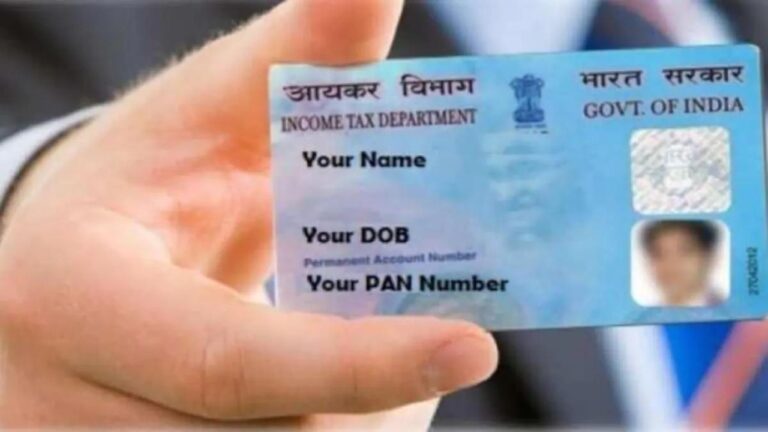

Do you have a PAN card? Then it is definitely mandatory to link your Aadhaar card with your PAN card. If you do not, you may face big problems in the future. According to the central government rules, the last date for linking PAN-Aadhaar has been fixed as December 31, 2025. If the linking process is not completed within this period, your PAN card may become invalid, which may also cause problems in financial transactions.

PAN card is an important document issued by the Income Tax Department of India. It is very necessary for opening a bank account, taking loans, paying taxes and other financial transactions. If you have not linked your Aadhaar card and PAN card, then your PAN card may become inactive and as a result you will face various problems.

It is now possible to check whether your PAN card number is linked with your PAN card by following a few steps using your smartphone. Many people are still not sure whether their PAN-Aadhaar is linked or not. So in today’s report, let’s first see how to check the PAN-Aadhaar link status online. In addition, if there is no link, then the process of how to link it quickly is also detailed in today’s report.

Also Read –Amazon Sale— Lava Agni 3 5G dual-display Phone At 33% Discount with Saving Offers!

PAN Card Aadhaar Card Link Status Check Method

1) First of all, you have to visit the official portal of the Income Tax Department (www.incometax.gov.in). You can also go directly to the official website by clicking on the link below.

2) Then click on Link Aadhaar Status on the home page of the Income Tax Department.

3) On the next page, mention the PAN card number and Aadhaar card number. Then click on View Link Aadhaar Status below.

4) Then if you see the text Your PAN XXXXXX is already linked to given Aadhaar XXXXXXXX, then your PAN card has an Aadhaar card number link.

PAN Card Aadhaar Card Number Link Online Method

1) First of all, you have to visit the official portal of the Income Tax Department. You can also go directly to the official portal by clicking on the link below.

2) Then click on the text Link Aadhaar on the home page of the Income Tax Department.

3) On the next page, mention the PAN card number and Aadhaar card number and click on Validate.

4) Then fill in the remaining information and link the PAN card to Aadhaar card number.