PSU Bank: If any sector in the Indian stock market has surprised investors the most over the past year, it’s PSU banks. Once synonymous with non-performing assets (NPAs) and poor service, these banks have emerged as the brightest stars on Dalal Street in early 2026. The recent rise of State Bank of India (SBI) to become India’s fourth most valuable company, surpassing TCS, is strong evidence that investor perception is changing.

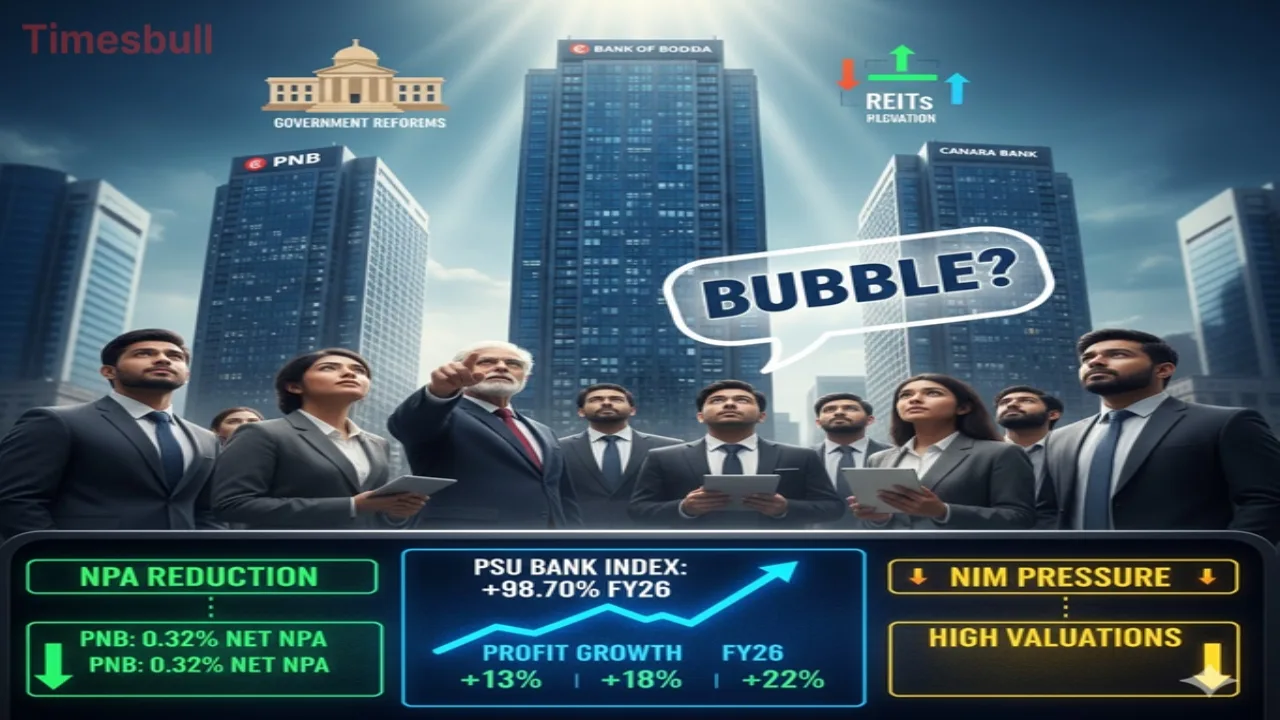

But as shares of PNB, Bank of Baroda (BOB), and Canara Bank surge, a debate has ignited in the market, Is this rally based on strong fundamentals, or is it simply a bubble fuelled by government narrative.

What Do the Data Say

If we look at the recent Q3 FY26 results of PNB or Canara Bank, it’s clear that this isn’t just a fluke. Punjab National Bank’s gross NPAs, which were once alarmingly low, have now fallen to 3.19%, while net NPAs are at just 0.32%.

This is commendable compared to any private bank. PNB reported a 13% increase in net profit, while Canara Bank and Bank of Baroda’s asset quality data are at their best in a decade. The capital adequacy ratio (CAR) of public sector banks is now in the range of 15-17%, meaning they no longer need frequent government recapitalization.

Government Narrative Versus Ground Reality

Critics argue that this re-rating of PSU banks is due to the government’s hype about a “developed India” and “next-generation banking reforms.” The announcement of a “high-level committee” for banking reforms in Budget 2026 and the plan to monetize the real estate assets of state-owned companies through REITs have certainly boosted sentiment.

However, experts believe that stocks cannot rise 40-50% based on narrative alone. Banks have taken drastic steps to “clean up” their balance sheets. Experts like Deepak Shenoy (Capitalmind) believe that public sector banks have a significant opportunity to sell their old real estate assets, which will further strengthen their Tier-1 capital without any government expenditure.

Is this a dangerous bubble

Even though fundamentals have improved, some challenges could prove this rally a ‘bubble.’ The biggest concern is the pressure on banks’ net interest margins (NIMs) as rising deposit rates are increasing their costs.

Furthermore, PSU bank valuations are no longer as cheap as they were two years ago; they now trade at a significant premium to their book value. If loan growth slows in the future or the interest rate cycle abruptly changes, these banks’ profits could be adversely affected, leading to losses for investors who bought at current high levels.