PAN Card New Update: If you have a PAN card, this news could be very important for you. Last year, the government launched the PAN 2.0 project. The Permanent Account Number (PAN), issued by the Income Tax Department, is now set to be unveiled in a new form. PAN 2.0 aims to make PAN-related processes more secure and easier. The government wants to reduce paper use and promote digital systems. For this reason, PAN 2.0 is being made completely paperless and technology-based.

Read Here: Business Idea-Earn Steady Income by Starting a Security Agency—Here’s How

What will change with PAN 2.0?

PAN 2.0 is an updated version of the existing PAN card. It will provide a digital, or paperless, PAN card, which will be issued free of charge. Any future corrections or updates to PAN information will be available free of charge.

Those who want both a digital and a physical PAN card will have to pay a fee of ₹50. After payment, this card will be sent by post to your registered address.

PAN cards already have a QR code, but PAN 2.0 will include a dynamic QR code. This will allow for quick and secure verification of PAN card information. This will significantly reduce the likelihood of fake PAN cards.

Most importantly, PAN 2.0 will not invalidate old PAN cards. Currently valid PAN cards will continue to be valid. PAN 2.0 is merely an upgrade. A PAN card holder will be issued a new PAN card only if they wish to update their information.

Those with old PAN cards that do not have a QR code can apply for a new PAN card with a QR code under PAN 1.0 or PAN 2.0. This will make their PAN more secure.

Read Here: 2026 MG Hector Facelift has launched in India – Know its all Key Details

Two PAN Card Issuing Agencies

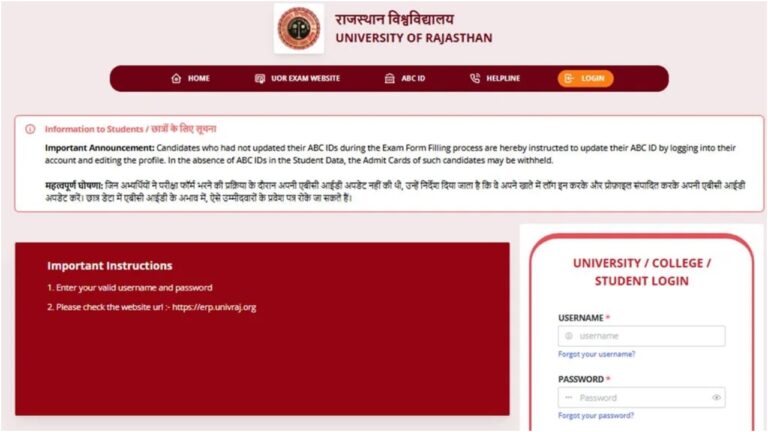

The government has authorized two agencies to issue PAN cards. These include Protean (formerly known as NSDL) and UTI Infrastructure Technology and Services Limited.

For this, you need to visit the website onlineservices.nsdl.com/paam/ReprintEPan.html. Here, you will have to fill in the required information like PAN number, Aadhaar number, and date of birth. After submitting the information, check it and verify it through OTP. After online payment, the PAN card will be sent to the address registered with the Income Tax Department.

You can also apply for a PAN card by visiting the website pan.utiitsl.com/reprint.html. After filling in the PAN number, date of birth, and captcha code, you will have to complete the further process. After verification and payment, the card will be issued.