The Employees Provident Fund Organization (EPFO) keeps changing the rules from time to time to provide maximum facilities to its account holders. In the year 2025, EPFO has made many big and important changes. Be it the rules for updating the profile, the process of transferring the PF account on changing the job or the policies related to more pension, everything has changed.

The aim of EPFO is to provide maximum facilities to the employees in less time, to make the processes digital so that transparency is maintained. This will directly benefit crores of account holders. Let us know about these big changes made this year in detail.

Updating the profile has become instant

EPF members can now update their Aadhaar-linked UAN without uploading any document.

If your Universal Account Number (UAN) is linked to Aadhaar, then you can update information like your name, date of birth, gender, nationality, parents’ name, marital status, spouse’s name, and date of starting the job online without any document.

No other document will be required for this. This will benefit more than 6 crore members.

If the subscriber’s UAN is before 1 October 2017, then for some changes, they may need employer approval.

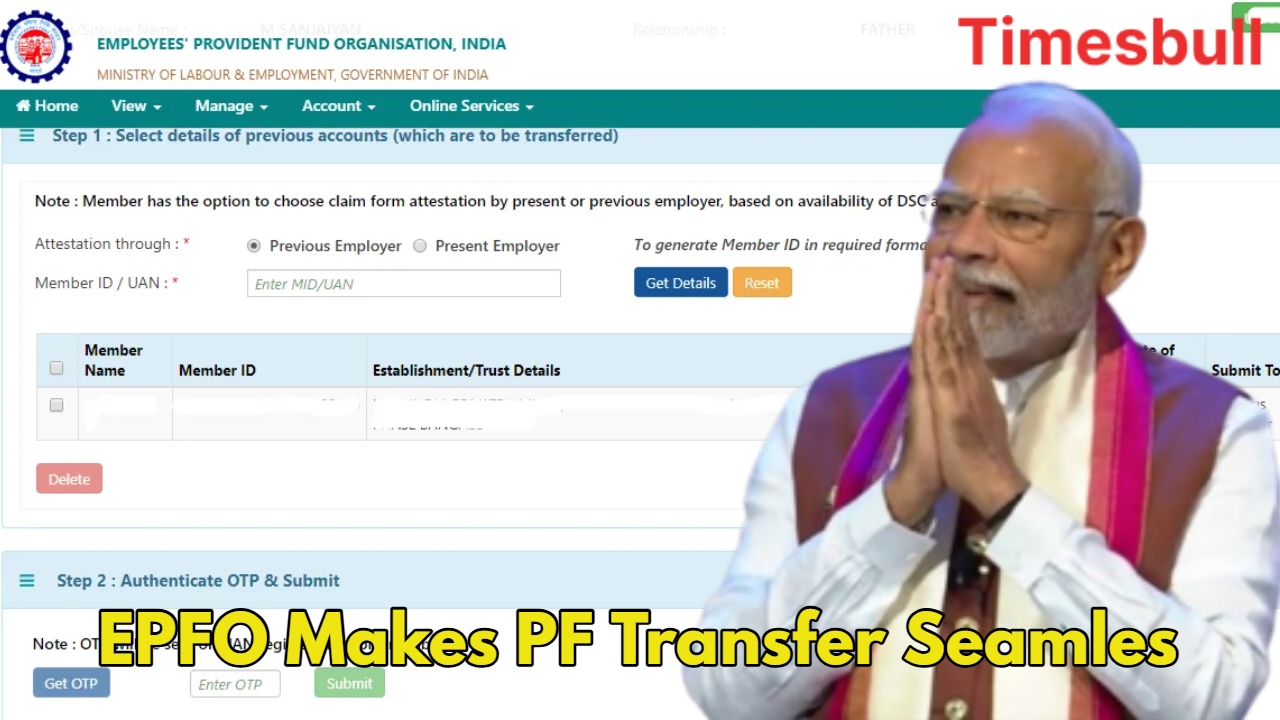

PF account transfer as soon as you change jobs

EPFO has made the process of transferring PF accounts on changing jobs very easy. This will benefit more than 1 crore 25 lakh members.

Transferring PF on changing jobs was earlier a complex and time-consuming process, which required the approval of the company. After the change in January 2025, in most cases, approval of the old or new company will not be required.

If your UAN is linked to Aadhaar and your details (name, date of birth, gender) match, then PF transfer will be faster. This will ensure the management and continuity of your savings.

This has eliminated the need for approval of transfer claim at the destination office. After the transfer claim is approved by the transfer office, the amount from the previous account will automatically be transferred to the member’s account in the destination office.

Correcting incorrect information is now easy

EPFO issued new guidelines regarding the process of Joint Declaration (JD) on 16 January 2025.

Now it will be easy to correct incorrect or incomplete information, which will make the claim process faster and transparent.

Earlier SOP version 3.0 was applicable in this regard, which has now been removed, and members have been divided into three categories. Like – those whose UAN is Aadhaar based – they can do online JD.

Those whose UAN is old but verified with Aadhaar – they can also do online JD. There is a provision for physical JD for those who do not have UAN, Aadhaar is not verified or the member has died.

New CPPS system of pension payment

From January 1, 2025, EPFO has introduced a new system called Centralized Pension Payment System (CPPS). Now pension will be sent directly to any bank account through NPCI platform. Under this, pensioners covered under the pension scheme will be able to withdraw their pension from any bank or its branch through NPCI platform.

The new system is expected to benefit more than 78 lakh EPS pensioners of EPFO.

This will eliminate the need for PPO transfer between regional offices.

If a claim goes to another office by mistake, it will be sent back to the same office from where the claim came.

Clear rules for pension on higher salary

EPFO has clarified the pension rules for those employees who want to get a pension on the basis of their higher salary. A similar process will be adopted for all.

If the employee’s salary is more than the prescribed limit and they make additional contributions, they can get a pension on a higher salary.

Companies running private trusts also have to follow the rules of EPFO. This rule can prove to be helpful in increasing the pension amount.