When it comes to safe investment, where there is no fear of fluctuations in the stock market, no risk, and tax relief, many people directly turn to post office schemes. One such very popular and reliable scheme is the National Savings Certificate, which is known as NSC. It is still as popular among the middle class and working people as it used to be earlier.

Its most special feature is that there is a government guarantee on your capital, which means your investment is completely safe and the interest is also excellent. This is the reason why in the current economic conditions people are once again rapidly turning towards NSC.

Bumper benefit of ₹2.25 lakh

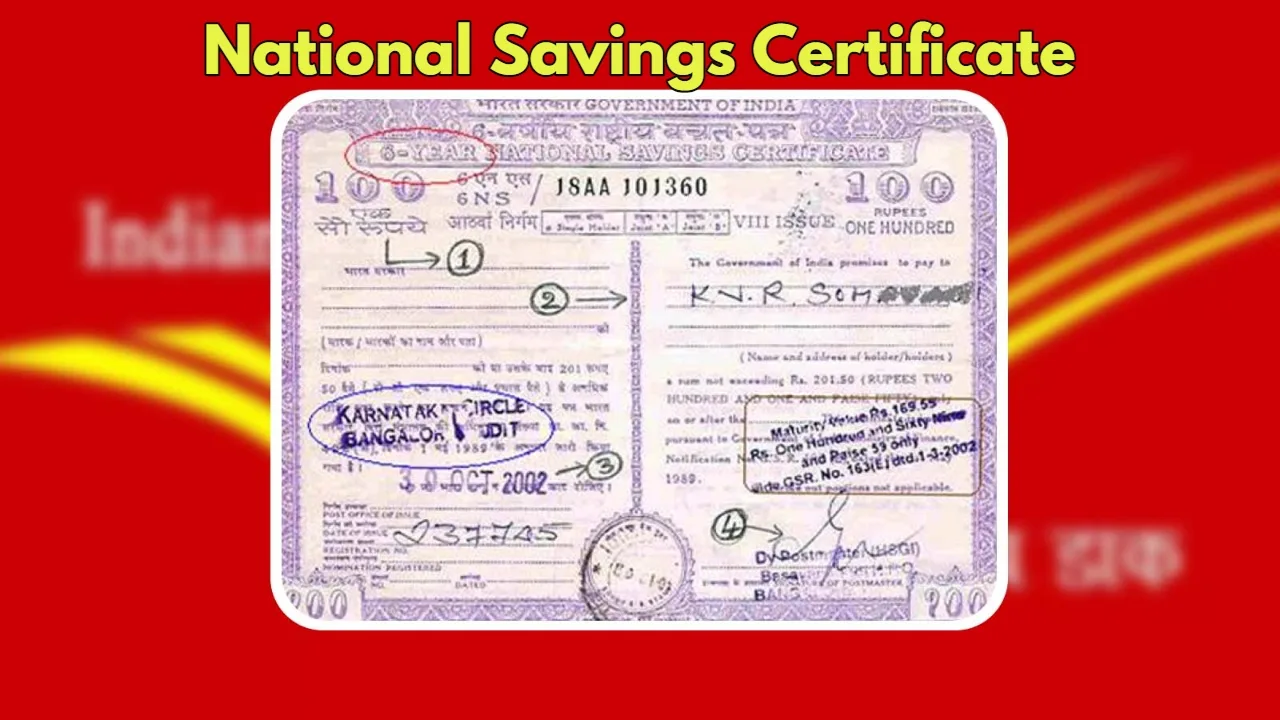

National Savings Certificate (NSC) is a small savings scheme supported by the Government of India, which is run through post offices across the country. Its main objective is to motivate common people to invest for the long term through small savings.

Current interest rate: Currently, its interest rate is 7.7% per annum.

Interest calculation: Interest is compounded annually, that is, you get the tremendous benefit of “interest on interest”.

Maturity period: However, you get the money only on maturity, that is, after the completion of 5 years.

That is, if you have taken an NSC of ₹1 lakh, then after 5 years you will get approximately ₹1.45 lakh, and that too completely safe, without any market risk.

You will get such a huge profit in 5 years

Let us understand with a concrete example how much profit you can make in 5 years by investing in NSC:

Suppose, you have invested a lump sum of ₹5 lakh in NSC. The current interest rate is 7.7% per annum. In this, the interest is compounded every year, but you get the entire amount together after the completion of 5 years.

After 5 years, your NSC of ₹5 lakh will increase to ₹7,24,513.

Total Profit: ₹2,24,513.

This shows how NSC can help you grow your investment quickly, without any hassle.

Investment of ₹10 lakh

If you invest ₹10 lacks instead of ₹5 lahks in this scheme, then at an interest rate of 7.7 percent, your total profit will be around ₹4,48,000 (four lahks forty-eight thousand rupees). This is indeed a great return, especially when we consider it as a low-risk investment.

Salient points of NSC

Some other important points about NSC that you should know:

Maximum investment limit: There is no maximum investment limit in NSC. You can invest as much as you want.

Tax exemption (Section 80C): The amount invested in NSC is eligible for tax exemption of up to ₹1.5 lakh under Section 80C of the Income Tax Act! This is another great way to save your taxes.

Minimum investment: This scheme can be started with a minimum investment amount of just ₹1,000. With this, any common man can easily start investing in it.

Types of account opening

Single Account: You can open an account in your name alone.

Joint Account: You can also open a joint account with someone else.

On Behalf of Minor: You can also buy NSC in the name of your child, which will be operated by the guardian.

Complete security: Since it is backed by the Government of India, complete security of both your principal and interest is ensured.

NSC is still an excellent investment option for those who want a safe, fixed, and good return scheme, and who want to avoid market risks. It not only increases your savings but also gives you tax relief. So, if you are looking for a safe and profitable investment for your future, then National Savings Certificate is an option you can trust.