If you are a beneficiary of Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), then this news is very important for you! The last date for the annual subscription to this scheme is 31st May. After this, if you do not do some important work, then you will stop getting this insurance protection cover of ₹ 2 lakh. If you want to continue the benefits of this scheme further, then you must keep a premium amount of ₹ 436 in your bank account by 31st May. Banks have also started sending messages to their customers regarding this. Let us know about this important scheme in detail so that you can take the necessary steps in time.

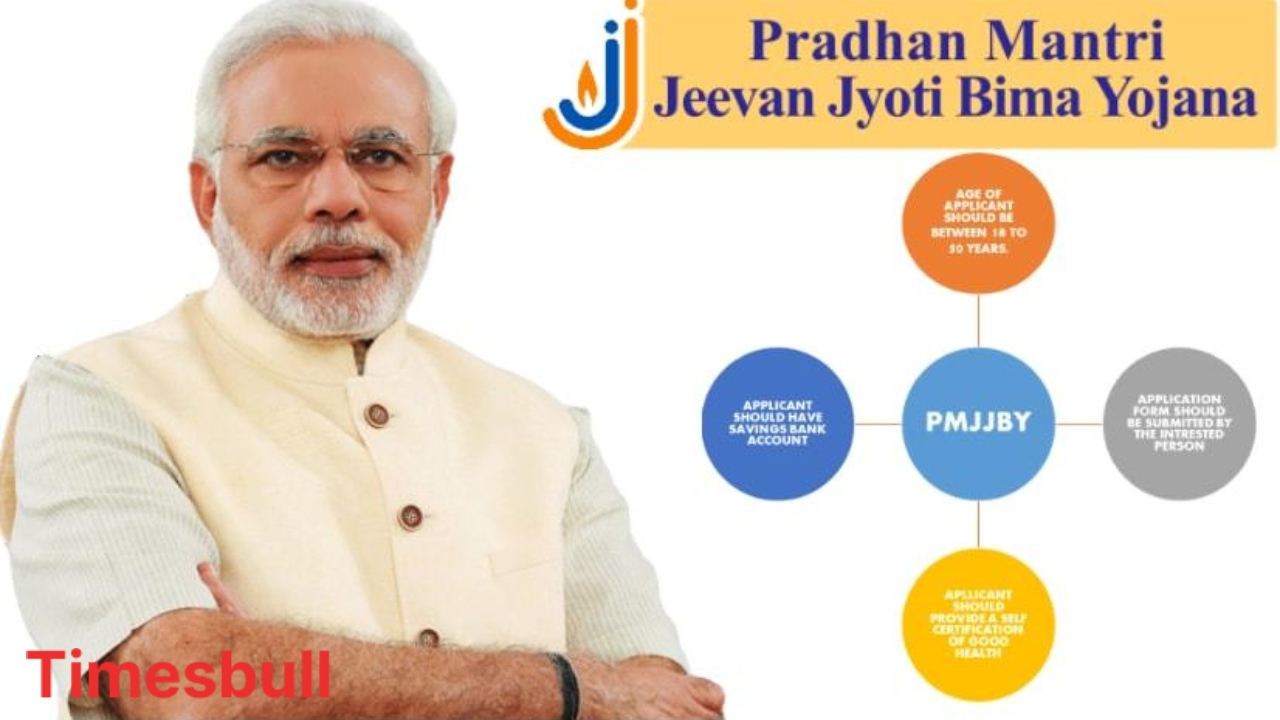

What is Pradhan Mantri Jeevan Jyoti Bima Yojana

This scheme provides life insurance cover of up to ₹ 2 lakh to its customers. The premium of this scheme has to be paid every year, and it is valid for one year. To keep the policy active, it is mandatory to pay this premium on time every year. This is a one-year renewable life insurance policy, which covers death due to any reason. This plan provides significant financial security for you and your family at a low premium.

Who can become a part of this scheme

Any Indian citizen in the age group of 18 to 50 years can join this scheme. Those who join this scheme before completing the age of 50 years can avail its benefits till the age of 55 years by paying a regular premium. The annual premium of this scheme is only ₹ 436, in return for which a life insurance cover of ₹ 2 lakh is available. Under this scheme, you can register the details of the nominee (dependent) by visiting your bank branch / Business Correspondent (BC) point, through the bank’s website, or by visiting the post office if you have a post office savings bank account. Under this scheme, the premium amount is automatically deducted from the customer’s bank account every year, freeing you from the worry of paying the premium every year.

Another great scheme of the government

Let us also tell you that the government also provides accident insurance cover of ₹ 2 lakh under the Pradhan Mantri Suraksha Bima Yojana (PMSBY). People in the age group of 18 to 70 years can join this scheme. In case of death or permanent disability due to accident, a cover of ₹ 2 lakh is available at a premium of just ₹ 20 per year. This scheme is a very economical and useful option for those who want to protect themselves from financial risks caused by accidents.