ATAL Pension Yojana – If you’re worried about money after retirement, you can take advantage of some special schemes. There are currently some schemes available where a husband and wife can jointly arrange for a monthly pension. You’ve likely heard of the Atal Pension Yojana.

Investing in this scheme is not only completely secure but also offers a promising future for financial progress. Under the Atal Pension Yojana, you can secure a monthly pension of ₹10,000. People won’t face any difficulties. If you want to open an account under the scheme, you need to understand the important things first.

Read More: New Credit Card Launched, Exclusive Offers Now Available With Your Monthly Salary

How to get a monthly pension of ₹10,000?

The Atal Pension Yojana is unique. After investing, you receive a monthly pension. The pension limit ranges from ₹1,000 to ₹5,000. A husband and wife can open an account by investing together. Both receive a pension of ₹5,000 each after the age of 60. Accordingly, you can benefit from a total monthly pension of ₹10,000.

To join the Atal Pension Yojana, you must be between 18 and 40 years of age. The younger you join, the less you will have to invest each month. You must invest upfront. After meeting all the scheme requirements, you will begin receiving a monthly pension after the age of 60. This will be auto-debited from your bank account.

Read More: How to Save Money on a Rs 30,000 Monthly Salary, Know the Smart Formula

At what age should you join the scheme?

To benefit from the Atal Pension Yojana, if you want a monthly pension of ₹5,000 at the age of 30, you will need to invest ₹577 per month. If you join the scheme at the age of 35, you will need to invest approximately ₹902 per month.

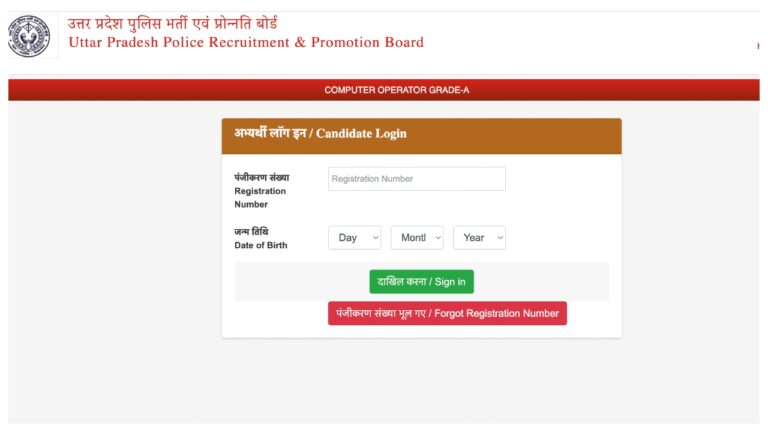

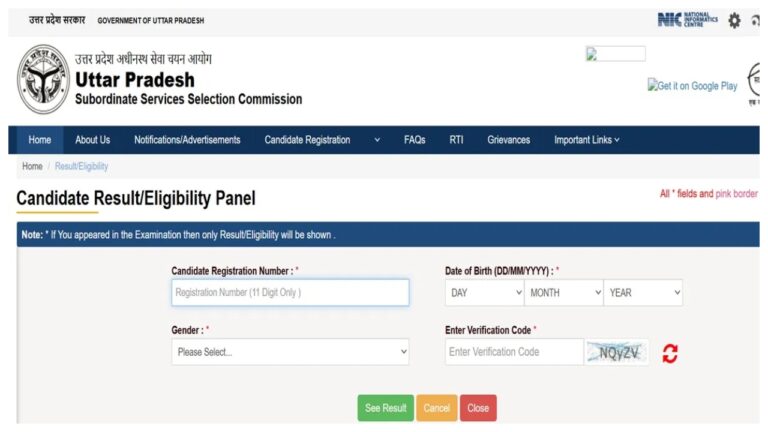

You can apply for the scheme at your nearest bank or post office branch. You must bring your Aadhaar card, mobile number, and bank account details. Many banks offer this facility online.

Therefore, it is important for both husband and wife to join. This doesn’t cause any problems. The number of people joining the Atal Pension Scheme is steadily increasing.