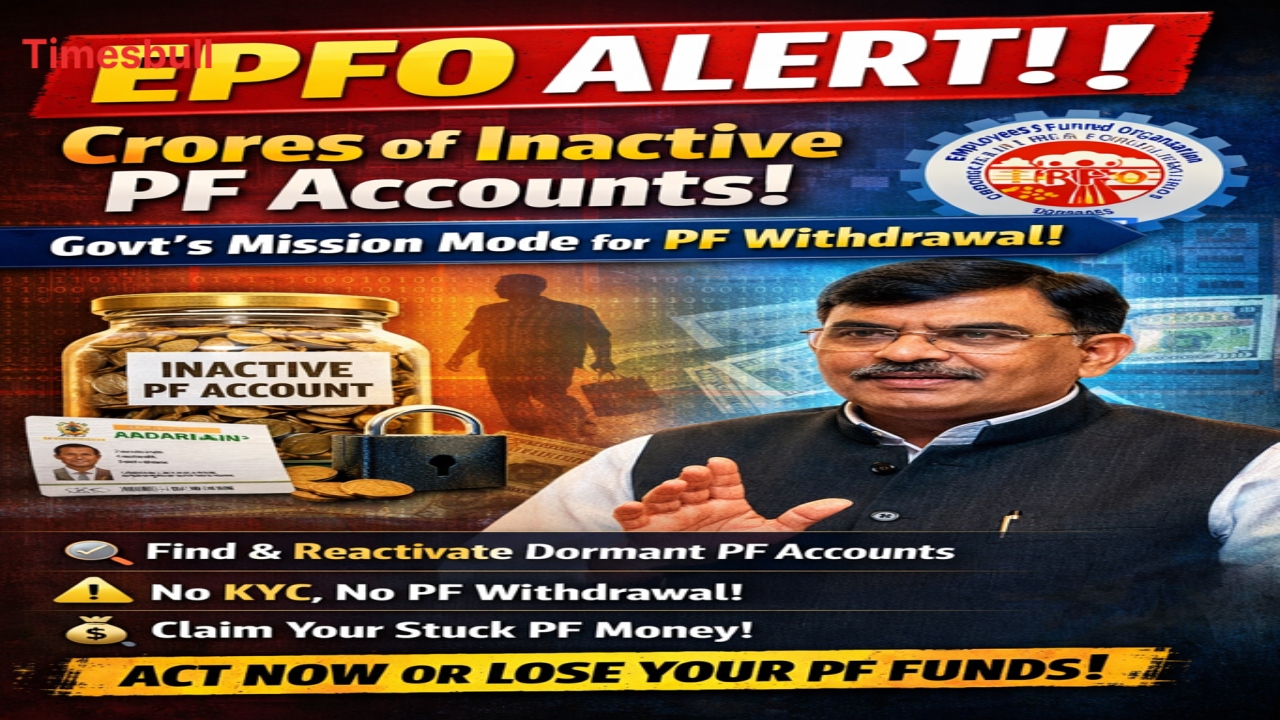

EPFO Digital Update: If you’re employed, don’t overlook this crucial change related to your future savings, the EPFO (Employees’ Provident Fund Organization). Crores of PF accounts in the country have become inoperative, holding thousands of crores of rupees stuck for years.

Union Labor and Employment Minister Mansukh Mandaviya has announced that the government will now work in mission mode to simplify the withdrawal process from these accounts. If you don’t update your PF account’s robust KYC in time, your hard-earned money could be lost forever.

EPFO’s Mission Mode

According to the Union Labor Minister, the government has developed a robust plan to identify crores of PF account holders whose money has been sitting in inactive accounts for years. Often, employees don’t transfer their old PF accounts after changing jobs, causing them to become inoperative.

Now, the government is launching a dedicated digital platform that will not only identify dormant accounts but also reach the heirs of those account holders. The aim is to ensure that every rupee reaches its rightful owner with absolute transparency.

KYC Verification

Under this new mission, the KYC (Know Your Customer) process has been given utmost importance. Without KYC verification, you will not be able to withdraw a single penny of your PF. The government has warned that if account holders do not update their identity and bank details scrupulously, the amount may lapse forever.

Aadhaar linking makes the PF claim process faster and faster, while updating your bank account ensures hassle-free transfer of funds directly into your account. Additionally, linking your PAN card significantly reduces TDS deductions, and keeping your mobile number updated ensures instant notifications for every transaction.

Deal for Those Employed Abroad

The Indian government is now mandating the inclusion of social security clauses in trade agreements with other countries. For example, similar agreements are being reached with other countries, similar to the one between India and the UK.

This will directly benefit Indian employees who return to India after working abroad for a few years. Their PF funds deposited abroad will no longer be wasted. Under the new system, employees will be able to access their deposits even after returning to India, providing them with solid financial security for their old age.

Digital EPFO

EPFO is now eliminating the old paper system and moving towards a modern technology and AI-driven system. Trials of this new system have begun at a rapid pace in Delhi. With this technological change, employees will no longer need to visit regional offices to lodge their complaints or claims. The entire system will be connected to a centralized IT unit, allowing you to manage your PF account seamlessly from anywhere in the world. This step will prove to be a milestone in reducing corruption and making PF withdrawals paperless.