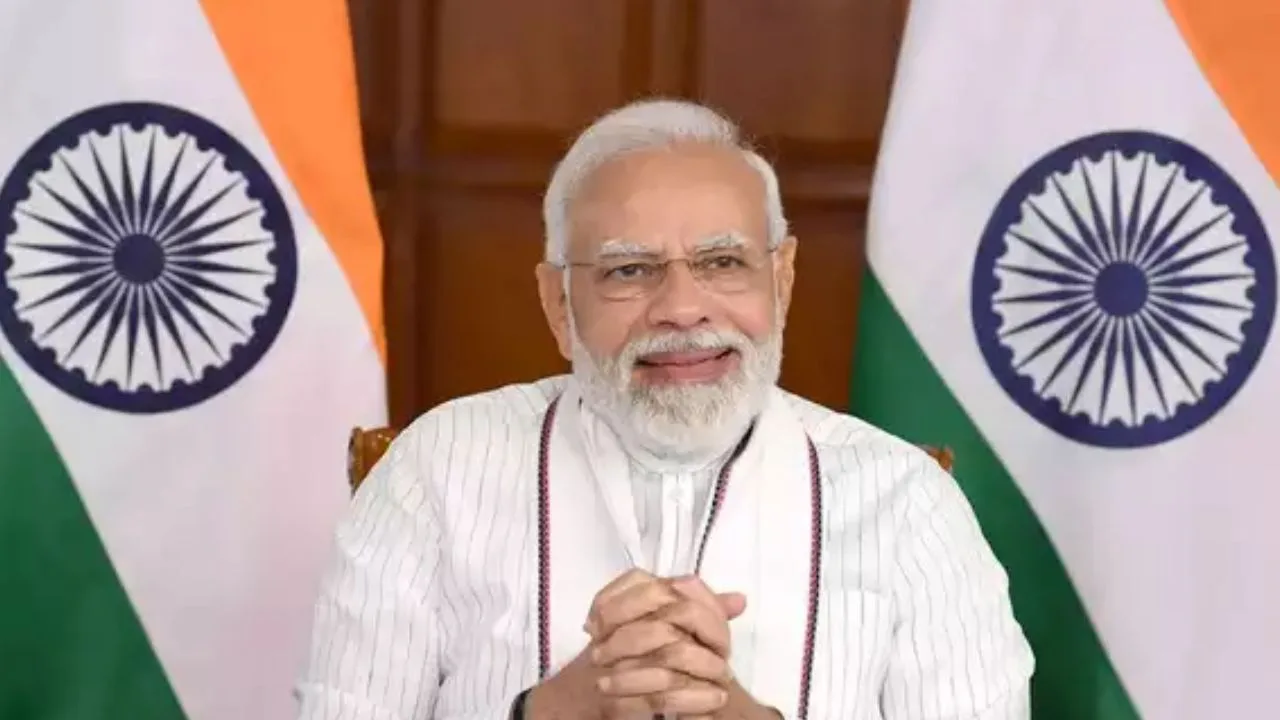

Home Loan: The aspiration to construct a home is a common dream for many, yet turning this dream into reality can be quite challenging. The central government, led by Narendra Modi, is committed to assisting you in achieving your housing goals. Specifically, through the Pradhan Mantri Awas Yojana-Urban (PMAY-U) 2.0, the government is offering interest subsidies on home loans to eligible beneficiaries. Let us delve into the specifics of this initiative.

Financial relief on home loans

The government provides financial relief on home loans via the interest subsidy scheme, targeting beneficiaries from economically weaker sections (EWS), lower-income groups (LIG), and middle-income groups (MIG). Those who secure a home loan of up to ₹25 lakhs for a property valued at ₹35 lakhs can avail themselves of this benefit. Eligible individuals will receive a 4% interest subsidy on the initial ₹8 lakhs of their loan for a duration of 12 years. Furthermore, these beneficiaries will be granted a total subsidy of ₹1.80 lakhs, disbursed in five annual installments through a straightforward process. They can monitor their account details via the official website, using an OTP, or through a smart card.

To qualify, applicants must not possess a permanent residence anywhere in the country. It is important to note that families with an annual income of up to ₹3 lakhs are classified as EWS, while those earning between ₹3 lakhs and ₹6 lakhs fall under the LIG category, and families with incomes ranging from ₹6 lakhs to ₹9 lakhs are categorized as MIG. The components of PMAY-U 2.0, including Beneficiary Led Construction (BLC), Affordable Housing in Partnership (AHP), and Affordable Rental Housing (ARH), will be executed as a centrally sponsored scheme, whereas the Interest Subsidy Scheme (ISS) will function as a central sector scheme.

Beneficiaries have the option to select one component from the four available, based on their eligibility and preferences, to receive the associated benefits. The four components of PMAY-U 2.0 are: (i) Beneficiary Led Construction (BLC), (ii) Affordable Housing in Partnership (AHP), (iii) Affordable Rental Housing (ARH), and (iv) Interest Subsidy Scheme (ISS).