To financially empower women, the Government of India launched the revolutionary scheme “Lakhpati Didi” in 2023. The primary objective of this scheme is to help women start their own businesses, increase their income, and become self-reliant. Women covered under this scheme receive an interest-free loan of up to ₹5 lakh, enabling them to start a new business or expand their existing business. This scheme directly targets women who are financially vulnerable and unable to progress due to a lack of support.

Which women are eligible for the Lakhpati Didi Scheme

This scheme is only available to women associated with self-help groups (SHGs). It is important to understand the eligibility criteria thoroughly. Applicants must be members of a recognized self-help group. Regarding the age limit, this scheme is open to women between the ages of 18 and 50.

This scheme directly targets women from small villages, towns, or economically disadvantaged families. After joining an SHG, women receive skill training to increase their income, including skills such as sewing, pyroprinting, food processing, dairy, and handicrafts.

Required Documents and Loan Details

After completing the skill training, women prepare their business plan and, based on this plan, receive an interest-free loan of up to ₹5 lakh. Basic documents required to avail of this scheme include an Aadhaar card for identity and address proof, a PAN card for financial identification, a bank passbook for loan disbursement, an income certificate to verify financial status, and a passport-sized photograph for the application form. Proof of affiliation with a Self-Help Group is also mandatory.

Simple Process to Apply for the Scheme

The application process for this scheme is extremely simple and can be done in two ways.

Online Application

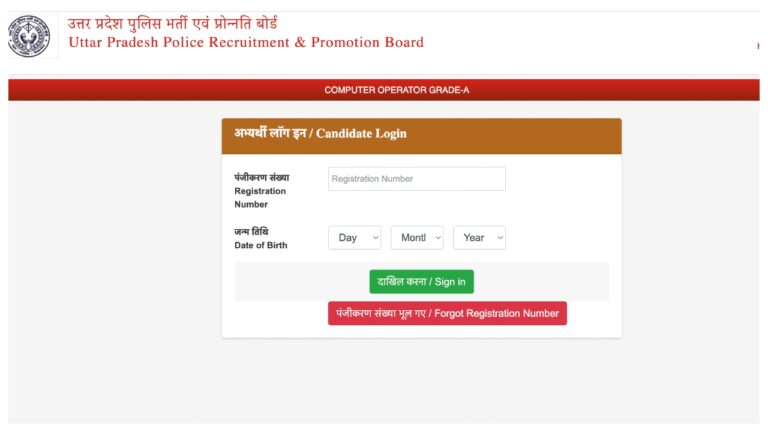

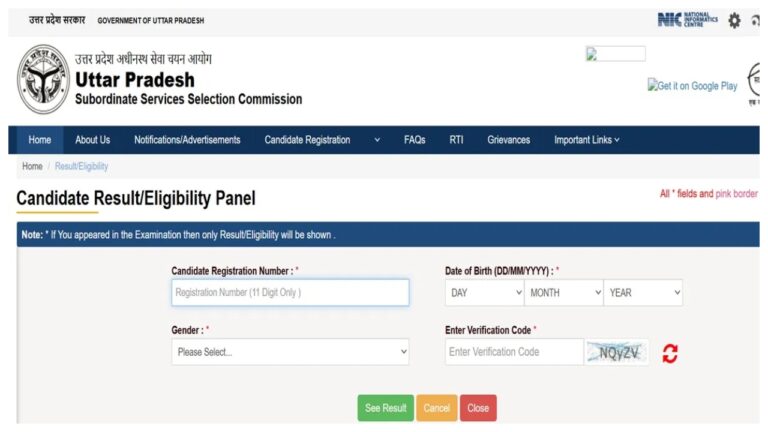

To apply online, you must first visit the Ministry of Rural Development’s website and fill out the online form. Next, upload the scanned documents and enter a summary of your business plan.

Offline Application

To apply offline, you must first join a recognized self-help group. After joining an SHG, complete skills training and prepare your business plan. You can submit the form and all documents to the SHG office, the Rural Development Department, or the nearest bank.

Once the documents are complete, the application is processed, and upon approval, the loan is disbursed. This scheme has increased the income of thousands of women and given them a golden opportunity to become self-reliant.

Also Read-New Labour Code Shock: Gratuity Now After 1 Year — But These Mistakes Can Make You Lose It Entirely