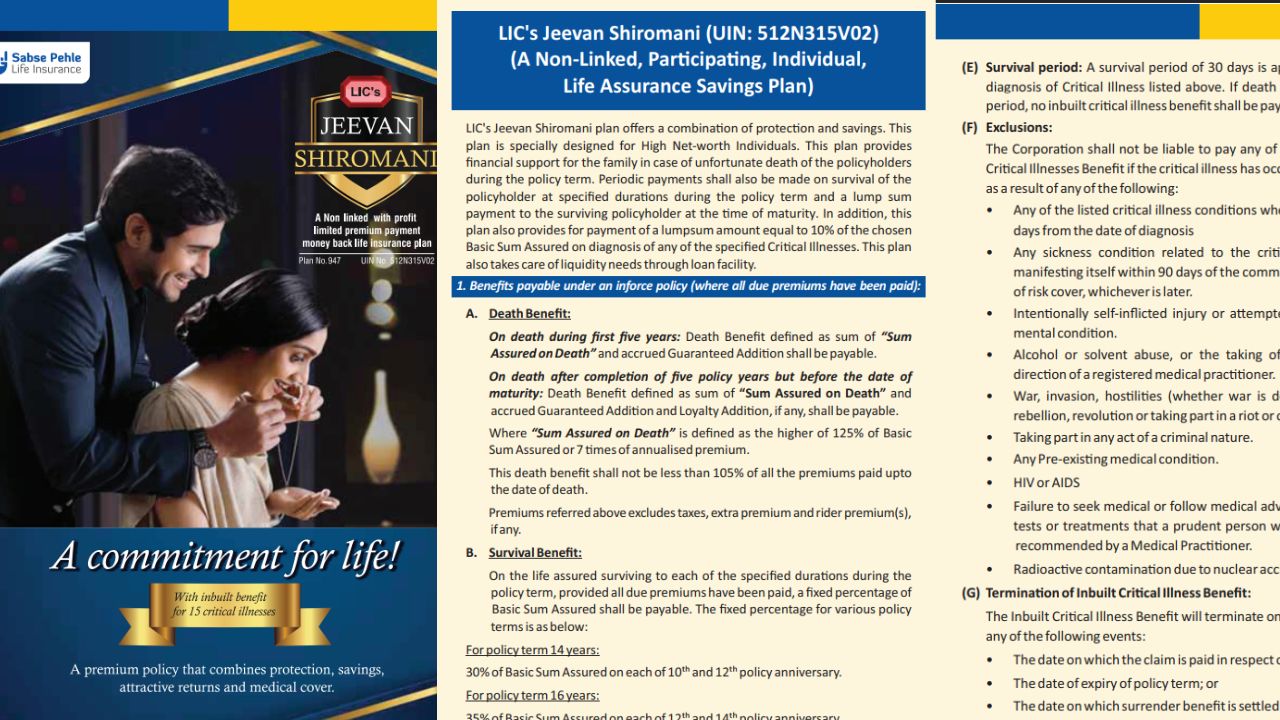

Have you ever thought about investing a small amount of money and getting ₹1 crore in return in just four years? It might sound unbelievable, but it’s true. India’s most trusted insurance company, LIC, has a plan for this. The scheme is called ‘Jeevan Shiromani.’

This is not just an insurance plan; it’s a strong foundation to secure your future. Designed for the middle to upper class, this scheme offers specific coverage, regular returns, and loan facilities if needed.

Future Assurance in Just Four Years of Premium: LIC Jeevan Shiromani Scheme

With the LIC Jeevan Shiromani Scheme, you only need to pay premiums for four years. However, keep in mind that this is a high-end policy, so the premium amount is relatively high. For example, if you want to get ₹1 crore, you will need to pay about ₹94,000 every month. You can choose to pay your premium monthly, every three months, six months, or annually.

Who Can Take This Policy?

To take this policy, you must be at least 18 years old. The maximum age at which you can start depends on the policy term you choose:

- For a 14-year policy, you can start at age 55.

- For a 16-year policy, you can start at age 51.

- For an 18-year policy, you can start at age 48.

- For a 20-year policy, you can start at age 45.

Money Back Facility

One of the most attractive features of this scheme is the money-back policy. You will receive a portion of the insurance money back at regular intervals, in addition to paying premiums. Here’s how it works:

- 14-year policy: 30% of the insurance amount is returned in the 10th and 12th years.

- 16-year policy: 35% of the insurance amount is returned in the 12th and 14th years.

- 18-year policy: 40% of the insurance amount is returned in the 14th and 16th years.

- 20-year policy: 45% of the insurance amount is returned in the 16th and 18th years.

You will receive the remaining amount once the policy is completed.

Loan Benefits

Another key feature of this scheme is the option to take a loan after one year of policy purchase. To be eligible for a loan, you must have paid at least one year’s worth of premiums. The loan amount will be determined based on the value of the policy.

For more detailed information and calculations related to this scheme, you can visit the official LIC website. If you want to secure your family’s future and invest in a policy with large insurance coverage, this scheme could be the right choice for you.