PAN-Aadhaar Link: In today’s digital age, PAN card and Aadhaar card are two such important documents, which are needed everywhere. From admission of a child to school to opening a bank account and filing an Income Tax Return (ITR), these documents are mandatory. The government has made it mandatory to link PAN and Aadhaar.

If for some reason your PAN and Aadhaar are not linked, then get it done immediately, because without it many of your important works can get stuck. Let us know, what will happen if Aadhaar-PAN is not linked and how to link it.

How to check whether Aadhaar-PAN is linked or not

- Visit the official website of the Income Tax Department incometax.gov.in.

- Click on the option of ‘Link Aadhaar Status’ below.

- A new page will open, where enter your Aadhaar and PAN number and click on ‘View Aadhaar Link Status’.

- On clicking, information about whether Aadhaar is linked to PAN or not will appear on the screen.

How to link Aadhaar-PAN online

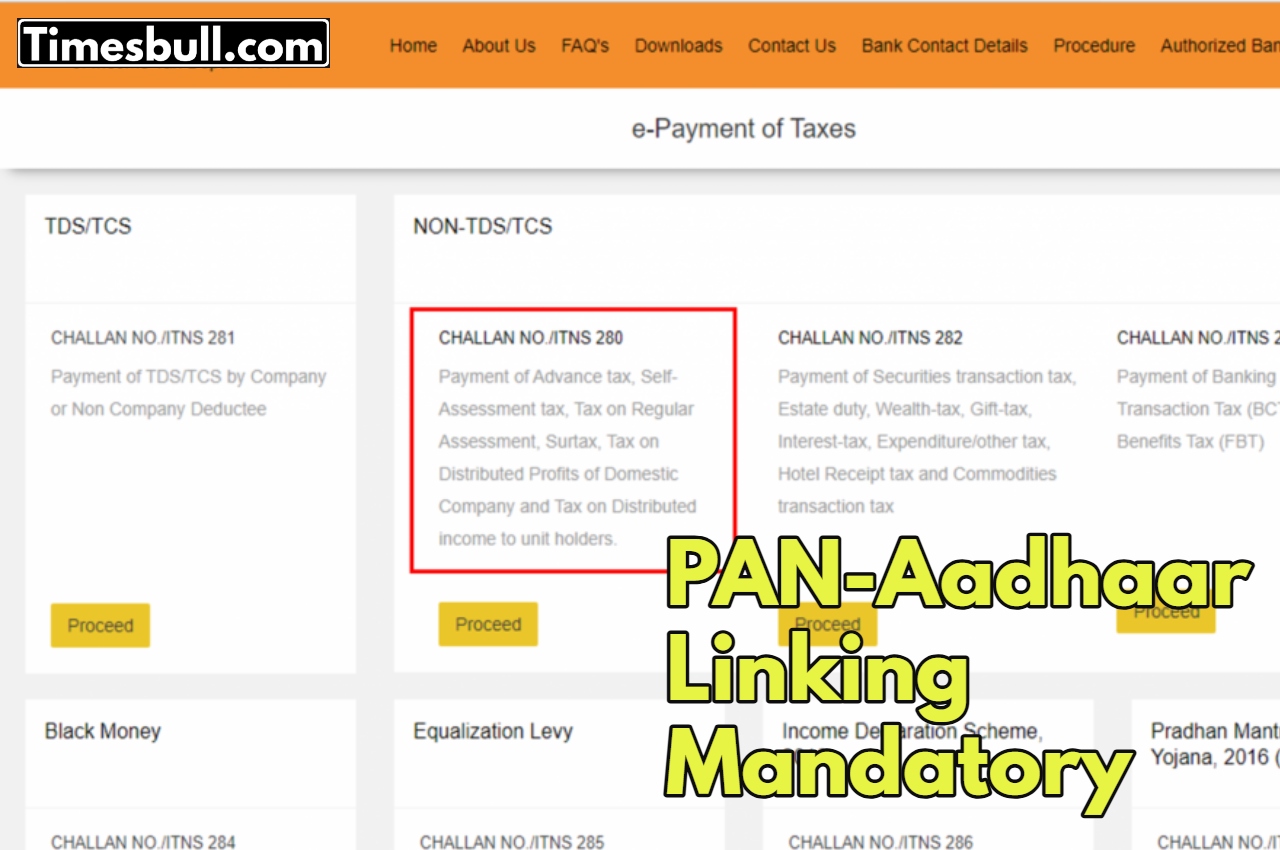

- First of all, go to the Income Tax Department website incometax.gov.in.

- You will get the option of ‘Link Aadhaar’, clicking on it will open a new page.

- Enter your PAN number, Aadhaar number, and name as per your Aadhaar card and click on ‘Link Aadhaar’.

- Now the Income Tax Department will process this link.

Link Aadhaar-PAN through message

- Type UIDPAN in your phone and give a space, then enter Aadhaar number and then PAN number after giving a space.

- Example- Type UIDPAN 0000022223333 AAAPA8888Q and send it to 567678 or 56161.

- After this, the Income Tax Department will put both numbers in the linking process.

What will happen if a PAN-Aadhaar card is not linked

- If PAN is not linked to Aadhaar, then PAN will become inactive. Due to which there may be problems in financial transactions. Bank account related work may also get stuck.

- If PAN and Aadhaar are not linked, PAN will stop working. Due to this you will not be able to do any transaction related to SEBI. If someone does not have an active PAN number, the bank can deduct 20% i.e. double TDS on the income.

- If the PAN card is inactive and still used for bank transactions or elsewhere, a penalty of Rs 10,000 can be imposed under section 272B of the Income Tax Act.