Post Office Scheme: There is big news for those investing in post office small savings schemes like PPF, Sukanya Samriddhi Yojana, and FD. The government has not made any changes in the interest rates on these schemes. This news is very important for people looking for safe investments, because in today’s era, where the returns may be a little low, the safety of capital is paramount. The government encourages people to save through these schemes, and now the interest rates will remain the same for the July-September 2025 quarter.

The government’s latest announcement on interest rates

The Finance Ministry has given a big update regarding the interest rates of small savings schemes. There has been no change in the interest rates of these schemes for the July-September 2025 quarter. This means that investors will continue to get the same returns as before. These savings schemes include popular schemes like Public Provident Fund (PPF), Senior Citizen Savings Scheme (SCSS), Sukanya Samriddhi Yojana (SSY), Post Office Fixed Deposit (FD), and National Savings Certificate (NSC). This stability is good news for investors who want predictable and safe returns.

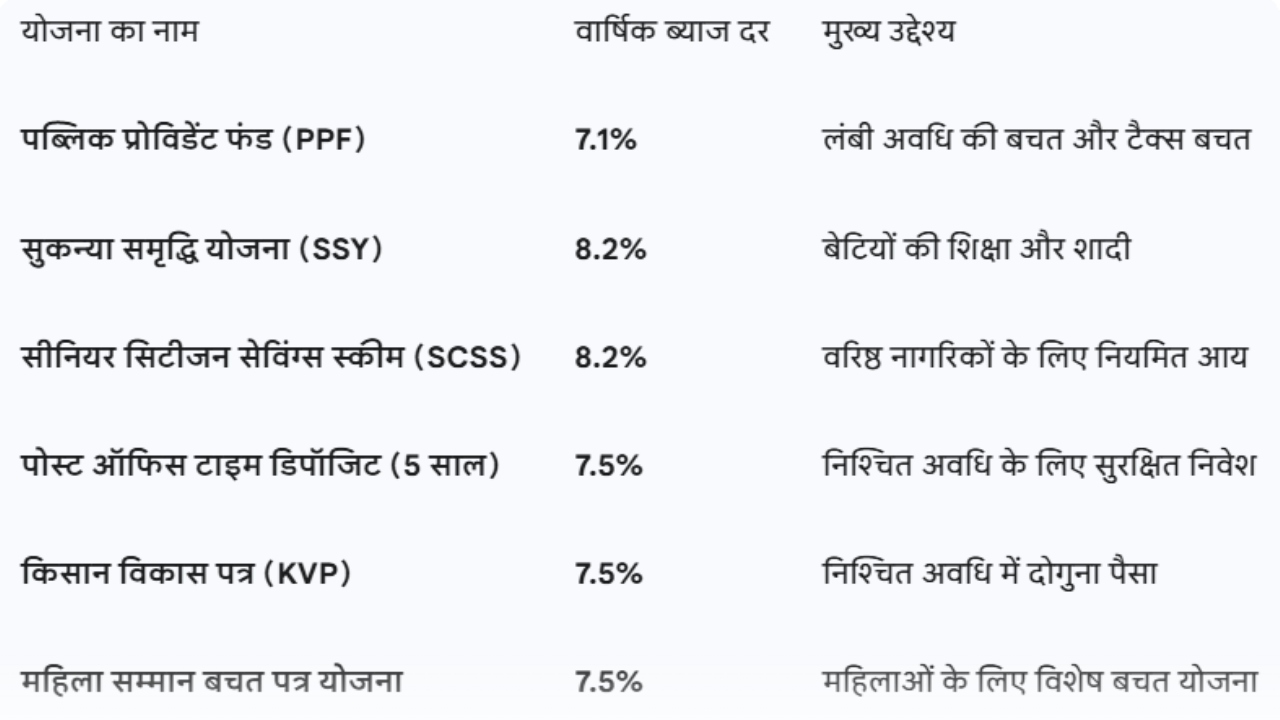

How much interest is being given to which scheme

The interest rates available on different small savings schemes are different, depending on your investment period and the purpose of the scheme. See here how much interest you are getting in which scheme.

As you can see, Sukanya Samriddhi Yojana and Senior Citizen Savings Scheme are getting the highest interest of 8.2%, which is very beneficial, especially for the future of daughters and the financial security of senior citizens.

How are the interest rates of these schemes decided

Let us tell you that the work of fixing the interest rates on these small savings schemes is done by the Ministry of Finance. There has been no change in these rates for the last 6 quarters, which shows a remarkable stability. While deciding these interest rates, the government takes into account the government bond yield and the economic condition of the country.

Recently, the Reserve Bank of India (RBI) reduced the repo rate by 1% in its monetary policy, which had a direct impact on the bond yield, and it fell. This is what has helped the government to keep the interest rates of these popular schemes stable. This is a positive sign for investors that the government gives priority to their savings.

Double benefit of tax savings with returns

A common investor always wants to invest in a place where there is little risk in their returns. This is the reason why people have unwavering faith in these government small savings schemes. These schemes offer double benefits:

Guaranteed returns

Here, the government guarantees the returns on your investment, so there is no doubt in your mind.

Tax benefits

Many schemes also offer tax benefits under Section 80C of the Income Tax Act, making your savings even more attractive. In short, these schemes not only safeguard your hard-earned money but also grow it over time and help you save taxes. It is indeed a safe and sensible investment option.