NPS Vatsalya Yojana: With India’s rapidly changing demographics and the shocking data from the “India Aging Report 2023,” retirement planning is no longer just a matter for the elderly. According to the report, India’s elderly population is expected to double to 347 million (25% of the total population) by 2050. To ensure a secure future, the government has laid the foundation for far-reaching initiatives like NPS-Vatsalya. The primary objective of this scheme is to ensure financial independence from the moment a child is born.

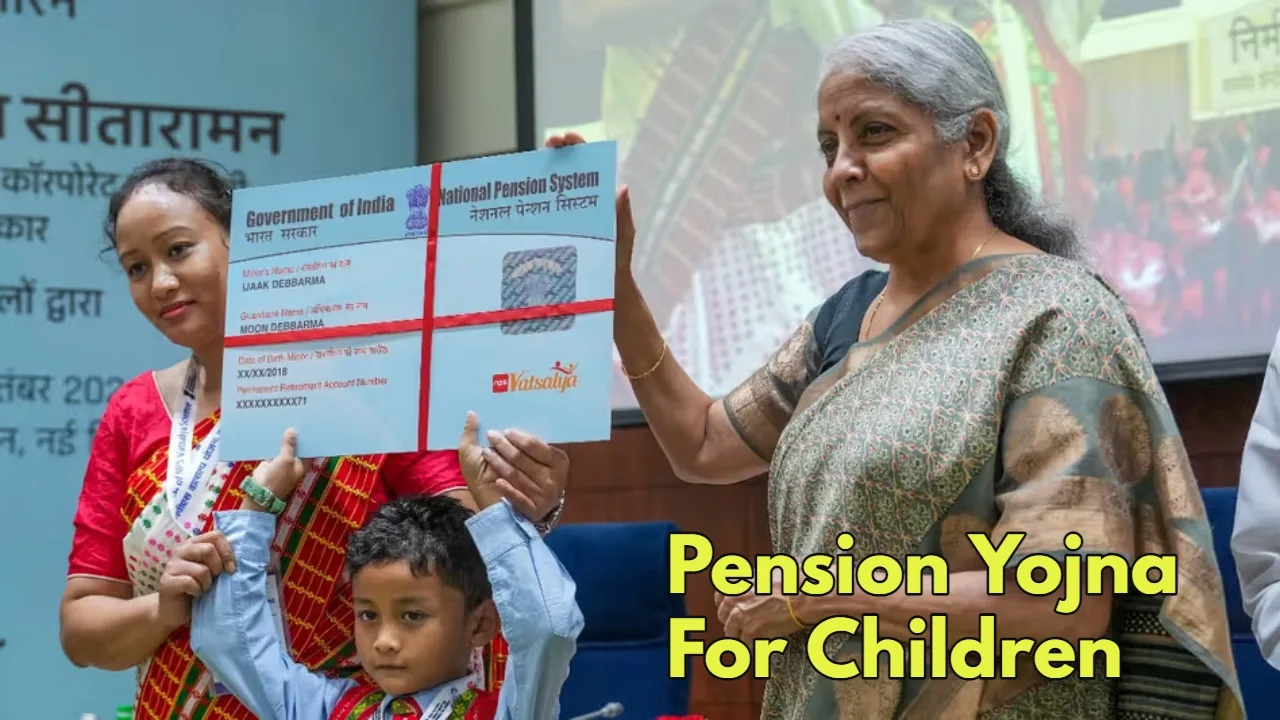

PRAN-DAN card will be available at birth

Pension planning should begin from the cradle, not when retirement approaches. The government proposes that every newborn be issued a Permanent Retirement Account Number (PRAN) and a PRAN-DAN card at birth.

Approximately 25 million children are born in India every year. If the Central Government contributes an initial ₹1,000 to each child’s account, the annual expenditure will be approximately ₹2,300 crore. This investment will prove to be a robust and lasting solution to reducing the burden of old-age pensions in the future. This amount is much more effective than the current old-age pension schemes.

Parental Involvement and Digital Linkage

The implementation of this scheme has been simplified. The child’s PRAN account can be linked to the parent’s mobile number or UPI ID. Parents will be encouraged to deposit at least ₹100 into the child’s account every month.

Innovative methods have also been explored to raise funds for this initial contribution, such as using unclaimed bank deposits, court fines, or traffic challan proceeds. Additionally, philanthropists and large companies can also contribute to this initiative as part of their CSR activities.

How to turn ₹1,000 into ₹4.2 crore

Time is the ultimate magician in pension planning. If a child becomes a responsible investor from birth, the powerful power of compounding can make them rich. According to calculations, if the investment amount is increased gradually at different ages and earns an average annual return of 9%, the results will be remarkable.

By the time this child turns 60, they will have a huge fund of over ₹4.2 crore. This fund will enable them to receive a solid pension of over ₹2.1 lakh per month in their old age. Most importantly, their original deposit will remain completely safe during this period.