If you also do a job and PF is deducted from your salary every month, then this news is very useful for you. Yes, many times in life you suddenly need money. In such a situation, the money deposited in the PF account proves to be helpful for you.

Many times, while trying to withdraw EPF, your application gets cancelled due to some mistakes, so there is no need to panic. First of all, you should find out where the mistake has happened. By correcting that mistake, you can apply for EPF again.

When can you withdraw your PF money

The rules for withdrawing Provident Fund (PF) are decided by the Employees Provident Fund Organization (EPFO). You can withdraw PF under certain circumstances. You can withdraw the entire amount of PF after leaving the job or retirement. If you have left the job and are unemployed for two months, then you can withdraw the entire amount from your PF account.

Apart from this, the entire amount of PF can be withdrawn even after retirement. Apart from this, there is also a rule of partial withdrawal, in which partial withdrawal is allowed under certain circumstances, even if you do not leave the job.

On which special occasions can you withdraw the partial amount from the PF

Partial withdrawal can be made from the PF account under certain circumstances. Provided your PF account is at least 5-7 years old! Under these circumstances, you can withdraw money for the treatment of a family member under medical expenses or the marriage of yourself, siblings, or children.

But in this, you can withdraw money only after at least 7 years of membership. Apart from this, money can also be withdrawn to buy a house or get a house built. This partial withdrawal can prove helpful to meet your needs.

These are the major reasons for EPF claim rejection

- If you give any wrong information, like bank account number, personal details, etc., while claiming EPF, then your claim may be rejected. Therefore, be very careful while filling out the application.

- Apart from this, if any discrepancy is found between your employment period and EPFO records, your claim may get automatically rejected. Make sure to match your company’s records with EPFO records.

- If you claim more than the amount deposited in your EPF account, it may be rejected. You should know how much money is deposited in your account.

- If you are not eligible for the amount you need or if the reason for not withdrawing money is not valid, the claim may get rejected. It is very important to give the correct reason for withdrawal.

- Sometimes, despite everything being right and due to technical fault in the system, there is a possibility of the claim getting rejected. In such a situation, you should try again.

- You need to know which mistakes can get your claim stuck.

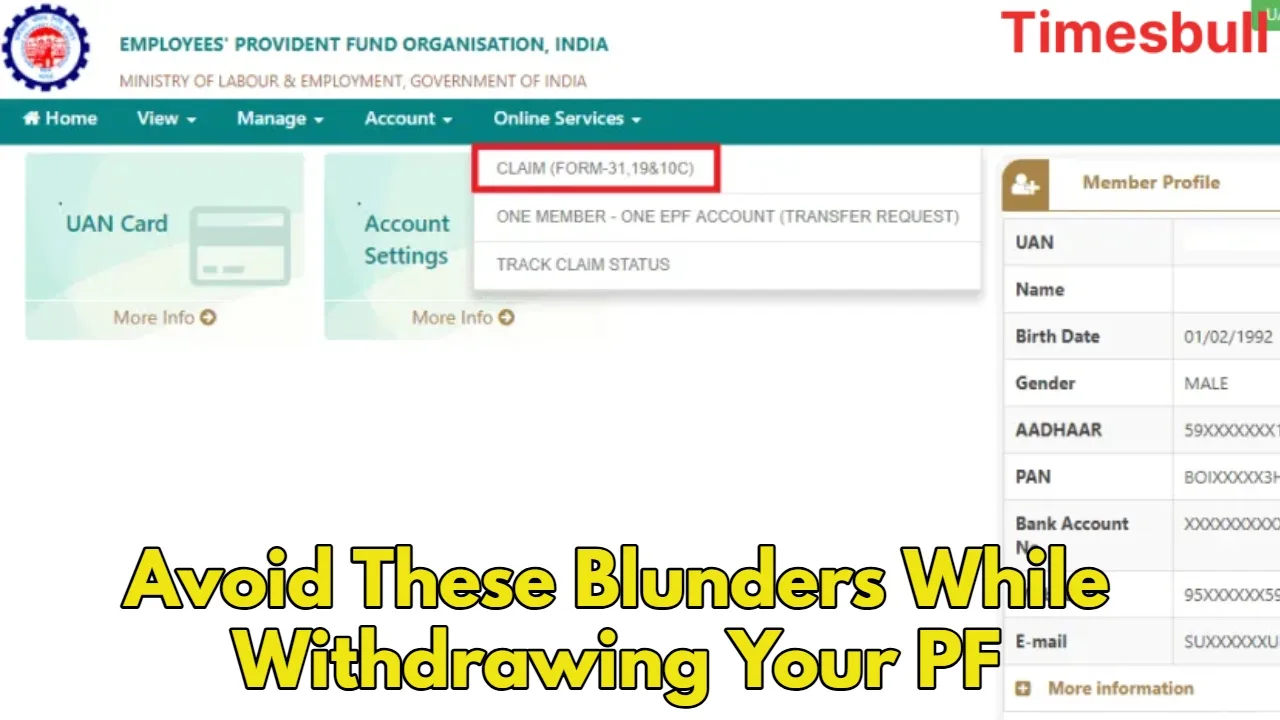

How to know the reason for claim rejection

If you are not able to know why your application got rejected, you can also check it by visiting the EPFO website. For this, you have to log in to the website. Then click on ‘Track Claim Status’ in the menu. There you will know why your application was rejected. You can also ask your company’s HR about this, or talk to the EPFO office. Once you know the real reason, you can correct that mistake and apply it again. There is no need to be disappointed.