Gratuity Calculator: If you have a government job, this news is important for you. Now, central employees can receive a gratuity of up to Rs 25 lakh. But what are the conditions for this? How is gratuity calculated? And which employees will benefit the most?

In this news, we will provide complete details so you can understand how much gratuity you will get and what is required to receive it. Let’s find out.

What is Gratuity?

Gratuity is a lump sum payment given to an employee when they leave their job or retire. It serves as a reward for the employee’s long service. The amount of gratuity is determined by the employee’s final salary and the number of years they have worked.

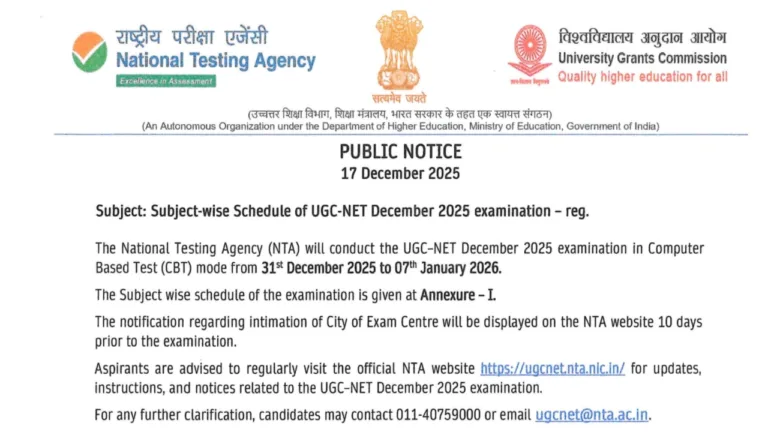

The gratuity limit for central government employees has been increased from Rs 20 lakh to Rs 25 lakh, effective from January 1, 2024. This increase comes after a 50% rise in the Dearness Allowance (DA) of central employees.

The new gratuity limit was announced on May 30, 2024, in a circular issued by the Department of Pension & Pensioners Welfare under the Ministry of Personnel, Public Grievances and Pensions.

The Gratuity Act

The Gratuity Act applies to various sectors such as factories, mines, oil fields, plantations, ports, railways, motor transport undertakings, companies, and shops with at least 10 employees. This law entitles employees to receive a gratuity equivalent to 15 days’ salary for each year of service.

For non-government employees, the gratuity limit is Rs 10 lakh. Seasonal establishments calculate gratuity based on seven days’ wages for each season.

In 2024, the gratuity limit for central government employees was raised to Rs 25 lakh after a 50% increase in their DA, which is now 50% of their basic salary. The Gratuity Act ensures that employees receive better gratuity terms in contracts or agreements. The government oversees companies that fall under its jurisdiction or operate in multiple states.

Who is Eligible for Gratuity?

Under the Gratuity Act, companies must pay gratuity to employees who have completed at least five years of continuous service. Employees are entitled to gratuity in the following situations:

- On resigning after completing five years of continuous service.

- Upon retirement based on company policy.

- In certain cases, employees can receive gratuity even after working for less than five years, such as:

- In case of the employee’s death, the gratuity is paid to the nominee or legal heir.

- If the employee becomes disabled due to an accident or illness, even if they have not completed five years of service.

- If employees working in underground mines complete 4 years and 190 days of continuous service.

- If employees in other organizations complete 4 years and 240 days of continuous service.

How to Calculate Gratuity?

The formula to calculate gratuity is simple:

Gratuity = (Last Salary) x (Years of Service) x (15 / 26)

- Salary components: This includes the basic salary, dearness allowance (DA), and commission.

- Monthly workdays: 26 working days are considered in a month.

- Calculation method: The gratuity is based on an average of 15 days’ salary for each year of service.

How to Claim Gratuity?

To claim gratuity, an eligible employee must apply Form I to their company. If the employee is unable to do so, the nominee or legal heir can apply on their behalf.

Once the company receives the application, it verifies the claim and calculates the gratuity amount. The company must ensure the payment is made promptly to avoid delays.

According to the Gratuity Payment Act, of 1972, the employer must pay the gratuity within 30 days from the due date. If the payment is delayed, the employer may have to pay interest on the outstanding amount.

Dispute Resolution for Gratuity

If there is a disagreement regarding the gratuity amount or eligibility, the matter can be raised with the governing body. The employee must file an application in Form N to the appropriate governing body in their region for dispute resolution.