The Post Office National Savings Certificate (NSC) is an excellent option for those looking to build a substantial fund for the future while avoiding market risks. The government guarantee and tax exemption under Section 80C make it a preferred choice for the middle class and those planning for retirement. In today’s detailed article, we’ll explore how investing in an NSC can earn lakhs in profits in just 5 years.

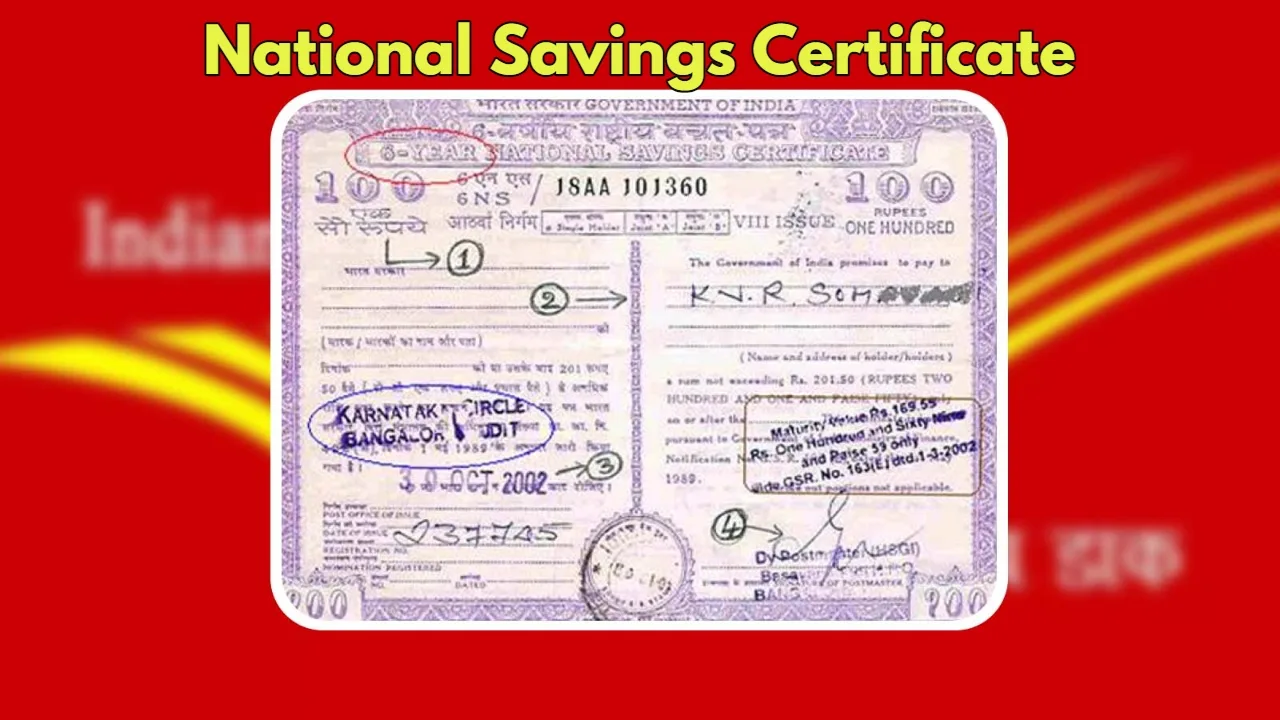

What is NSC, and how does it work

The National Savings Certificate is a small savings scheme backed by the Government of India. Its biggest advantage is that your money is completely protected from stock market fluctuations, and returns are guaranteed at the time of investment. The maturity period of an NSC is 5 years. You can start investing with as little as ₹1,000. The special thing is that there is no upper limit on the investment; you can deposit any amount as per your capacity. This scheme is ideal for investors who want to invest a lump sum and see it grow safely.

How much return will you get on an investment of ₹10 lakh

Currently, the Central Government offers an annual interest rate of 7.7% on NSC. Interest is calculated annually but is paid only at maturity. If an investor deposits ₹10 lakh in this scheme, they will receive a maturity amount of approximately ₹14,49,035 after 5 years. This simply means that you will earn a net profit of approximately ₹4.49 lakh in interest alone, without any risk. Similarly, if you invest ₹5 lakh, your amount will grow to ₹7,24,517 after 5 years. This is where the magic of compound interest comes into play, allowing your money to grow exponentially over time.

The Double Benefit of Tax Deduction on Investment in NSC

NSC is renowned not only for its returns but also for its tax savings. The amount invested in this scheme is eligible for a deduction of up to ₹1.5 lakh annually under Section 80C of the Income Tax Act. Another interesting aspect is that the interest earned each year is considered a ‘reinvestment’, which in itself is tax-deductible. However, it is important to note that the total interest earned at maturity is added to your total income and taxed according to your tax slab. This scheme is very useful for employed individuals who want to reduce their tax liability.

Who can open an NSC account

Investing in NSC is very simple, and its rules are quite clear. Only resident citizens of India can invest; Non-Resident Indians (NRIs), companies, or trusts are not eligible for this scheme. Any adult can open an account in their own name or on behalf of their minor child. Additionally, two or three people can open a joint account. Children over the age of 10 can also take out an NSC in their own name, while for mentally disabled individuals, their legal guardians are eligible to open an account.

Should you invest in NSC

If you prioritize security and want a guaranteed return by locking your money in for 5 years, there’s nothing better than NSC. This scheme not only protects your capital but also offers excellent inflation-beating returns. To invest in it, you can visit your nearest post office and submit the required KYC documents, such as your Aadhaar card, PAN card, and photo, and start your account immediately.