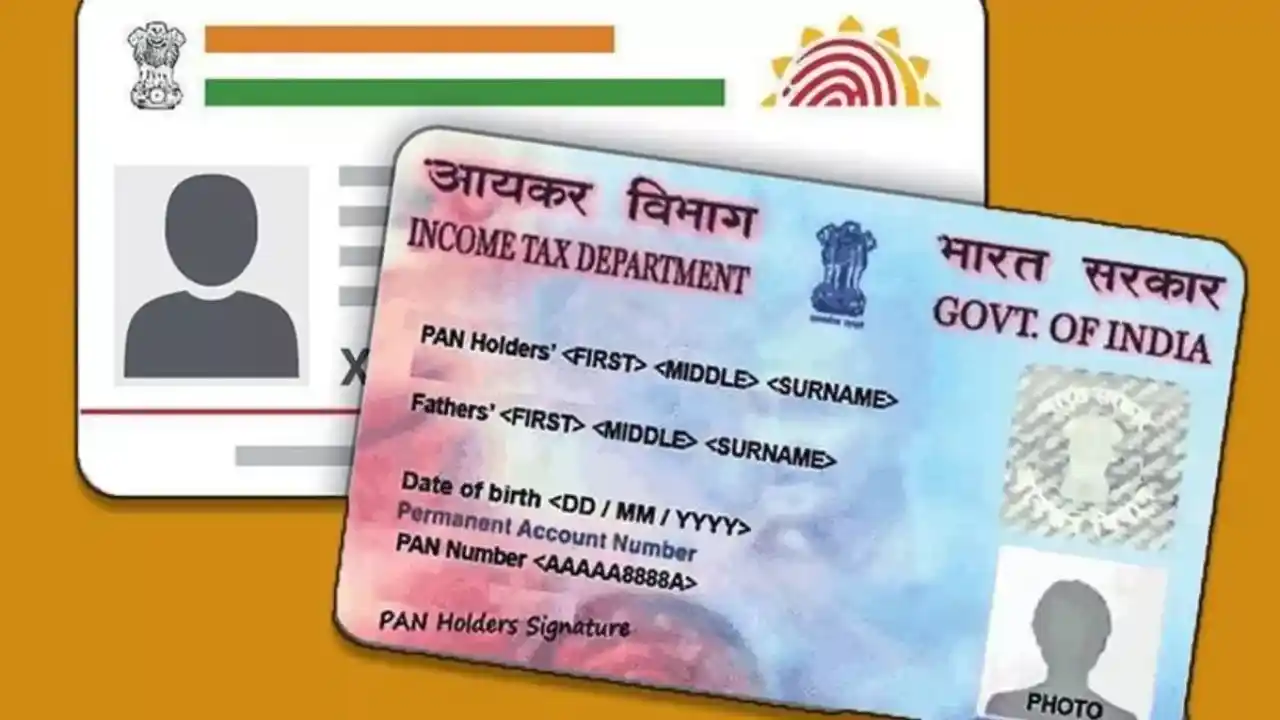

The National Payments Corporation of India (NPCI) has launched a new and very special feature on the Income Tax-Filing Website. This feature will make the process of PAN and bank account verification easier and faster than ever before. Its main goal is to make this process even more accessible and available in real-time for taxpayers and government departments. NPCI has issued a circular saying that it has launched a new Application Programming Interface (API).

This API will make the verification of PAN details, bank account status, and account holder’s identity easier in real-time. This data will be verified directly from the Core Banking System (CBS) of banks, ensuring accuracy and reliability. The circular states, “This API will help government departments to verify customer account details such as PAN verification, account status, and account holder’s name with their bank’s CBS.”

What is an API

NPCI has urged all member banks to implement this facility on a priority basis, as this service is being made available to the Government of India. This means that all banks will be connected to this new system so that this process can work effectively across the country.

What does this mean for taxpayers

This new verification feature can bring several significant benefits to taxpayers, making their tax filing and refund process better than ever before:

Faster verification process

The process of linking PAN and bank accounts will now be much faster. Earlier it used to take time, but now it will be almost instant.

Reduction in errors

The chances of manual error in verification will be reduced, as the data will be taken directly from the bank’s system. This will eliminate the hassles caused by incorrect information.

Fast and secure refunds

Refunds and alimony will now be received quickly and securely. You will not have to wait long for your money, and there will also be less chances of fraud.

More reliable data

The process of data verification will be more reliable and secure. Since the information is coming directly from the source, its authenticity cannot be doubted.