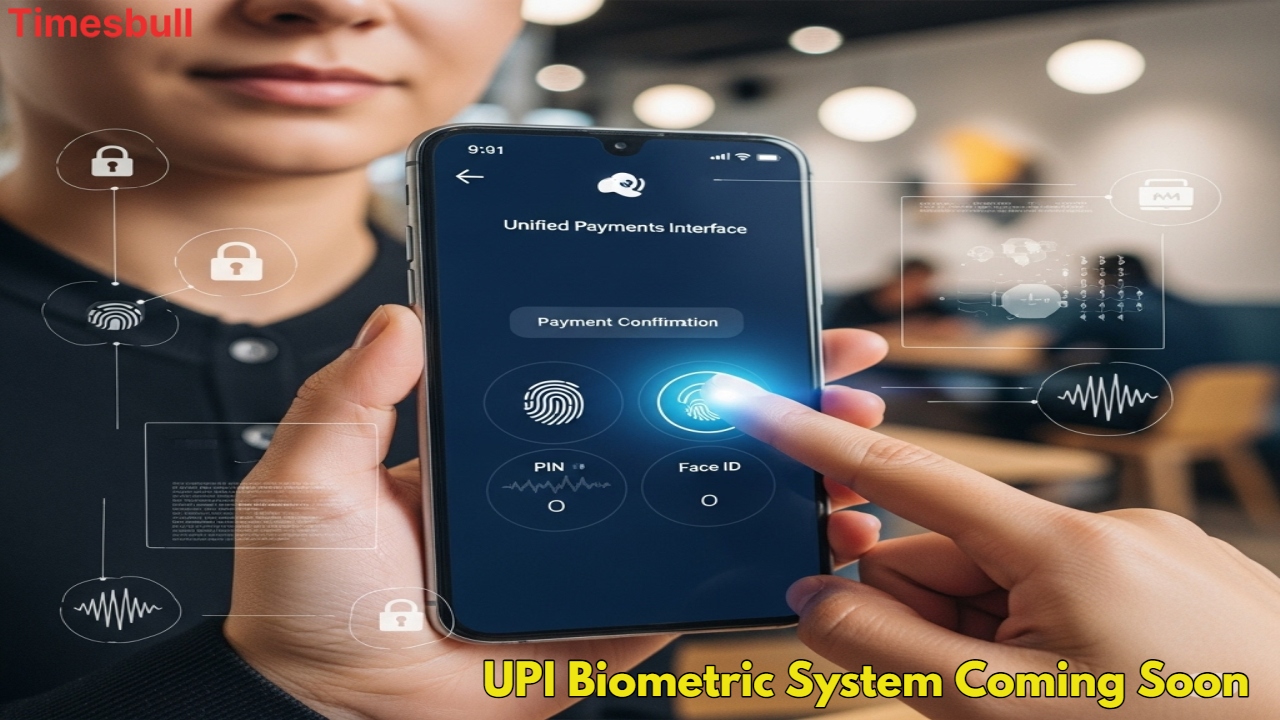

The trend of UPI payment in India is increasing day by day. Till now, it was necessary to enter a 4 or 6-digit PIN for every payment, but this method may change soon. According to a recent report, the National Payments Corporation of India (NPCI) is working towards making UPI payments even more secure and easy, and this new method can be ‘Face ID’ or ‘Fingerprint’.

Why face or thumb instead of PIN

Nowadays, almost every smartphone has the facility of fingerprint or face unlock. These methods are so secure that duplicating them is not easy even for experienced hackers. When this system is linked to UPI, you will neither need to remember the PIN nor type it again and again. Payment will be done just by showing the face or putting the thumb.

How will this system work?

According to a report by Business Standard, NPCI wants to link UPI with biometric verification. That is, just like you unlock your phone, UPI payment will also be possible. If your Android smartphone or iPhone has a biometric lock, then you will be able to verify UPI payment with the same. This will not only increase security, but will also make payment very easy.

In which apps will this facility be available?

All third-party apps providing UPI facility will have to connect with this new biometric system. However, this will not be very difficult, because today most apps already have the option of Face ID or Fingerprint lock. Many UPI apps in India, like Paytm, Google Pay, and Phone Pay, already support biometric lock. Now, NPCI will work with these app developers so that this facility works in the last stage of payment as well.

Security concerns

This system certainly seems very convenient and safe, but there is a risk in it too. If your phone gets stolen or hacked, then hackers can get a direct way to access your money. In such a situation, the bank and the app will have to provide an additional security layer so that your money remains completely safe.

Even though NPCI has not made any official announcement about this yet, they are certainly working towards making UPI even more reliable and smart.