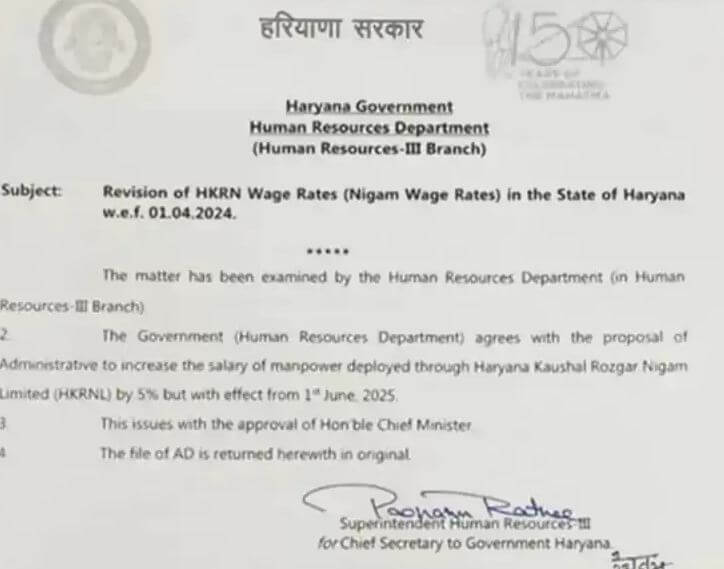

Salary Increase- There is good news for the employees of Haryana Kaushal Rojgar Nigam. The state’s Naib Saini has given a big gift to the employees of HKRN by increasing their salary by 5 percent. The new rates will be applicable from June 1, 2025. Due to this, the salary of the employees will increase from 900 to about 1200 rupees. This will benefit 1.18 lakh employees of HKRN. The Human Resources Department has also issued an order in this regard. This increase is 3 percent less than last year.

Last year, the salary was increased by 8%

These employees were merged under Haryana Kaushal Rozgar Nigam (HKRN) on 13 October 2021. Earlier these employees were working on DC rate and contract basis. Earlier in July 2024, the salary was increased by 8 percent. In 2023, there was an increase of 10 to 20 percent.

UPS will be implemented in the state from August 2025

The Haryana government has decided to implement the Unified Pension Scheme (UPS) notified by the Centre under the National Pension System (NPS) for its employees from August 2025. Under the current NPS, employees contribute 10%, while the state government contributes 14%. With the implementation of UPS, the state government’s contribution will increase to 18.5%, leading to a monthly expenditure of about Rs 50 crore and an annual cost of Rs 600 crore.

This will benefit more than two lakh state government employees appointed on or after January 1, 2006. A state government employee opting for UPS will get 50% of the average basic salary drawn during the 12 months preceding retirement as pension, provided the employee has completed 25 years of service. If the employee retires after completing 10 or more years of qualifying service, he will be assured of a minimum guaranteed pay of Rs 10,000 per month.

In case of death of the pensioner, his family will receive 60% of the last drawn pension amount.Dearness Relief (DR) will be applicable on both assured pension payment and family pension. DR will be calculated in the same way as DA applicable to serving employees.However, dearness relief will be payable only when pension payment commences.