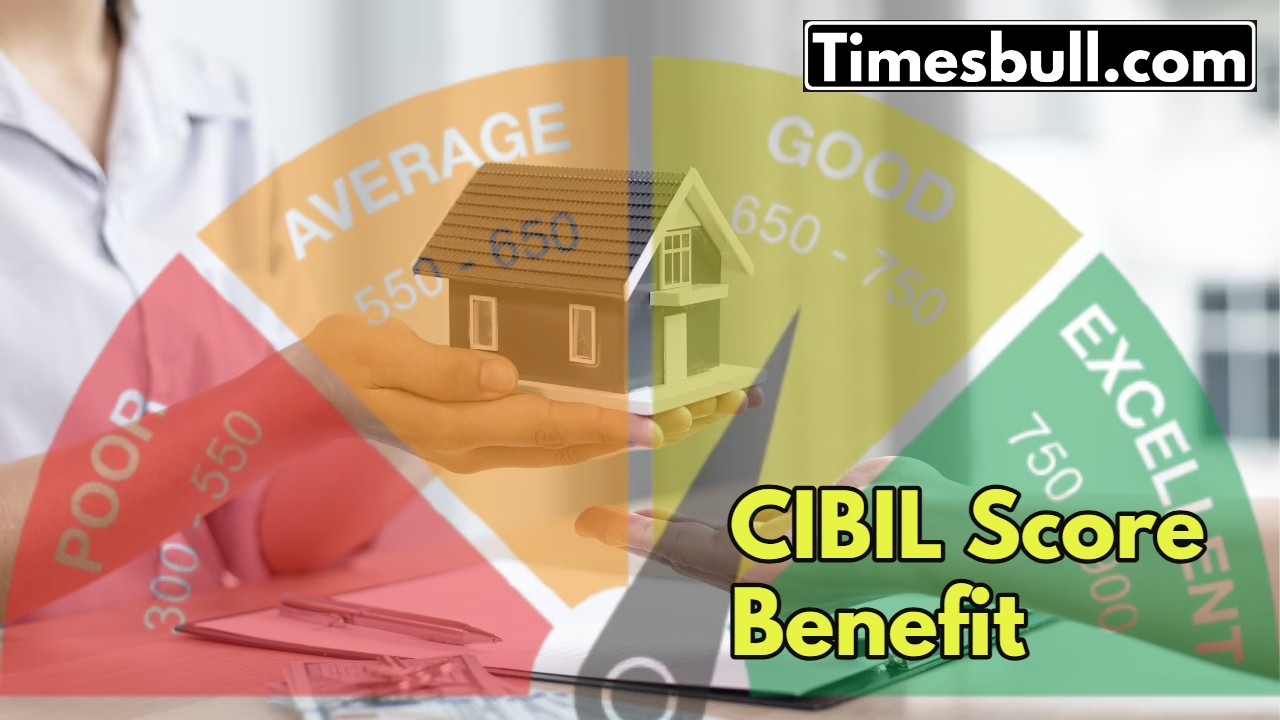

CIBIL Score Benefit: Whenever it comes to taking a loan from a bank, the bank looks at your CIBIL score. The CIBIL score is very important because it reflects your financial history. By looking at the CIBIL score, banks can find out how capable you are of repaying the bank loan.

Many people do not understand the importance of a CIBIL score, but by having a good CIBIL score, you can get a loan from the bank at a very low interest rate. If your CIBIL score is good, you can save up to Rs 19 lakh on taking a home loan of Rs 50 lakh from the bank. This is an important aspect of securing your financial future.

Home Loan on Good CIBIL Score

Suppose your CIBIL score is 820 and you are taking a home loan of Rs 50 lakh from the bank for 20 years. In such a situation, you will get a home loan at an interest rate of 8.35 percent. In this way, you will pay a total of Rs 1.03 crore to the bank with an interest of Rs 53 lakh. This shows how much a good CIBIL score can benefit you.

Home Loan with Low CIBIL Score- High Interest, Huge Loss

Suppose your CIBIL score is 580 and you are taking a home loan of Rs 50 lakh from a bank for 20 years. In such a situation, you will get a home loan at an interest rate of 10.75 percent. In this way, you will repay the loan with an interest of Rs 71.82 lakh.

This interest amount is about Rs 18.82 lakh more than before. In such a situation, you can easily see that a good CIBIL score can save you lakhs of rupees. It is very important part of the financial planning.

The CIBIL score is an important measure of your financial creditworthiness. A good CIBIL score not only helps you get loans at lower interest rates, but also secures your financial future. Therefore, it is very important to maintain and improve your CIBIL score. It is an important step in achieving your financial goals.