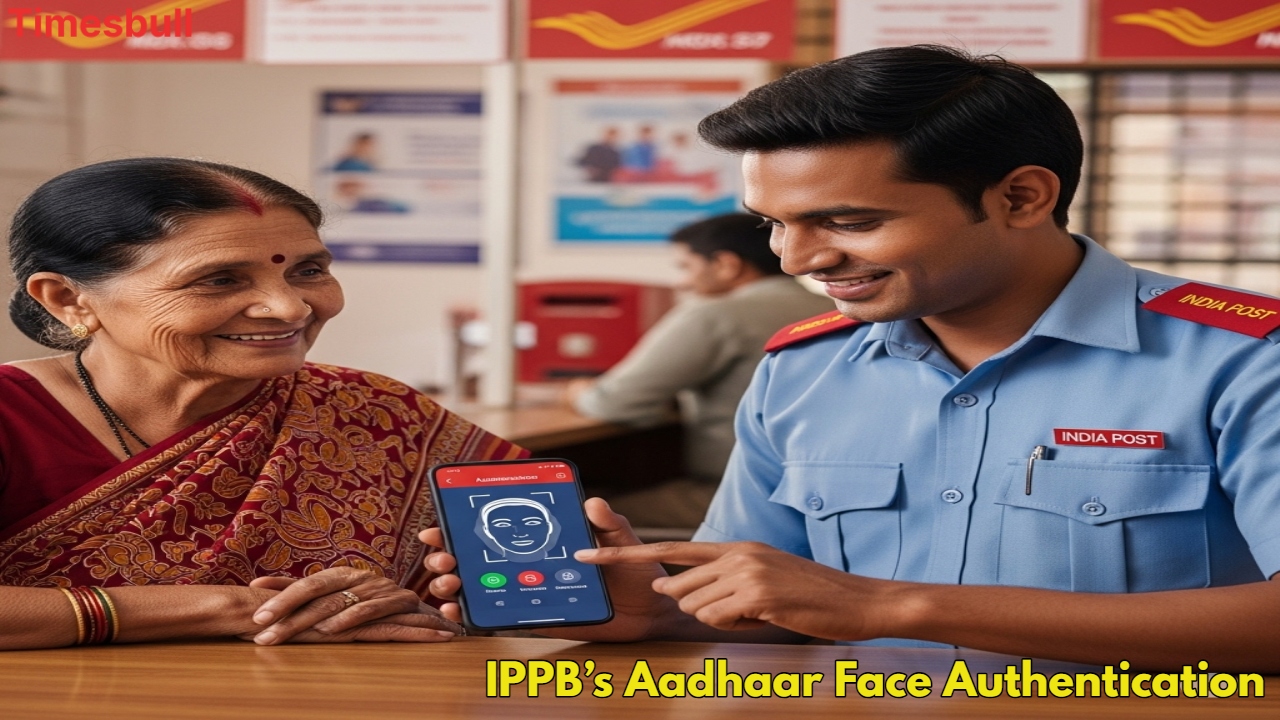

If you are a customer of India Post Payments Bank (IPPB), then there is some big news for you! The bank has taken a big step to make transactions even easier. Now you will not need biometrics or OTP for every transaction. Yes, IPPB has launched the facility of Aadhaar-based face authentication, so that you can send or receive money only by facial recognition. This new facility will prove to be a boon, especially for the elderly and the disabled, who often face problems due to the problem of fingerprints.

IPPB launches Aadhaar-based face authentication facility

This new feature makes banking not only convenient but also respectable. Let’s know about it in detail.

Who will get the most benefit

The elderly and the disabled will benefit the most from this facility. Often, with aging, fingerprints become unclear, which causes problems in biometric verification. With the help of face authentication, they will now be able to use their banking services without any hassle. This facility is not limited to transactions only, but will also help in other banking services like account opening and balance checking.

How does this technology work

This new facility has been created under the guidelines of the Unique Identification Authority of India (UIDAI). R. Viswasaran, Managing Director and CEO, IPPB, said that this initiative ensures financial inclusion on a large scale. He said, “We believe that banking should not only be accessible but also dignified. With this facility, we are ensuring that no customer is left behind due to the limitations of biometric fingerprint or OTP verification.”

Promoting security and Digital India

IPPB believes that this feature of face authentication will ensure safety during health emergencies, especially when physical contact can be risky. This initiative is in line with the Digital India and financial inclusion mission of the Central Government. The bank said that this is an example of how technology can be used to enhance convenience while maintaining the values of equality, access, and empowerment.

IPPB

India Post Payments Bank (IPPB) was launched in 2018 and operates under the Department of Posts, Ministry of Communications. The Government of India has a 100% stake in it. It provides its services through more than 1.6 lakh post offices in the country, out of which about 1.4 lakh post offices are in rural India. It is one of the largest banking networks in the country.