Atal Pension Yojana: Do you want to get a fixed income every month even after the age of 60, so that you do not have to depend on anyone, Then the Central Government’s Atal Pension Yojana (APY) is very beneficial for you. This is a government pension scheme, in which you can get a guaranteed monthly pension of ₹ 1,000 to ₹ 5,000 in old age by depositing a very small amount every month. Your pension amount depends on your investment. If you also want to get ₹ 5,000 every month in old age through this scheme, then let’s know in detail how to apply for this scheme and all the important things.

What is Atal Pension Yojana

Atal Pension Yojana (APY) is a scheme launched by the Government of India especially for people working in the unorganized sector. Its main objective is to make people financially self-reliant in old age. You can invest in this scheme from the age of 18 to 40 years. On completion of 60 years of age, you start getting a fixed pension every month according to your chosen scheme. This scheme is run by PFRDA (Pension Fund Regulatory and Development Authority), which is the main regulator of the pension sector.

Why is it special for you

Atal Pension Yojana offers many great benefits, which make it a safe and attractive investment option:

- Guaranteed pension

- Low investment, big benefit

- Freedom to choose a pension

- Tax exemption

- Benefit to the nominee.

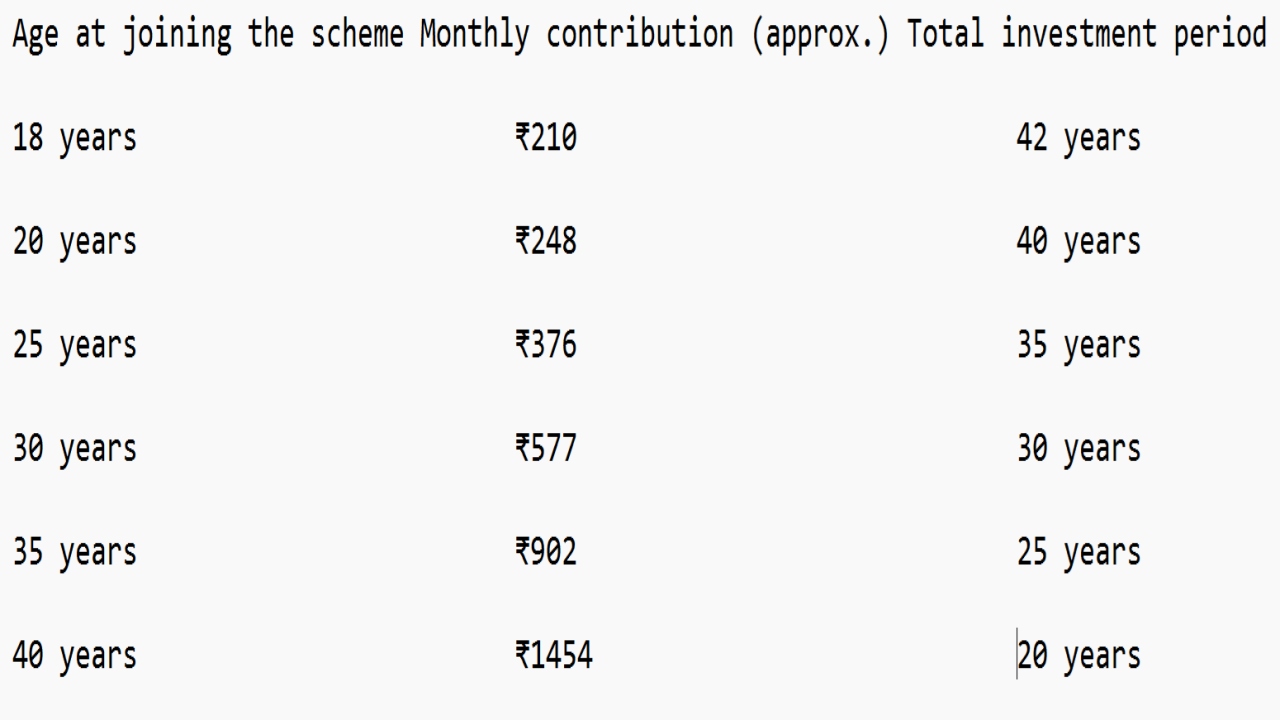

How much investment will have to be made for a pension of ₹ 5000

It is important to know how much contribution you have to make every month for a monthly pension of ₹ 5000, according to your age:

What documents are required for the Atal Pension Yojana?

While applying for the Atal Pension Yojana, you will need some important documents:

- Bank Account Number

- Aadhaar Card

- Identity Proof

- Age Proof

- Address Proof

- An Active Mobile Number

How to apply for the Atal Pension Yojana

Applying for the Atal Pension Yojana is very easy. You can do it both online and offline:

Offline Method

Visit your nearest bank or post office branch where you have a savings account.

Get the APY registration form from there.

Fill in all the details asked in the form, such as name, address, Aadhaar number, mobile number, and nominee details correctly.

Submit the form along with a photocopy of your Aadhaar card and other required documents.

Your APY account will be opened, and the contribution amount will be automatically debited from your account every month.

Online Method

You can also apply for APY online. For this, log in to your bank’s net banking.

After logging in, find the option of ‘Social Security Schemes’ or ‘APY’.

Click on ‘Apply for APY’.

Fill in your details, pension option (₹5000), and nominee details, and submit the form.

Give your consent for auto-debit.

Your registration will be completed, and you will get your PRAN (Permanent Retirement Account Number).

How to apply directly through the website

First of all, visit the website https://enps.nsdl.com/eNPS/NationalPensionSystem.html.

From here, go to the ‘Atal Pension Yojana’ tab and click on ‘APY Registration’.

Fill the ‘New Registration’ form and click on ‘Continue’.

After filling the form, fill in your details in ‘Complete Pending Registration’ and complete the KYC (Know Your Customer) process.

After this, you will get an ‘Acknowledgement Number’.

Choose the amount of pension you want after the age of 60, as per your wish.

Also, tell how the installment is to be deducted monthly, quarterly, half-yearly, or annually.

After this, fill out the nominee form correctly.

After completing the process, you will be directed to the eSign tab on the NSDL website.

Once the Aadhaar OTP is verified, you will be enrolled in the scheme.