NPS Vatsalya Scheme: If you want to start investing early for your child’s retirement, then NPS Vatsalya Yojana can be a great option for you. By investing just Rs 1,000 every month, you can create a fund of more than Rs 4 crore for your child. NPS Vatsalya Yojana gives parents an opportunity to invest in the name of children from infancy, which gives the benefit of compounding in the long term.

This scheme can help in making the future of children financially strong with flexible investment options and safe returns. Parents can open an NPS account in the name of the child by depositing just Rs 1,000 annually. For this reason, this scheme is affordable and accessible to families of every economic class. Let us know how to invest in it and what are its benefits…

NPS

Suppose Yamini (a fictitious name) opened an NPS account in the name of her child as soon as he was born. She invested only Rs 1000 every month until his child became an adult (18 years of age). After becoming an adult, Yamini’s son continued his NPS account and he also continued to invest Rs 1000 regularly till the age of 60. In this situation, when her son retires, he will have a fund of more than Rs 4 crore. You can see its calculation here…

Monthly investment in NPS account: Rs 1000

Total investment period: 18 years

Interest rate: 10%

Total investment in 18 years: Rs 2,28,000 (Rs 2.28 lakhs)

Expected corpus at age 18: Rs 6,75,300 (Rs 6.75 lakhs)

Potential corpus at age 60: Rs 4,40,78,734 (Rs 4.40 crore)

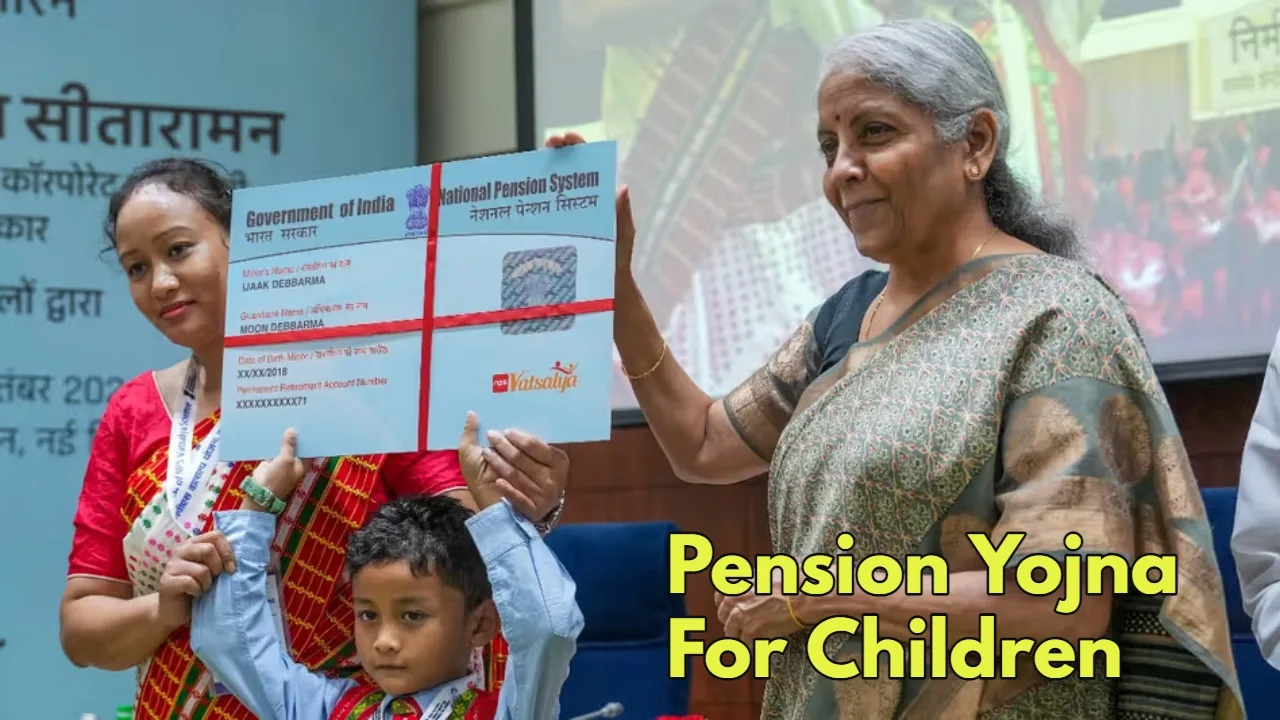

What is NPS Vatsalya Scheme?

NPS Vatsalya Yojana is an important step in India’s pension system. This new scheme is being launched to secure the financial future of children. The task of managing the NPS Vatsalya Yojana will be in the hands of the Pension Fund Regulatory and Development Authority (PFRDA). The NPS Vatsalya scheme will allow parents and guardians to save and arrange funds for the future of their children by investing in a pension account.

The launch of NPS Vatsalya is an important step by the government towards promoting long-term financial planning and security for all. This is a big step towards securing the financial future of India’s future i.e. children and making them financially empowered.