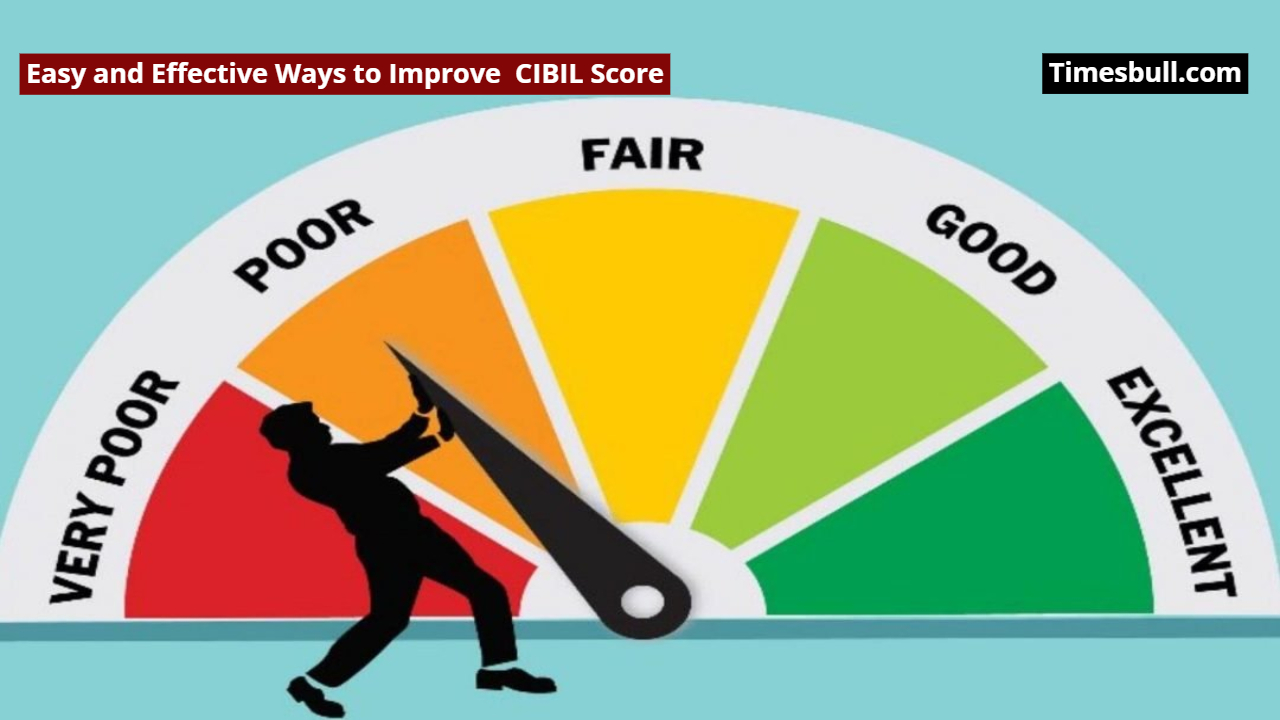

CIBIL Score Improvement: A CIBIL score is a three-digit number determined by your credit history and payment behavior. This score indicates how responsibly you manage loan or credit card payments. Banks and NBFCs use this score to determine whether it is safe to lend you money. The higher the score, the greater the likelihood of getting a loan on better terms.

Timely Payments Improve Credit Score

If you have taken a home loan, personal loan, car loan, or any other EMI, it is crucial to pay on time. Credit card users should also pay their bills in full before the due date. Late payments not only incur additional charges but also have a direct negative impact on your CIBIL score. Regular and timely payments strengthen your credit profile.

Balanced Use of Credit Card Limit is Essential

Many people make the mistake of using their entire credit card limit. This signals that you are overly dependent on credit. According to experts, it is considered best to use only up to 30 percent of your total credit card limit. Spending within your limit helps improve your credit score gradually.

Be Cautious of Defaults in Joint Loans

If you have taken a joint loan with a friend, relative, or family member, extra caution is necessary. If the loan is not paid on time, everyone is considered a defaulter. This affects not only your partner but also your credit score. Therefore, clarity regarding payment responsibility is essential when taking a joint loan.

The Right Balance of Secured and Unsecured Loans

The type of loans you have also matters in improving your CIBIL score. Maintaining a balance between secured loans like home loans and car loans, and unsecured loans like personal loans and credit cards is important. Relying solely on unsecured loans can be detrimental to your score. The right mix strengthens your credit profile.