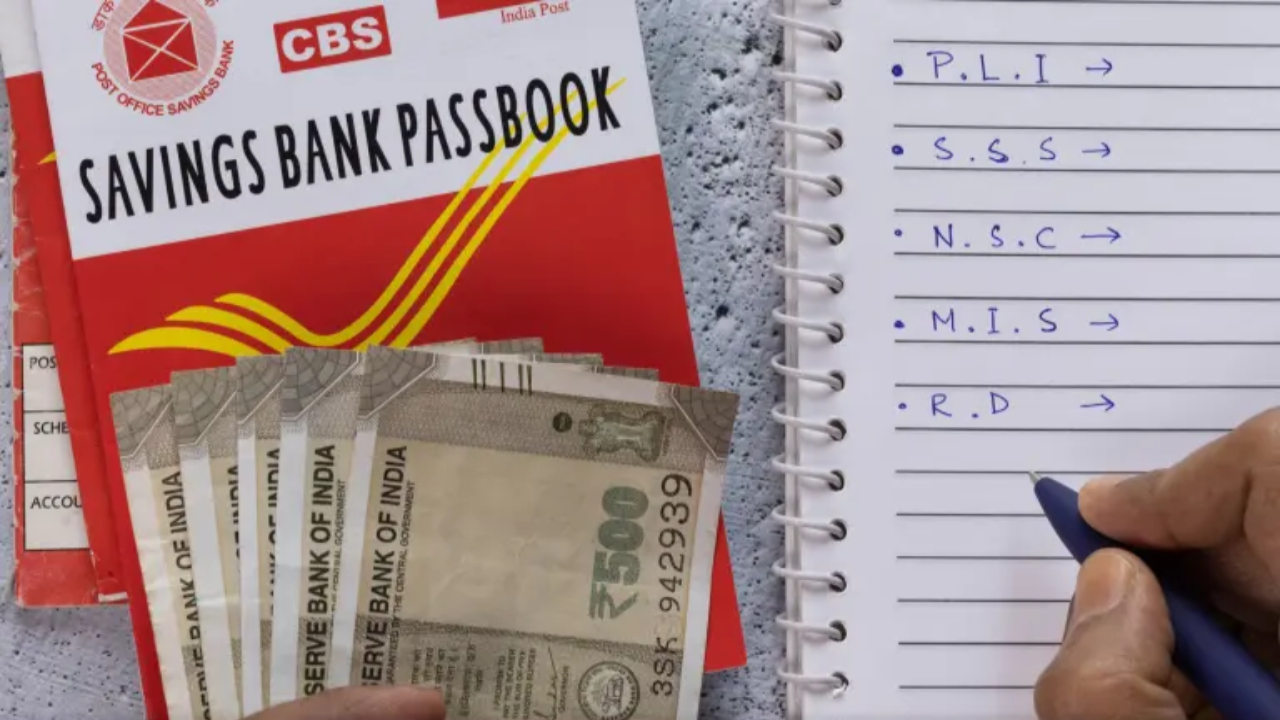

The Post Office National Savings Recurring Deposit (RD) scheme is one of the most reliable and secure savings schemes offered by the Indian Postal Department. This scheme is ideal for those who want to invest a small amount every month and earn good returns over a fixed period.

Regular monthly savings, along with quarterly compounding interest and a government guarantee, make this scheme unique. This scheme is especially excellent for working professionals, housewives, senior citizens, and children who want to plan for a secure future with minimal risk.

Eligibility and Deposit Limits

Any Indian citizen is eligible for this scheme, whether as a single individual, a joint account holder, or a guardian in the name of a minor. The minimum deposit amount in this scheme is just ₹100 per month (subsequently in multiples of ₹10). There is no maximum deposit limit. The deposit period is 5 years (60 months), and the term is fixed. A minor child above 10 years of age can open and operate their own account, while for younger children, the account can be opened by their guardian.

Interest and Guaranteed Returns Mathematics

This scheme currently offers an annual interest rate of 6.7% (until September 2025). Most importantly, interest is calculated on a quarterly compounding basis, which exponentially increases your returns. If you invest ₹10,000 every month, the calculations show that you will receive a guaranteed interest return of ₹1,13,658 at maturity, i.e., after 5 years. Thus, you invest a total of ₹6,00,000, resulting in a total corpus of ₹7,13,658. The best time to deposit money is on or before the 15th of every month.

Important Terms and Features of an RD Account

You can avail a loan of up to 50% of your deposit amount after one year of opening the account. This is extremely helpful in case of an emergency. You can prematurely close the account after three years. However, if you close it before three years, you will receive interest at a lower rate, similar to that of a Post Office Savings Account. Currently, this scheme does not offer any tax benefits under Section 80C of the Income Tax Act.

Default and Account Revival

If you fail to deposit money in a month (default), a penalty of ₹1 for every ₹100 is imposed. A maximum of four consecutive defaults is allowed. If four consecutive defaults occur, the account may be closed, but you have the option to reopen it. This rule encourages regular savings.